Crypto US strains show today's mixing performance with focus on Core Scientific (Corz), MicroStrategy (MSTR) and Coinbase (Coin).

Corz is down -0.84% before the market, and is one of the worst performers in the sector this year. Meanwhile, MSTR has gained momentum after purchasing a new $285 million Bitcoin, pushing its five-day profit to 16%. Coin heads to its first quarter 2025 revenue report on May 8, rising 0.88% ahead of the market as it is about to recover from a sharp decline in YTD.

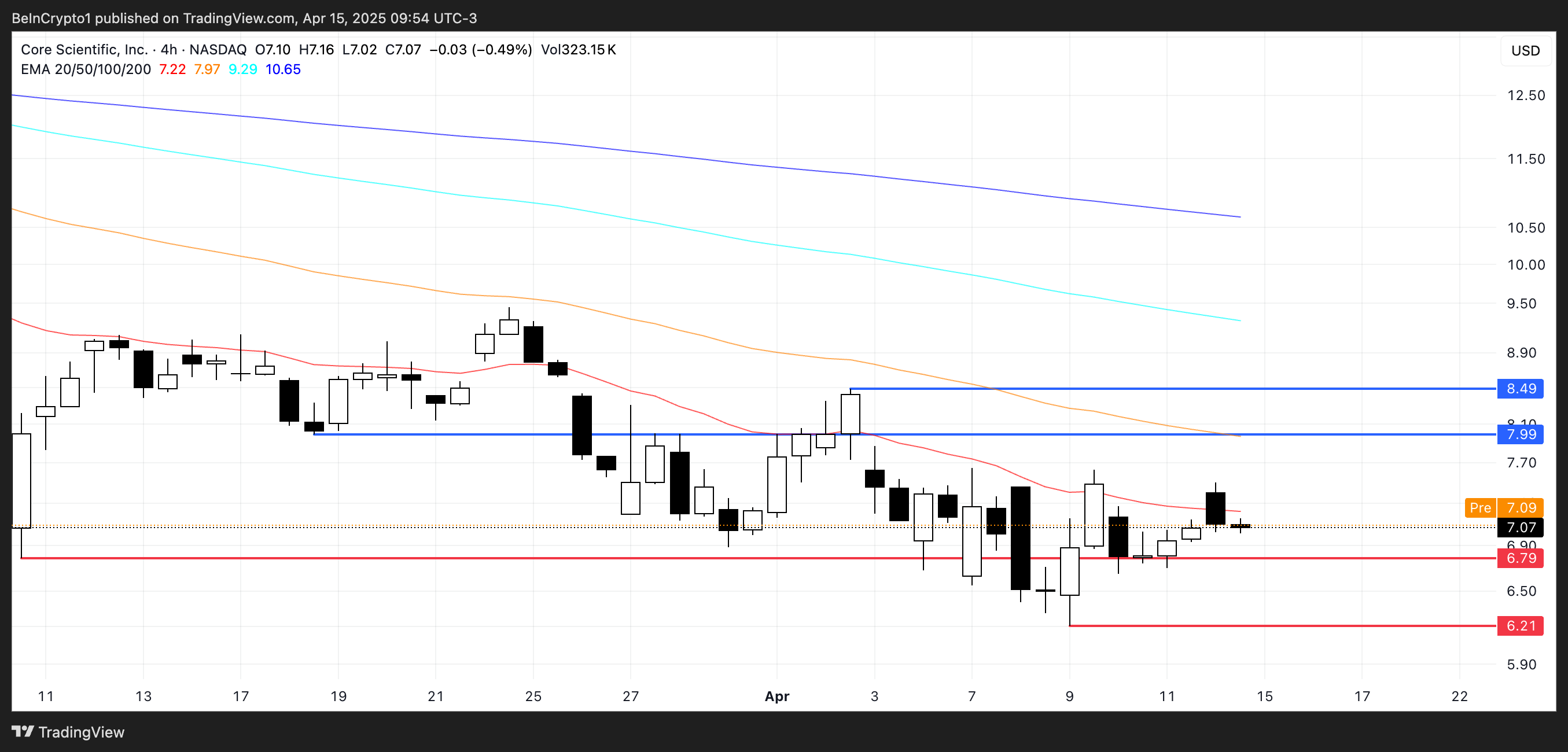

Core Scientific (Corz)

Core Scientific (CORZ) continues its recent performance, down -0.84% in pre-market trading. Despite broader strength across crypto-related stocks, stocks struggle to attract buyers.

The company operates one of North America's largest Bitcoin mining businesses. Provides infrastructure, hosting and self-mining services through a network of data centers.

Corz price analysis. Source: TradingView.

Corz has fallen nearly 50% since the start of the year, making it one of the worst performances of any crypto stock. In contrast, peers like Marathon Digital (Mara) and Coinbase (Coin) are far better.

Others benefit from diversification and stronger narratives, but core scientifics are linked to mining economics. This is hit by rising costs and a thin margin, but could rebound as BTC rebuilds momentum.

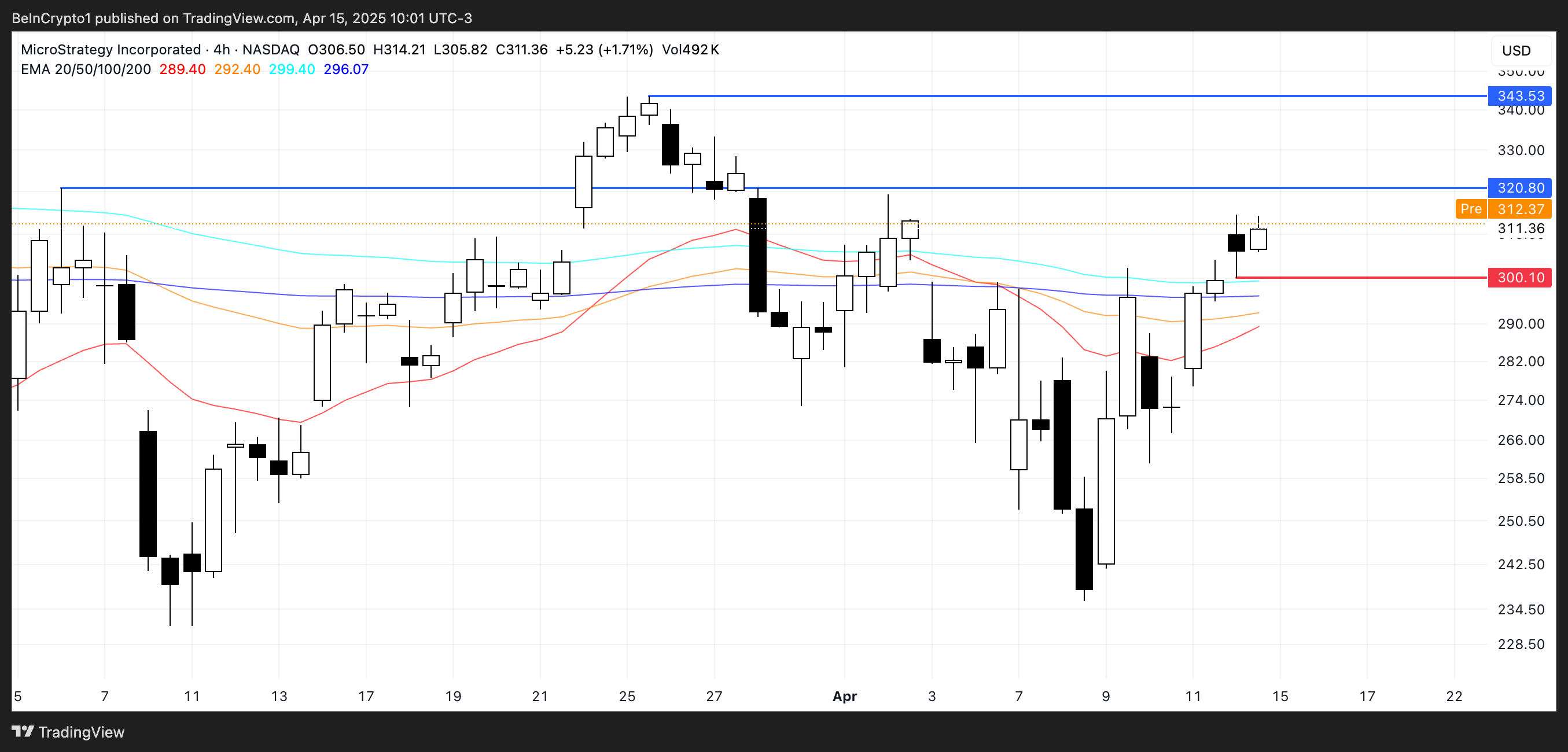

Strategy (MSTR)

MicroStrategy (MSTR) rose 3.82% yesterday, pushing its return from the start of the year to 7.54%. The stock shows strong momentum alongside Bitcoin's recent price recovery, with MSTR prices rising 16% over the past five days.

The company, led by Michael Saylor, is best known for its aggressive Bitcoin accumulation strategy. Originally it focused on enterprise software, but has since been heavily linked to BTC's performance.

MSTR price analysis. Source: TradingView.

The strategy recently purchased an additional $285 million worth of Bitcoin and added 3,459 BTC to its balance sheet. This will result in a total holding of 531,644 BTC.

The move will strengthen the company's position as Bitcoin's biggest corporate holder and effectively turn it into a leveraged BTC play for investors.

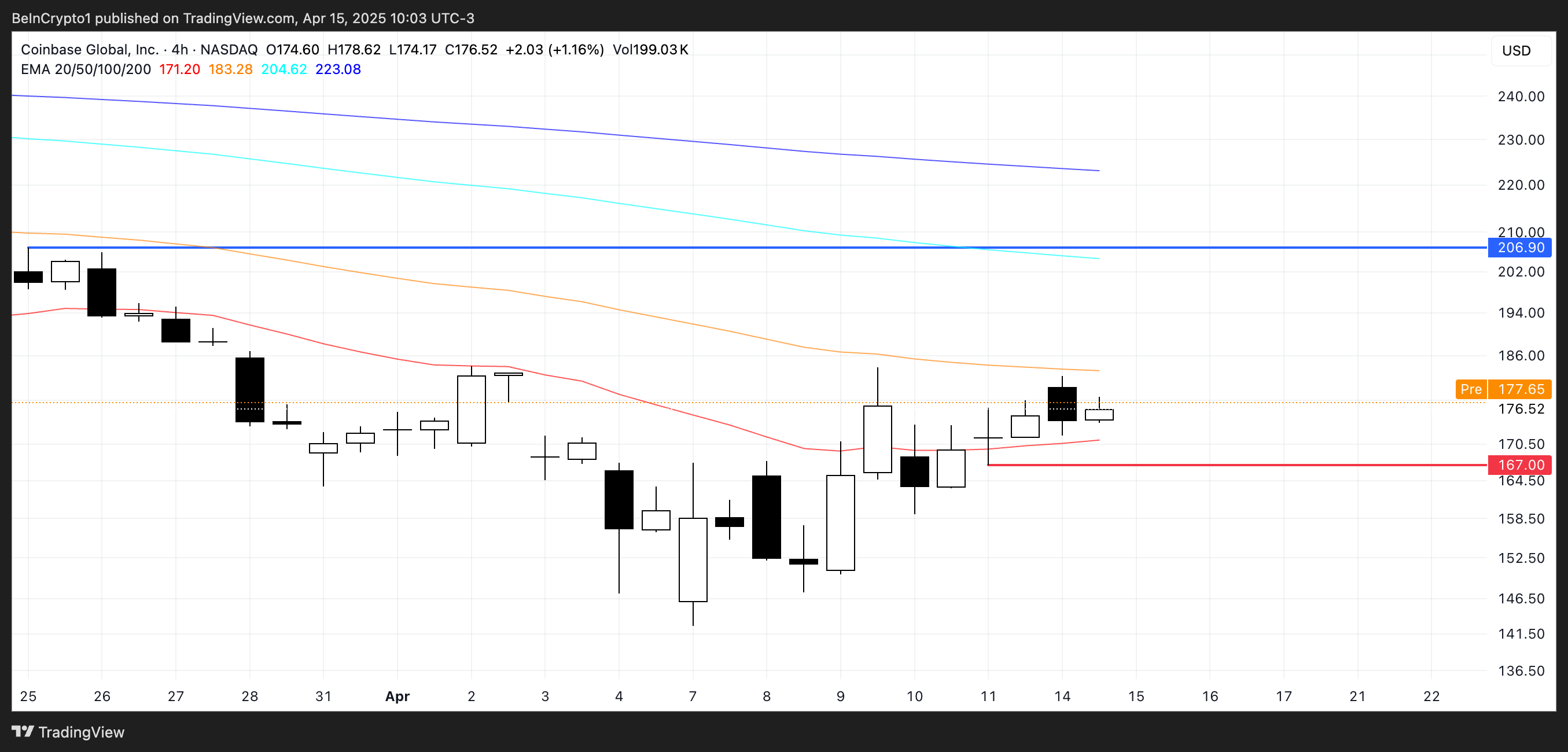

Coinbase (coin)

Coinbase (Coin) is up +0.88% in the pre-market market, indicating a continuing sign of short-term strength. This move comes ahead of major revenue updates.

Coin price analysis. Source: TradingView.

The company operates one of the largest cryptocurrency exchanges in the United States, offering trading, custody and staking services. Coinbase is set to report its first quarter 2025 revenue on May 8th. This could be a big catalyst for inventory.

The coin has increased by 12% over the past five days, falling nearly 29% since the start of the year before attempting to rebound.