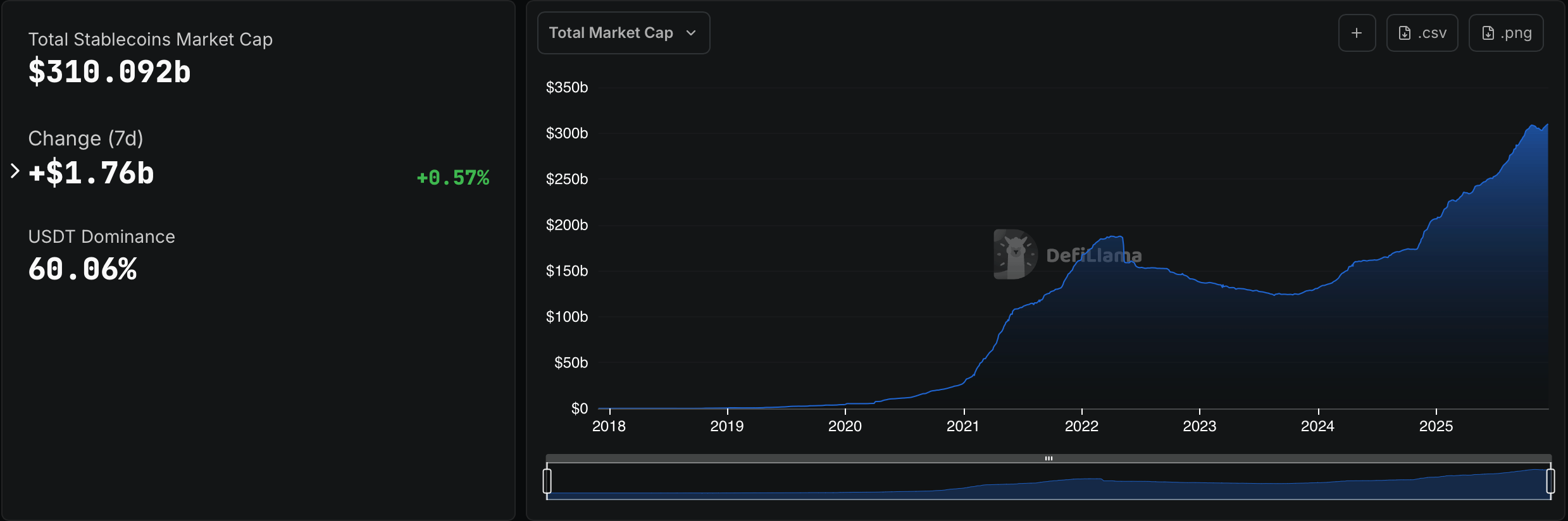

Stablecoins are on the rise again, with the fiat-pegged token economy topping the $310 billion mark in the second week of December, setting another all-time high.

Stablecoin market reaches new peak, surpassing $310 billion

In mid-November, stablecoins rose to an all-time high of $309 billion before recording a modest pullback. From there, the stablecoin economy fell to a low of $302.88 billion based on data compiled by defillama.com. Since then, the fiat-pegged token sector has crossed the $310 billion threshold this week, reaching $310.092 billion as of Saturday, December 13, 2025.

The week-on-week increase was approximately 0.57%, with approximately $1.79 billion flowing into the stablecoin sector over the past seven days. Tether’s USDT remains in the lead with a 60.06% share, and the market capitalization of the leading stablecoin currently stands at $186.256 billion. USDT recorded weekly increases, increasing its market capitalization by $536.21 million. Meanwhile, Circle's USDC added $613 million over the same period, increasing its total to $78.414 billion.

Source: Defillama.com, December 13, 2025.

Among the top 10 stablecoins by market capitalization, Circle’s USYC posted the largest 7-day gain, rising 4.02%. At the same time, BlackRock's BUIDL has retreated significantly, falling 13.24% over the past week, leaving its market cap at $1.321 billion. Zooming out, BUIDL recorded a monthly contraction of 42.05%, with over $958 million flowing out of the token over time.

read more: Options and Futures: Why the crypto options market has 97% room to grow

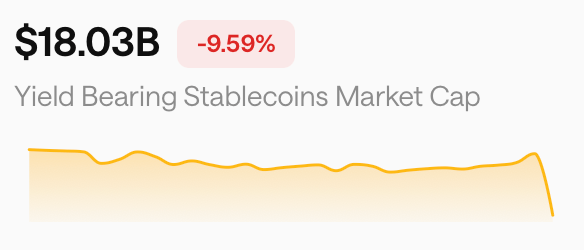

Other stocks outside the top 10 in terms of 7-day gains were Tron's USDD, which surged 23.46%, and crvUSD, which rose 28.92%. Ethena’s stablecoin also continues to be dragged down this week as USDe fell by 2.98% and project USDtb suffered a huge drawdown of 18.99%. This is a trend that has occurred for most stablecoins with yields after the October cryptocurrency market crash, when basis/yield economics became less attractive.

Over the past 30 days, the combined market capitalization of all yield-bearing stablecoins has fallen by more than 9% to just over $18 billion, according to an analysis by Stablewatch.io. In this corner of the market, redemptions are outpacing new issues as a widespread risk-off mood makes investors cautious. This pullback is demand-driven, with alUSD down 73%, smsUSD down 67%, and sBOLD down 14% in the last week.

Source: Stablewatch.io analysis on December 13, 2025.

This means that this week's growth and all-time highs have been driven almost entirely by non-yielding stablecoins, known as payment stablecoins. This split points to a clear trend toward fluidity and simplification as the end of the year approaches. Whether these dynamics will continue into 2026 is an open question, and for now investors seem content to keep things simple, simple, liquid and ready to move. Time will tell whether this preference ultimately changes.

Frequently asked questions 🧠

- What is the current size of the global stablecoin market? The market capitalization of stablecoins recently exceeded $310 billion, a new all-time high.

- Which stablecoins are driving recent growth? Most of the recent expansion has been driven by non-yielding payment stablecoins such as USDT and USDC.

- Why are high-yield stablecoins decreasing? Redemptions exceed new issuance as investors tend to prioritize liquidity in a risk-off environment.

- How have high-yield stablecoins performed recently? The market capitalization of both companies has fallen more than 9% over the past 30 days, to just over $18 billion.