According to Coinbase, about two-thirds of institutional investors have a positive outlook on Bitcoin going into 2026.

“Most respondents are bullish on Bitcoin,” David Duong, head of research at Coinbase Institutional, said in a research report titled “Navigating Uncertainty.”

Coinbase conducted an institutional investor survey with 124 respondents and found that 67% of institutional investors have a positive outlook for Bitcoin (BTC) over the next three to six months.

It added that there was a “significant divergence” of opinion on where in the market cycle we are, with 45% of financial institutions believing the market is in the late stages of a bull market, compared to just 27% of non-financial institutions.

Cryptocurrency government bonds are buying momentum

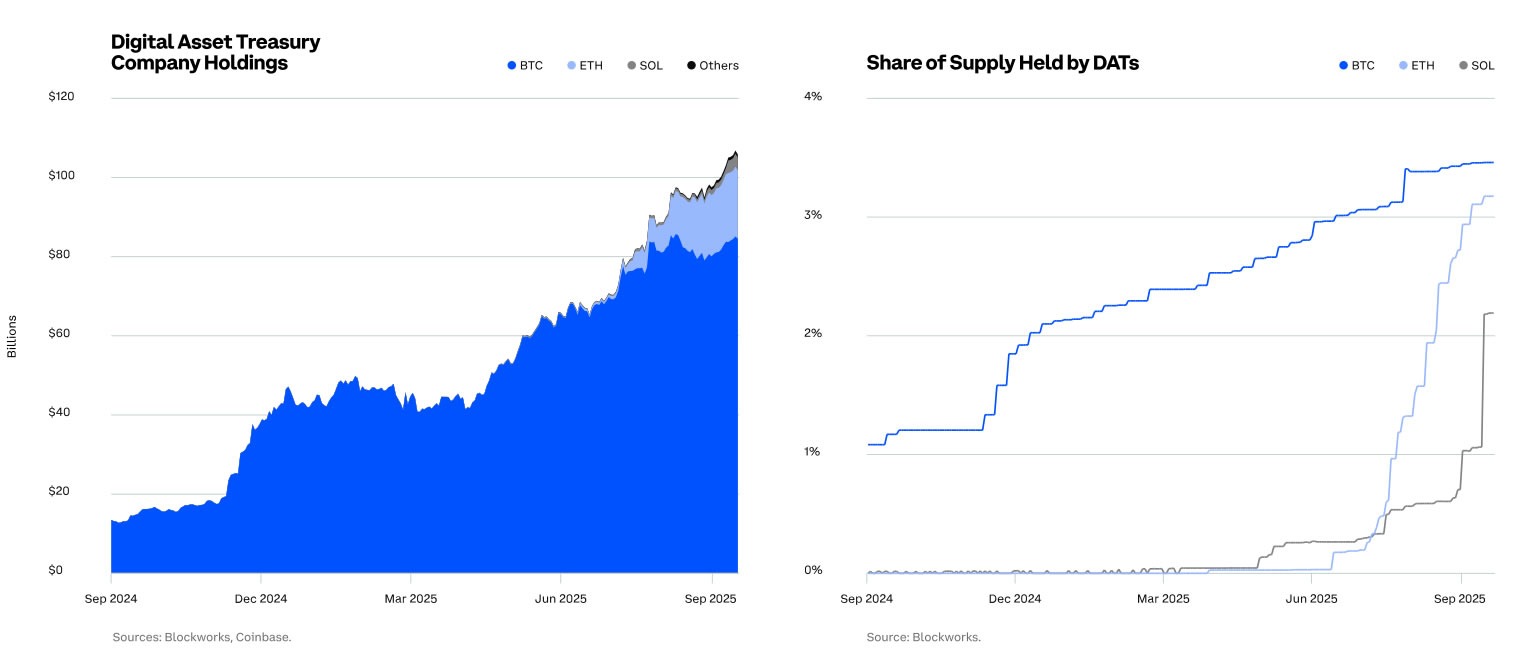

“Looking at the supply and demand situation, the impact digital asset treasury companies have had on the market this year cannot be overstated,” Duong wrote.

Bitmine, which is chaired by Tom Lee, is one of the companies that has been on a buying spree since the market crash that pushed the price of ether back below $4,000, raising more than 379,000 ether (ETH) worth about $1.5 billion.

Meanwhile, Michael Saylor hinted on Sunday that Strategy may buy more Bitcoin after sharing a chart showing his $69 billion Bitcoin holdings. Even if the stock price falls, DAT's crypto assets will remain intact, suggesting a long-term conviction.

The holding amount of DAT crypto assets continues to increase rapidly. sauce: coinbase

There's room to maneuver in a bull market

Coinbase’s Duong said that while the crypto bull market “has room to go higher,” he is becoming more cautious following the events of October 10th.

“We still see resilient liquidity conditions, a strong macro backdrop and supportive regulatory dynamics.”

Coinbase also highlighted that macro and liquidity tailwinds could drive the market in the fourth quarter, including two more expected Federal Reserve rate cuts and large money market funds on the sidelines.

“Further Fed rate cuts and increased fiscal and monetary stimulus in China could encourage more investors to stay on the sidelines.”

Favorable settings for Bitcoin

The company said that while the current setup looks particularly favorable for Bitcoin, it has taken a more cautious approach to positioning altcoins.

Cryptocurrency markets remained stable over the weekend, with Bitcoin breaking above $109,000 after regaining the support-turned-resistance level of $108,000, and Ether briefly surpassing $4,000, but sentiment remains cautious and no major recovery attempts have yet been seen.