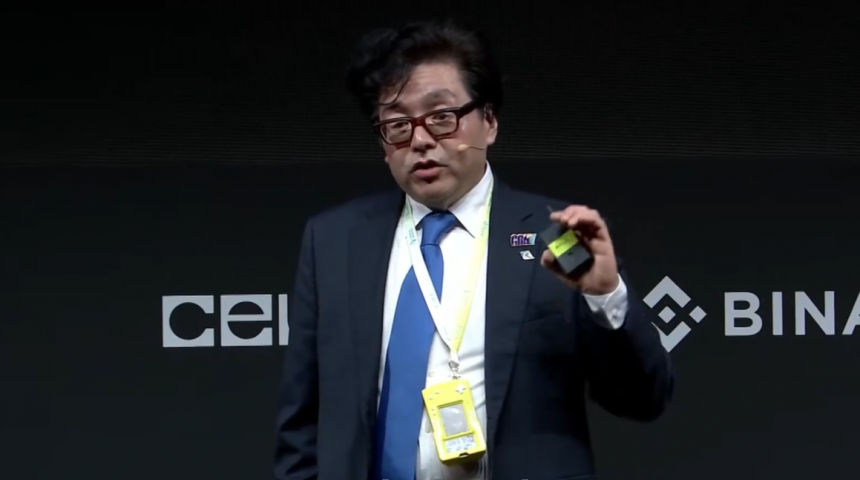

Tom Lee reiterated one of the most aggressive Ethereum targets on the market, telling attendees at Binance Blockchain Week on December 4 that ETH could eventually trade for $62,000 as it becomes the core infrastructure for tokenized finance.

“Okay, now that we’ve talked about cryptocurrencies, let me explain why Ethereum is the future of finance.” Lee said from the stage. He characterized 2025 as Ethereum's “1971 moment,” drawing a direct analogy to when the U.S. dollar left the gold standard and sparked a wave of financial innovation.

Lee's paper on Ethereum

“In 1971, the dollar came off the gold standard. And in 1971, it galvanized Wall Street to create financial products that would allow the dollar to become a reserve currency,” Lee argued. “By 2025, everything will be tokenized. So it’s not just dollars that will be tokenized, it’s stocks, bonds and real estate.”

In his view, this change positions ETH as the primary settlement and execution layer for tokenized assets. “Wall Street will once again leverage this to build products on smart contract platforms, and Ethereum is where they are building this,” he said. “The vast majority, the vast majority of this, is being built on Ethereum,” Lee said, pointing to current real-world asset experiments as early evidence, adding, “Ethereum has won the smart contract war.”

Lee also emphasized that ETH's market behavior does not yet reflect its structural role. “As you know, ETH has been rangebound for five years, as I have shown here, but it is starting to break out,” he told the audience. “The reason we converted Bitmine into an ETH treasury company and became deeply involved in Ethereum is because we saw this breakout coming,” he explained to the audience.

The crux of his valuation case is expressed through the ETH/BTC ratio. Lee expects Bitcoin to rise sharply in the near term. “I think Bitcoin will reach $250,000 in a few months.” From there, he derives two main ETH scenarios:

First, we believe there is significant upside potential if the ETH/BTC price relationship returns to historical averages. “If the ETH price ratio to Bitcoin returns to its eight-year average, the price of Ethereum would be $12,000,” he said. Second, a more aggressive case where ETH rises to a quarter of the price of Bitcoin would hit his long-held target of $62,000. “Compared to Bitcoin, if it hits 0.25, it’s worth $62,000.”

🔥 TOM LEE ASKS $62,000 $ETH

“I think Ethereum is going to be the future of finance, the payment method of the future, and compared to Bitcoin, at 0.25 it’s $62,000. Ethereum at $3,000 is significantly undervalued.” pic.twitter.com/VydvLou9IE

— CryptosRus (@CryptosR_Us) December 4, 2025

Lee connects these ratios directly to the tokenization narrative. “If 2026 is all about tokenization, that means the utility value of Ether should rise, so this rate is something to keep an eye on,” he told the crowd, arguing that valuation should track growing demand for ETH block space and its role as “the payment rail of the future.”

He concluded with a sharp assessment of current levels. “Of course, I think Ethereum at $3,000 is significantly undervalued.”

At press time, ETH was trading at $3,128.

Featured image created with DALL.E, chart from TradingView.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is diligently reviewed by our team of leading technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.