Ethereum is dormant below the $2.5,000 resistance, constrained by reduced volatility and suppressed trading activities. A critical movement in either direction may require a new injection of supply or demand to break the current equilibrium.

By Shayan

Daily Charts

ETH now shows muted trading activity and compression volatility just below the $2,500 key resistance zone.

After a strong rebound between 2.2k and 2.1K dollars from the 0.5-0.618 Fibonacci support band, the price came across a confluence of technical barriers, i.e. a 200-day moving average and underside of a previously broken wedge pattern.

This confluence snatches upward momentum, suggesting that market participants are in equilibrium, with no control over buyers or sellers.

As a result, ETH is at a critical time. If sales pressure increases, rejections from this level can cause more significant revisions. Conversely, if the Bulls force a breakout that exceeds this resistance, a short aperture could last, driving the price towards the 2.7k mark.

4-hour chart

In the lower time frame, ETH remains confined to a narrow integrated band, with minimal volatility and no directional movement. The fair value gap between $2.3K and 2.39K serves as a support, but the resistance coincides with the lower bound of the broken wedge.

This technical deadlock can be resolved quickly, as breakouts from either side are likely to cause critical movements.

In particular, early formation of head and shoulder patterns in this inflection zone suggests an increased probability of bearish collapse. If this pattern is confirmed, the decline to psychological support of $2K becomes increasingly plausible.

By Shayan

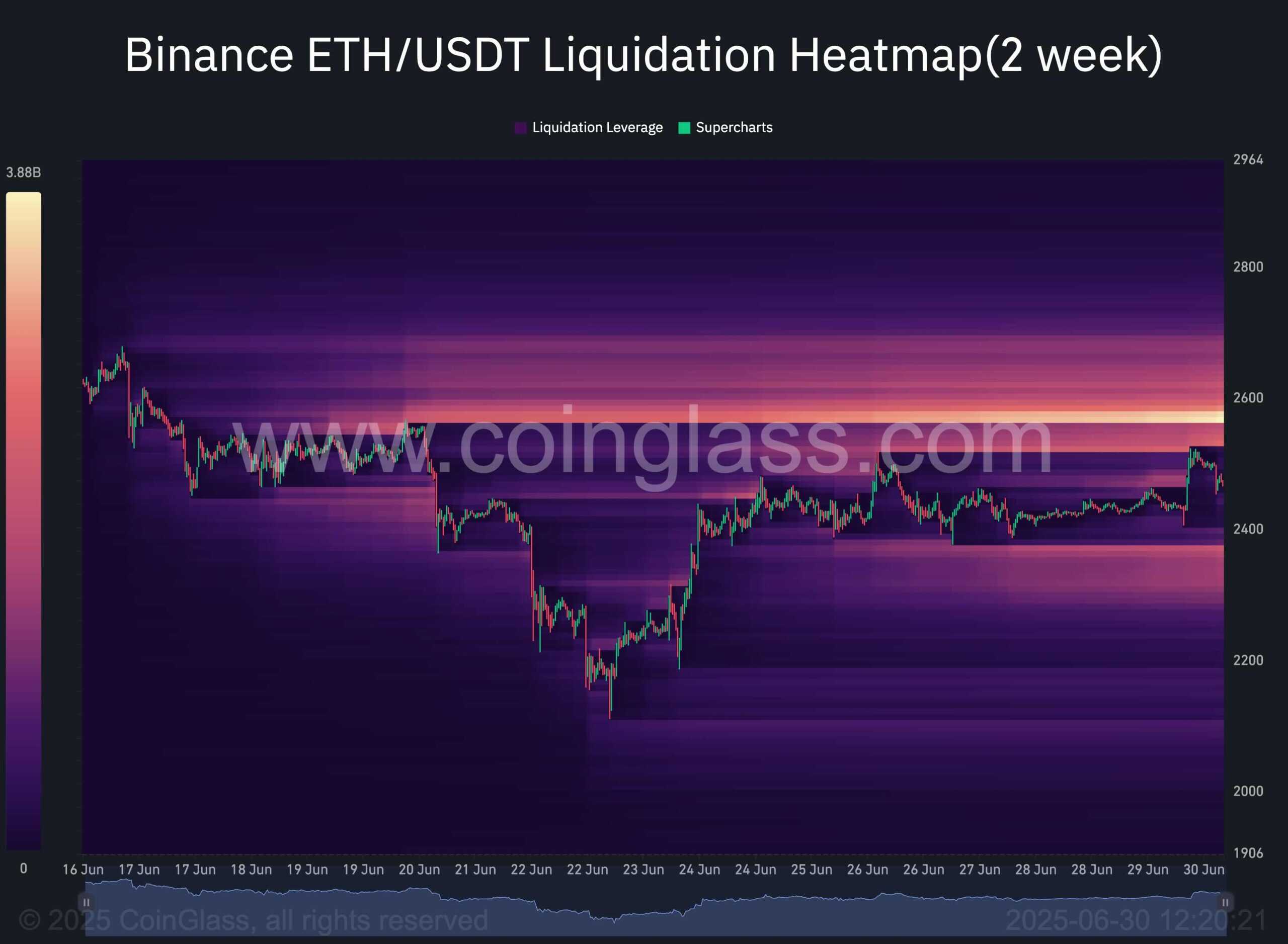

This chart shows a benance clearing heatmap highlighting areas where significant clearing events are likely to occur.

High concentration potential liquidation levels act as a price magnet, just as large traders, commonly known as “whales,” take advantage of these liquidity zones to efficiently execute their orders. Once these orders are met, the direction of prices will be quickly reversed.

Currently, a large liquidity cluster is located just above the important level of $2.5,000, suggesting a possible price movement towards this zone, which could trigger shorter apertures. However, this also highlights sustained sales pressures close to current prices and the presence of active sellers. So the $2.5,000 level remains a significant resistance, and the next critical move could shape Ethereum's short-term trajectory, whether it's a breakout or a rejection.