On Tuesday, Bitcoin Spot ETF recorded a net outflow, snapping a three-day influx streak that led to over $1 billion.

Due to the uncertainty surrounding future policy decisions in the Federal Reserve, institutional investors appear to be reducing exposure in anticipation of increased market volatility.

Agency to which Fed decisions are pulled back from BTC ETF as looms

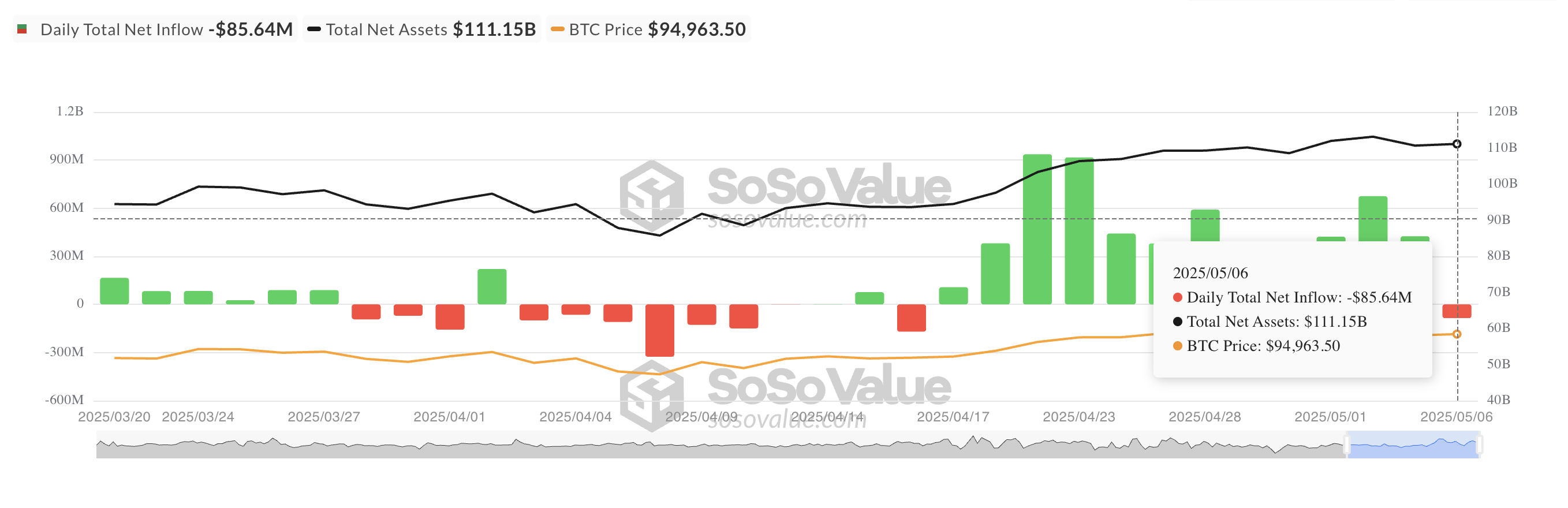

The BTC Spot ETF produced a net flow of $85.64 million on Tuesday, showing a shift in institutional sentiment just before today's latest policy meeting in the US Federal Reserve.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

The outflow came after a strong inflow of over $1 billion for three consecutive days into these BTC-backed funds. This suggests a pullback to prepare market participants for the potential volatility surrounding today's FOMC announcement.

It can also be viewed as a strategic step to avoid short-term losses in the event of a disadvantageous policy signal or unexpected market response.

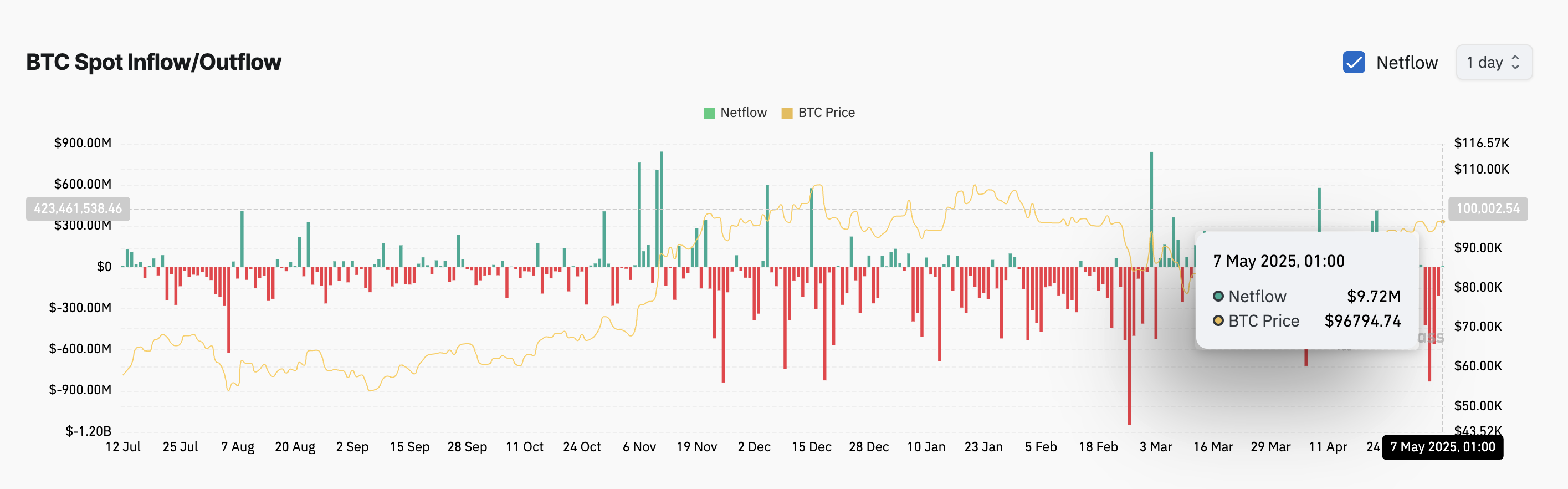

Despite ETF leaks, on-chain data reveals a surge in spot net inflows today. This indicates that while institutional players may be reducing ETF exposure, they may rotate capital directly to the spot position to capitalize short-term price fluctuations before and after the Fed's announcement.

According to Coinglass, BTC's spot-net inflows will be $9.72 million. When assets look at spot inflows, the number of coins or tokens purchased and moved to the spot market is increasing, indicating an increase in demand.

BTC spot inflow/outflow. Source: Coinglass

This indicates a surge in accumulation among participants in the BTC spot market.

Bitcoin rises with buyer strength

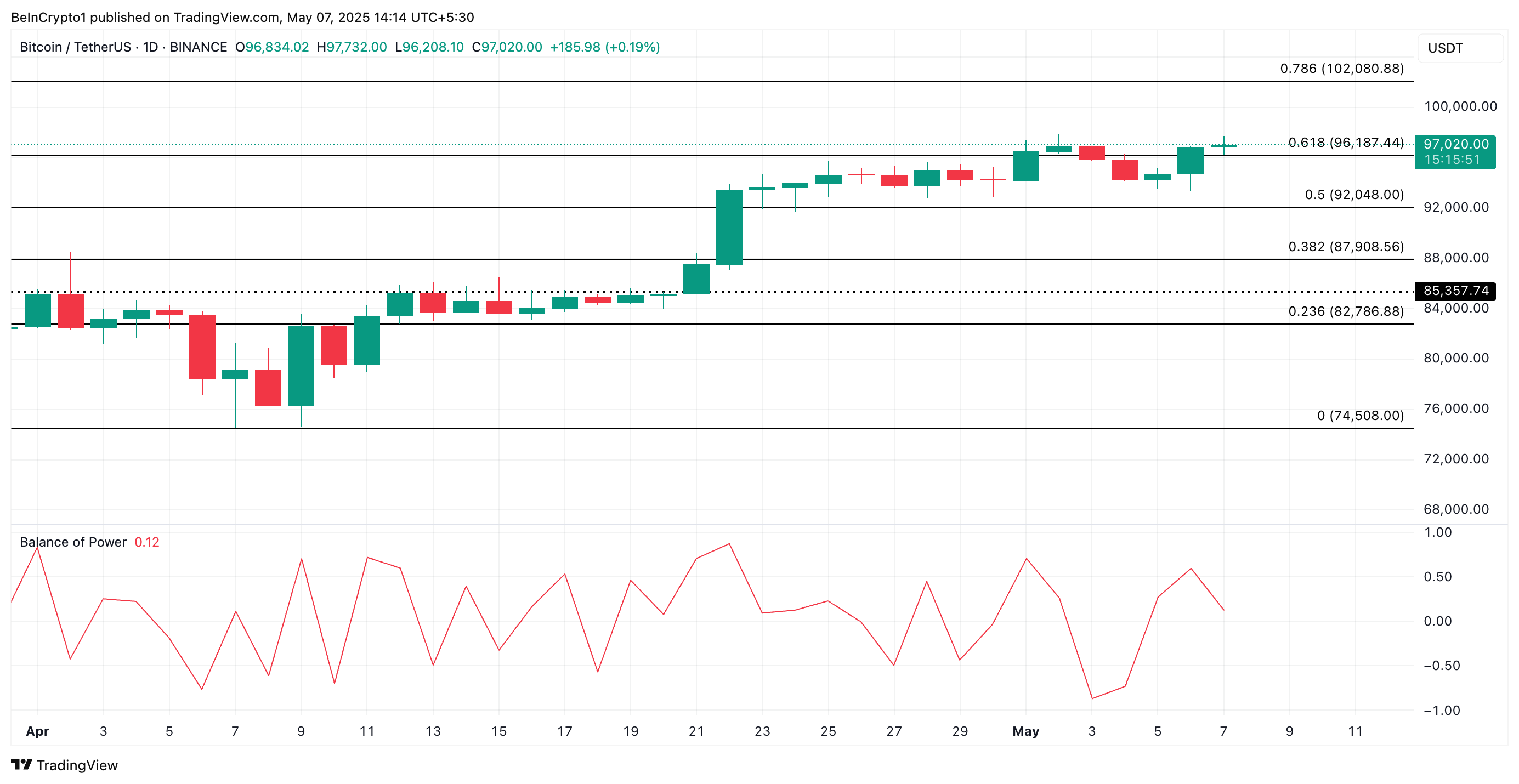

BTC traded at $96,679 at press time, focusing on a 2% surge in the past day. The Coin's aggressive balance of power (BOP) reflects a steady rise in spot buying activities prior to the FOMC meeting. At the time of writing, this is 0.10.

This indicator measures the strength of buyers and sellers by comparing closing prices with trading ranges over a given period. When that value is positive, buyers dominate the market, suggesting intense momentum and upward pressure on asset prices.

If BTC is favorable in rocket and market conditions, then post-FOMC meetings are favorable, it could rise to $102,080.

BTC price analysis. Source: TradingView

However, if market volatility causes a shift to the downside, BTC could reduce its recent profits and violate $96,187 in support, dropping to $92,048.