The recent US government shutdown has created uncertainty in traditional financial markets, prompting investors to seek alternative, safer assets.

With the US dollar depreciating slightly amid the political impasse, more and more liquidity is flowing into the crypto sector. This, coupled with ongoing ecosystem developments, has boosted the performance of several crypto-related stocks. Here are some of the most notable ones this week.

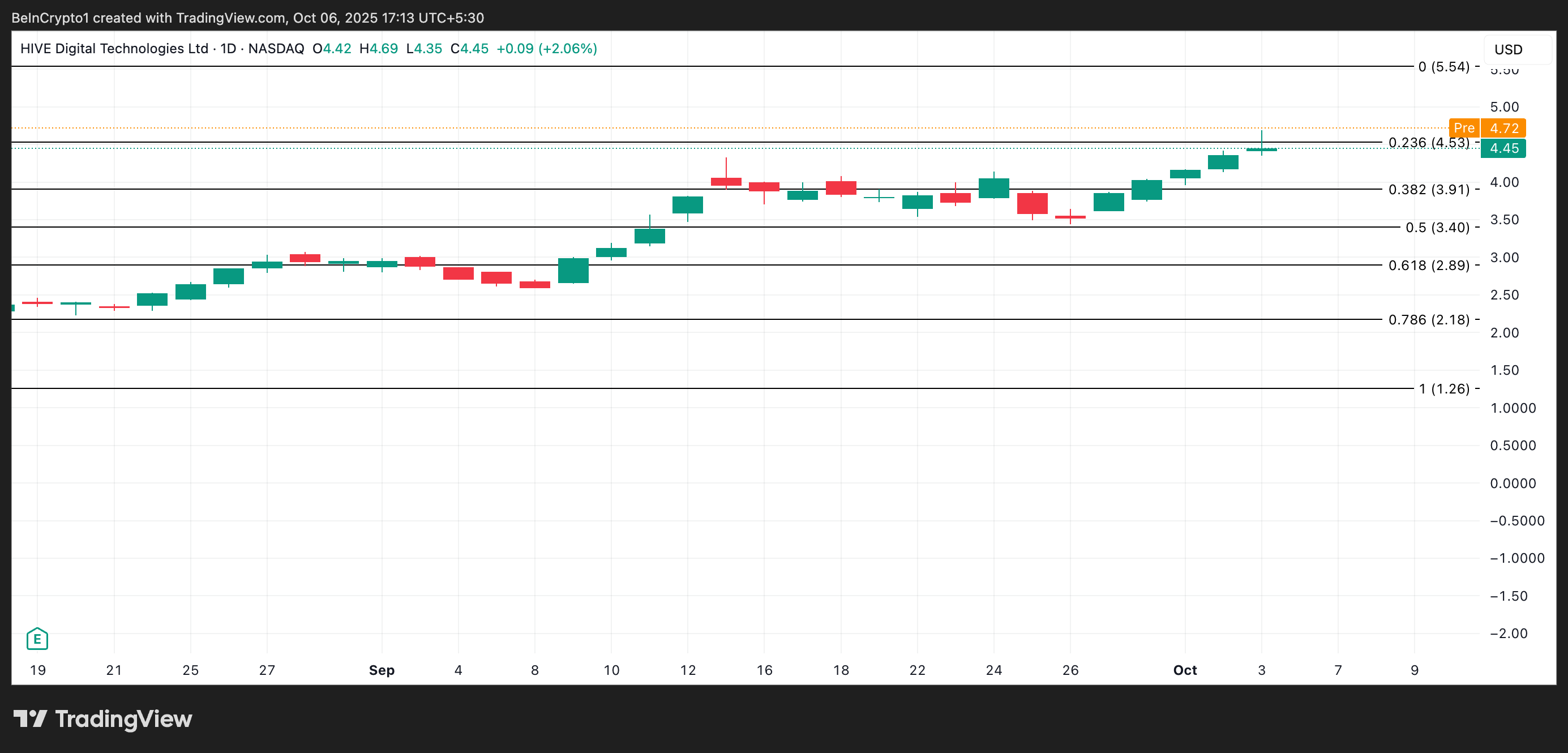

HIVE Digital Technologies Co., Ltd. (HIVE)

HIVE Digital stock closed Friday at $4.46, up 2.29% on the day. Cryptocurrency stocks are in the spotlight this week following the company's strong September production report and rapid progress on its new facility.

In a report on October 6, the mining giant announced that it produced 267 BTC in September, an 8% month-on-month increase from August's 247 BTC, and a 138% year-on-year jump from 112 BTC in September 2024.

The report also confirmed that HIVE Digital's 100 MW Phase 3 Valenzuela facility is nearing completion ahead of schedule. HIVE's production efficiency continues to outperform broader market challenges, with September's 267 BTC marking the highest monthly production in 2025.

This solid operating outlook and improving market sentiment positions HIVE as a crypto stock to watch this week.

If the buying momentum strengthens, HIVE stock could break above $5 and rise towards $5.54.

HIVE price analysis. Source: TradingView

However, if selling pressure increases, the stock could fall back to around $3.91.

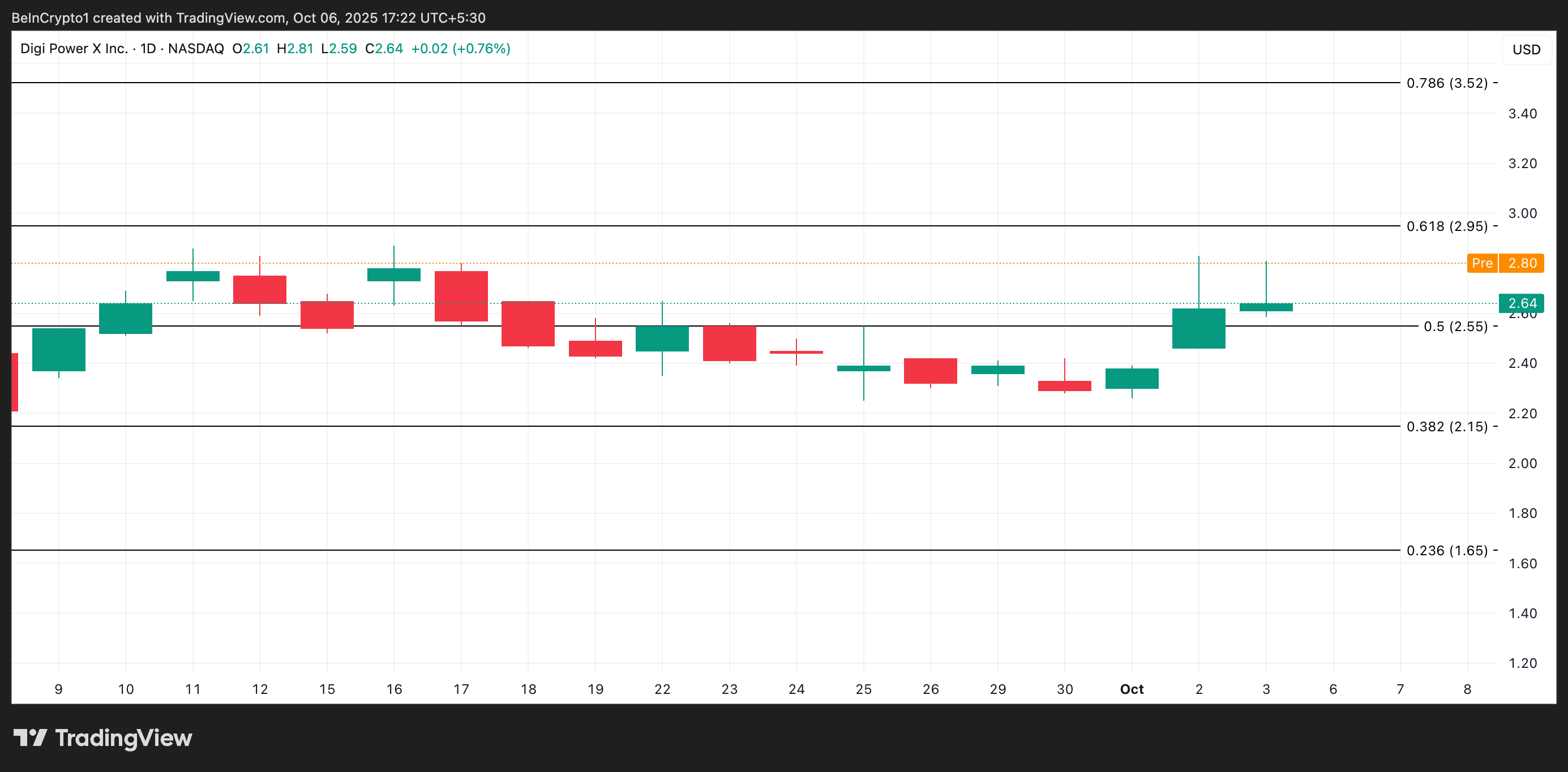

Digipower X (DGXX)

DGXX closed Friday's trading at $2.64, a gain of just 1%. This modest increase reflects cautious optimism as investors digest the company's latest operating updates.

On October 1, the company announced that ARMS 200, an AI-Ready modular solution, received Tier III certification based on the ANSI/TIA-942 standard validated by EPI. This makes Digi Power X one of the few global providers with a certified modular AI data center platform.

The first Tier III certified ARMS 200 pods are expected to be delivered to the company's Alabama facility by November, with commissioning scheduled for December.

The company also deepened its partnership with Super Micro Computer (Supermicro) to integrate AI-optimized rack-scale systems into the ARMS platform.

Financially, Digi Power X is well capitalized, with approximately $29 million in cash, Bitcoin (BTC), Ethereum (ETH), and deposits as of September 30th.

If these updates increase pressure on the buy side as the week progresses, DGXX could rally towards $2.95 and potentially breakout on strong volume.

DGXX price analysis. Source: TradingView

However, if selling pressure increases, the stock could fall below $2.55.

Riot Platform (RIOT)

RIOT rose slightly last Friday, rising 1% to close at $19.44. The company also released a 2025 operational update that could impact trading action this week.

According to a report released on October 3, Riot Platforms produced 445 BTC in September, a 7% month-on-month decrease but an 8% year-over-year increase.

The company's average daily transaction amount was 14.8 BTC, down from 15.4 BTC in August. Riot sold 465 BTC during the month, generating a net profit of $52.6 million at an average price of $113,043 per BTC. Despite the slight drop in production, the hashrate deployed by the company remained strong at 36.5 EH/s, up 29% year-on-year.

If news of Riot's Bitcoin production decline during September dampens investor sentiment, demand for the stock could weaken and the price could fall below $18.84 in the next few sessions.

Riot price analysis. Source: TradingView

On the other hand, if buying activity increases as the week progresses, the stock could move higher towards $23.66.

The post 3 US Crypto Stocks to Watch This Week appeared first on BeInCrypto.