This is a segment of the Forward Guidance Newsletter. Subscribe to read the full edition.

The US economy signed in its first three months. This is the first quarterly decline since 2022.

Today's advanced GDP estimates for Q1 showed a 0.3% annual decline, lower stock prices and higher Treasury yields and gold. Analysts expected GDP to grow by 0.4% in the first quarter.

The report was the day that President Trump marked 100 days in office, during which the S&P 500 notched its worst performance (-7.3% since inauguration) since the first 100 days of President Nixon's second term. Nasdaq Composite lost 11%. This is the biggest decline since President Bush's first term in 2001.

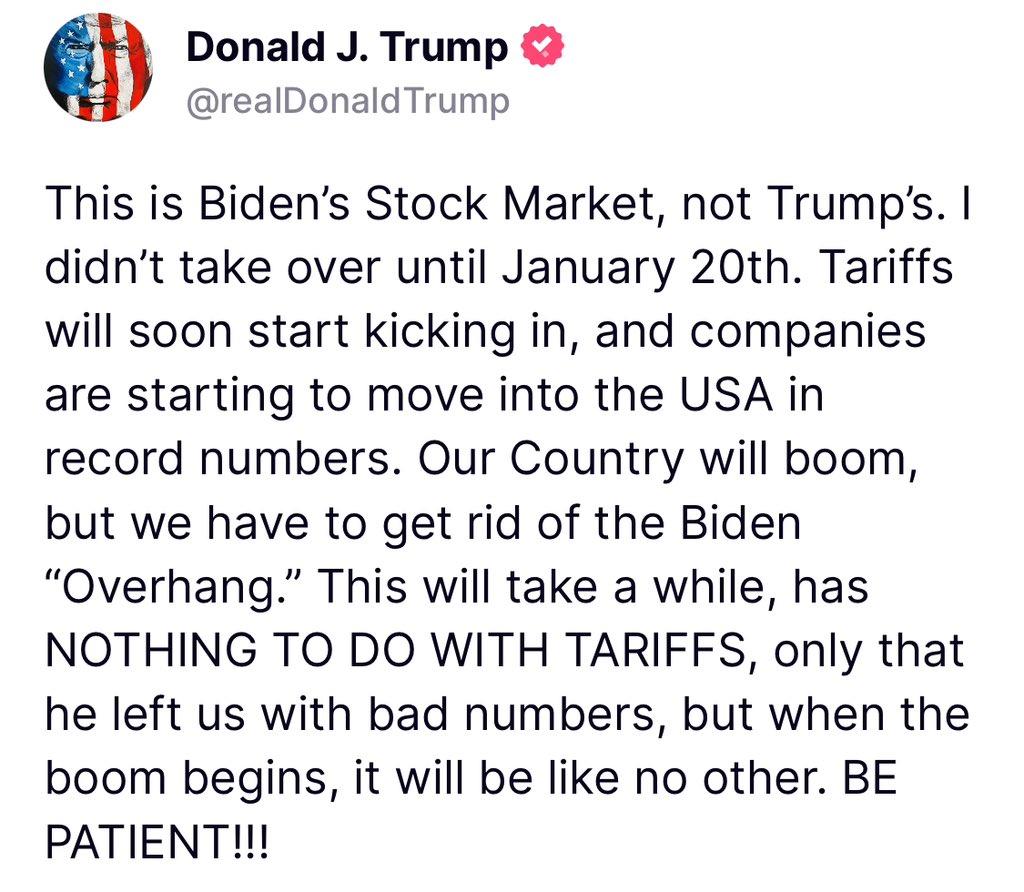

In a Truth Social Post on Wednesday, Trump claimed that “it's not Trump's stock, it's Biden's stock market.”

The “liberation date” tariffs came at the beginning of the second quarter, but first quarter data suggested that consumers and businesses began preparing more aggressive trade policies at the beginning of the year. In the first quarter, imports increased along with lower consumer and government spending. This is the perfect recipe for negative printing.

Imports rose more than 41% in the first quarter, compared to a 1.9% decline in the last quarter of 2024. Imports of goods have risen by more than 50%, indicating that consumers and businesses have been rushing to increase inventory ahead of expected tariffs.

GDP printing, as expected, is between the forecast from the Atlanta Fed's GDPNOW (-1.9%) and the New York Fed's Nowcast (2.6%).

The Treasury also announced plans to improve its buyback programme today. The Treasury said in a statement that “possible enhancements” could be made on purchase amounts, scheduling and frequency.

The update sends yields after Treasurys was sold earlier this month, raising concerns about slowing the economy and closing financial position. Trump said the surge in yields is enough to help him compete for some of his tariff policies. He issued a 90-day suspension in most countries, just a week after the release date.

Investors are now awaiting signs that the administration has trade contracts with other countries. After comments from Treasury Secretary Scott Bescent that the situation with China is “unsustainable,” the stock felt a short-term relief, but has since shaken its recovery path.