Bitcoin (BTC) is inching towards a milestone that we felt ambitious just a few months ago. The mood of the entire trading desk and cryptographic telegram group is mostly electricity, with one question dominating. Can the king of codes jump to $140,000 at the end of the year?

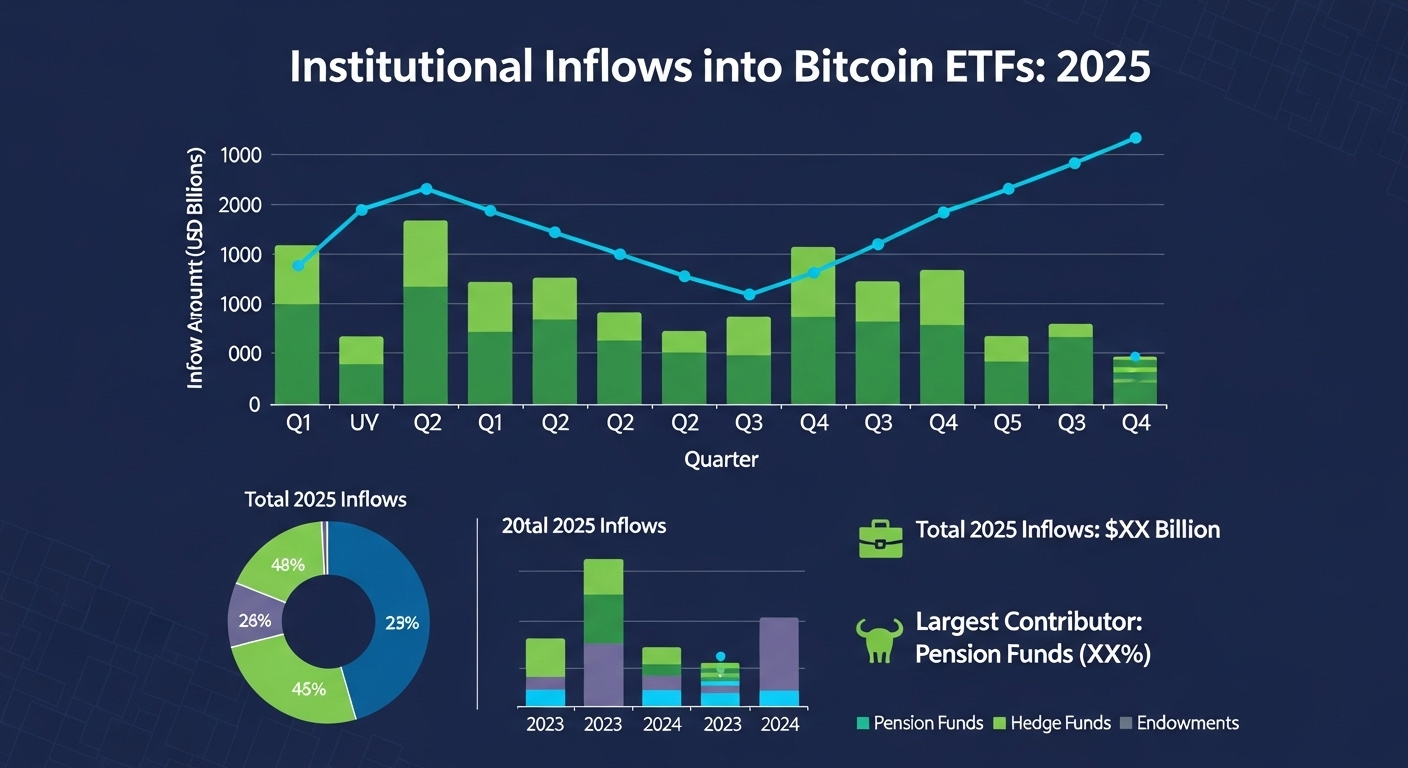

The rally isn't running with retail hype alone. Hedge funds, pension giants, Wall Street's biggest asset managers – institutional players are moving their money to Bitcoin at a pace they've never seen before. On-chain trackers show billions of fresh influxes, indicating that traditional finance is no longer just testing waters. They are swimming with their arms.

New urgency on Wall Street

Part of this rush comes from a surge in demand for spot Bitcoin ETFs. As US regulators loosen their grips, companies like BlackRock and Fidelity are actively expanding their positions. That extra liquidity gives the market a robust backbone, allowing traders to stack BTC more comfortably at higher price levels.

Next is the macro image. The widely anticipated Federal Reserve cuts could serve as a light liquid for the rallies. Historically, cheap borrowing pushes capital towards high returns, risk-on-play. Bitcoin is currently wearing that crown.

$140,000 Questions

Currently, traders are focusing on a psychological level of $140,000. The technical chart shows bullish MACD crossovers and strong RSI support, making it even more upside down if momentum continues. Still, it is worth noting that profit-making stages and sudden macroeconomic changes can stir up short-term volatility along the way.

But if the rally remains intact, breaking $140K will allow you to unlock FOMO's fresh waves from both retail and institutional investors.

Why is Magazine Finance on the Watchlist?

Bitcoin dominates the conversation, but some investors are positioning it for what comes next: the Altcoin season. Magacoin Finance has quietly built momentum with pre-sale for early bird buyers, who saw a huge profit potential after BTC's rally went out to a wider market.

With utility-driven toconomies, engagement communities and appropriately-timed entries into the cycle, Magazine Finance has been raised by market watchers as a possible play of return. Some projections – speculative, but post-start ROI potential was placed in the 70x+ range. If Bitcoin beats $123,000 and wins the edge towards $140,000, then expect this kind of Presale project to pop up on more radar.

At past market gatherings, capital often flowed from BTC into midcaps and emerging tokens, creating large opportunities for early invokers. As Bitcoin runs seriously beyond $123,000 towards $1,000,000, Magacoin Finance can set up a stage to attract attention from both retail traders and big players hunting the next high-growth token.

For more information about Magacoin Finance, please visit.

Website: https://magacoinfinance.com/c4w

Access: https://buy.magacoinfinance.com/c4w

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance