The Arbitrum Foundation has announced on its former Twitter X (formerly Twitter) that DAO is moving on to the next stage of its stable financial funds program (STEP) after an on-chain voting.

As part of a new phase of DAO's initiative to diversify the Treasury with investments in real-world assets (RWAS), it will allocate 35 million ARB worth around $11.6 million at current prices to tokenize the US Treasury through Franklin Templatelet, Spico and major issuers of Wisdom.

It's a big day for RWAS!

Arbitrumdao has approved 35M ARB via step 2 to accelerate the institutional adoption of RWA at @FTI_US @Spiko_Finance and @wisdomtreefunds

Only on Arbitrum, this means 👇pic.twitter.com/atnyof4qsh

-Arbitrum (@arbitrum) May 8, 2025

Funds will be distributed to three issuers

According to a DAO post, after the proposal process which evaluated more than 50 submissions, the Step Committee recommended an allocation of 35% for Franklin Templeton's FOBXX (tokenized as Benji), 35% for Spiko's USTBL, and 30% for WisdionTree's WTGXX.

The committee, made up of elected members of the community, chose to achieve a proper balance between fees, existing TVL, risk-adjusted setup and community involvement.

While almost 89% of participants voted in favor of the allocation, many of them expressed satisfaction with the decision as they believe that they reflect a proper balance of costs, risk and returns without compromising on the broader goal of supporting arbitrum's RWA growth.

Only 0.01% voted against it, with around 11% choosing to abstain. Voting lasted for several days and ended Thursday at 9am from May 1st. On behalf of the committee, according to a proposal submitted by Arbitrum DAO Strategic Consultant Entropy Advisors, the non-selected applicant will reapply in the next round.

“We are thrilled to be selected as manager of the Step 2 program, and we are already deepening our strong connection with the Arbitrum user base,” said Roger Bayston, head of digital assets at Franklin Templeton. “By leveraging Arbitrum's leading Layer 2 technology, we can provide clients with faster, more scalable and cost-effective solutions. This collaboration not only strengthens our commitment to innovation, but also places us at the forefront of the next generation of financial services infrastructure.”

Step Initiatives are important for DAOs

The Step Initiative is a strategic move to promote more institutional involvement in the arbitrum ecosystem and expand its influence on the broader blockchain and financial sector.

Matthew Fiebach, co-founder of Entropy Advisors, shared his thoughts on development in a recent interview. According to him, the fact that organizations such as BlackRock, Franklin Templeton, Spiko and Wisdom Tree are publicly published on the forum with DAO is “an incredible achievement for the entire crypto space.”

“From day one, Arbitrum has been strategically placed at the heart of Crypto's convergence with Tradfi, and Step is a great example of DAO's solid push.

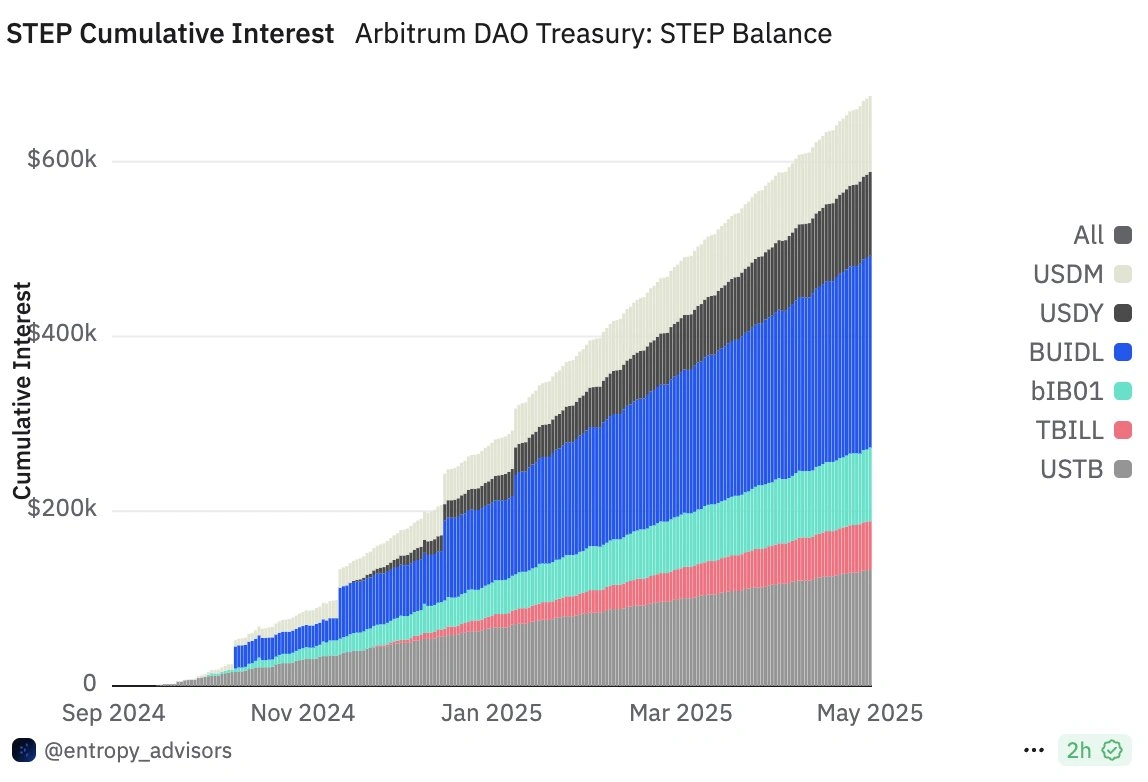

Arbitrum Dao has seen more than $650,000 in interest since its launch over six months ago. Source: Arbitrum

All three organizations involved in the Arbitrum Initiative have decades of experience in managing assets, and involvement in Step 2 can inform other agencies that their network is a reliable and secure platform for managing RWA.

Partnerships with these established TRADFI companies will help demonstrate that Arbitrum is safe and has a mature ecosystem that can handle institutional-grade financial operations.

According to a post from Arbitrum, DAO's interest has been generated more than $650,000 since it was launched more than six months ago.