Coinbase Prime, the facility division of popular cryptocurrency exchanges, has announced that it will end its custody support for 49 Altcoins by the end of this month.

This movement affects the lesser known range of tokens. These include assets related to niche blockchain projects and real estate-related tokens.

49 Altcoins loses custody support in Coinbase Prime

The decision was published in an April 14th post on X (formerly Twitter).

“We regularly evaluate the assets we support to ensure that they continue to meet our standards. Based on recent reviews, Coinbase Prime has ended custody support for 49 assets and will be effective at the end of the month,” the post read.

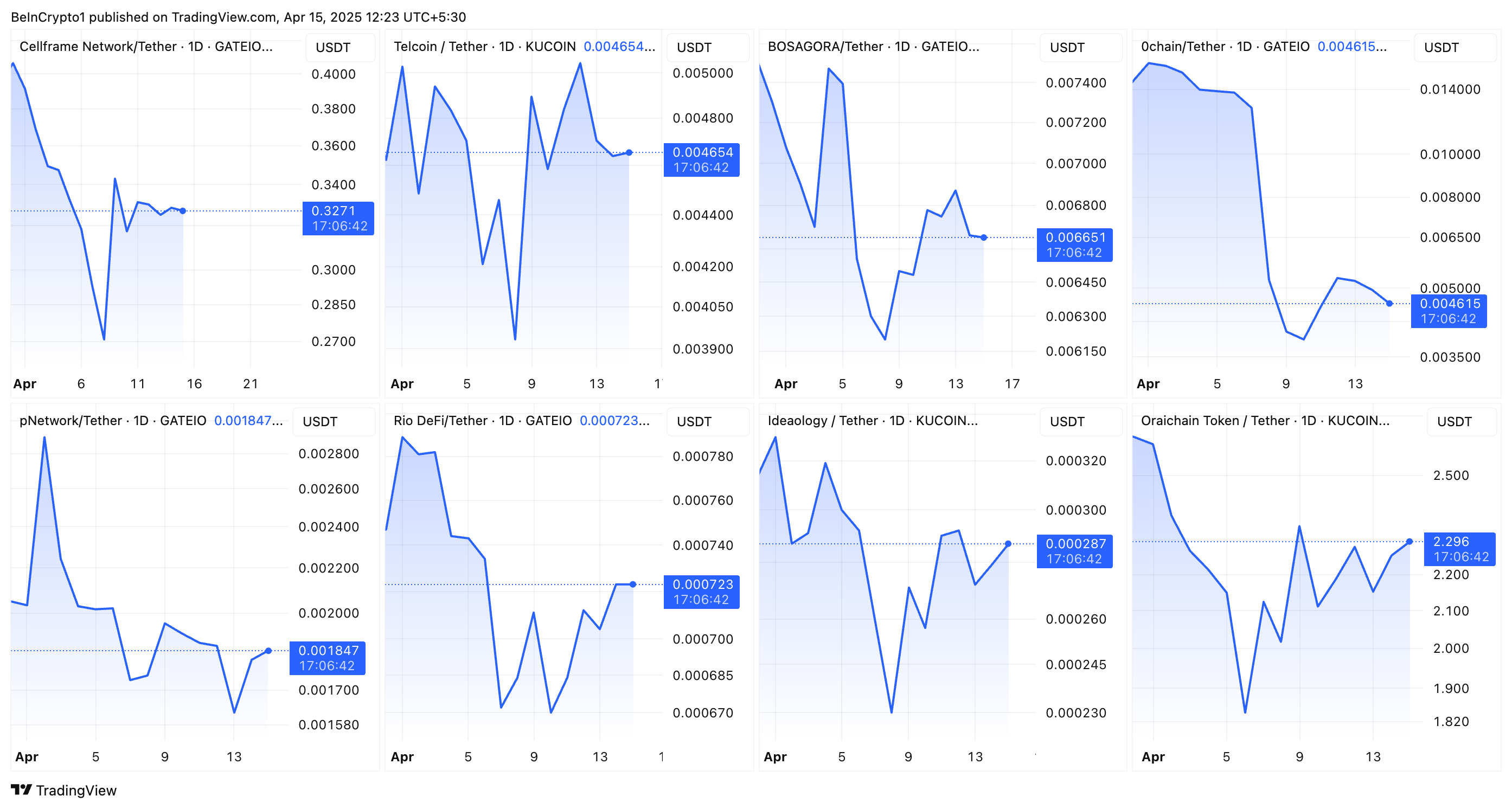

The affected tokens include Bosagora (BoA), 0chain (ZCN), PNETWORK (PNT), Telcoin (Tel), and Oraichan Token (Orai). The list also mentions Sentinel Protocol (UPP), Cellframe (Cell), Ideaology (Idea), and Riodefi (RFUEL), which correspond to various use cases within the blockchain ecosystem.

Even real estate and investment-related assets were affected. 1717 Bissonnet (1717), The Edison (EDSN), Draper Garland Apartments (GFDG), Forest Crossing Apartments (GFFC), Hello Albemarle (HLAB) and others were some of the tokens mentioned.

Some of the notable tokens saw a modest decline, while others were not affected. Plus, PNT, Orai, Idea and Tel have been valuing prices a lot on the past day.

Cell, Tel, BoA, ZCN, PNT, RFUEL, IDEA, Orai price performance. Source: TradingView

For context, Coinbase Prime offers a set of services designed to meet the needs of institutional investors. The platform offers custody, trading and financing solutions. The former allows institutions to securely store their digital assets, ensuring compliance and protection of large investments.

Nevertheless, the latest decision to remove these assets suggests that the platform is reassessing its offering. Coinbase has not disclosed any specific reasons for removing these specific assets.

Still, this move can be linked to factors such as low liquidity, market activity, and failure to meet facility-grade compliance standards. For institutional clients using Coinbase Prime, this change means that the holdings must be transferred or liquidated by the end of April 2025.

According to its website, Coinbase Prime currently supports more than 430 assets. This shift therefore represents a relatively small adjustment of the broader product.

This announcement comes as Exchange Coinbase continues to expand its portfolio. A few weeks ago, the exchange listed Doginme (Doginme), Keyboard Cat (Keycat), and Definitive (Edge). This move led to a noticeable rise in token prices.

However, the wider market situation had a negative impact on the exchange. Beincrypto reported that Coinbase shares experienced a 30% DIP in the first quarter of 2025. Additionally, this period marked the company's worst quarter since the collapse of the deprecated cryptocurrency Exchange FTX.

As Coinbase moves forward in the volatile cryptocurrency market, this decision to list certain assets appears to be part of a larger strategy to focus on more liquid tokens and better serve the needs of institutional clients.