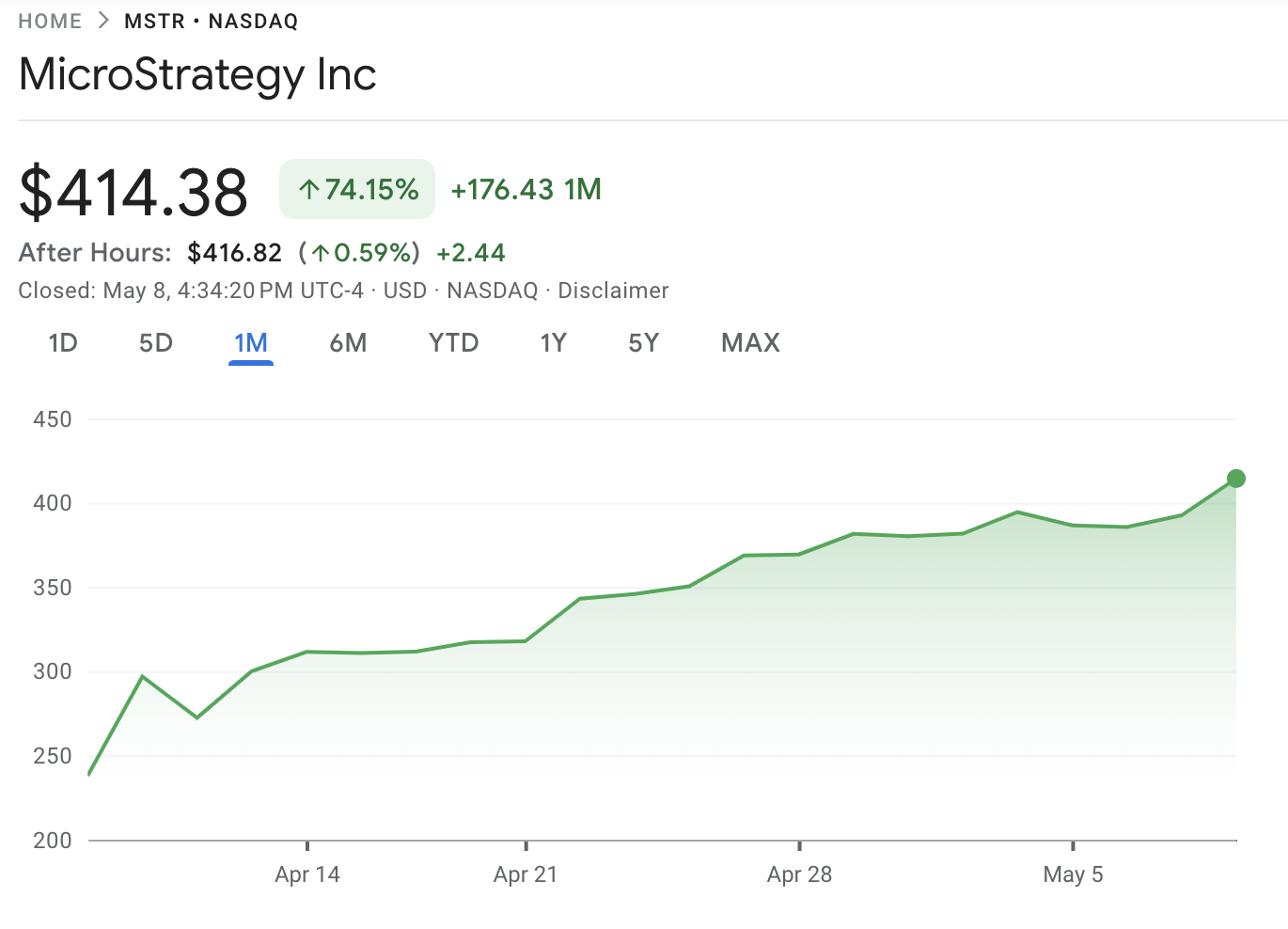

Strategic stocks have been surged recently along with Bitcoin profits. MSTR spiked 7% today and 75% last month despite massive losses in early March and the first quarter.

Critics are increasingly wary of the company as its debt obligations could soon become unstable. Nevertheless, its rating has consistently risen in the weeks before this milestone.

Strategic Bitcoin Betting Pays

Bitcoin could hit $100,000 today, marking a shift in the crypto industry. Bitcoin's biggest corporate holder, Strategy can easily breathe despite rumours of persistent bearishness.

The company recently reported a massive first quarter loss, but its stock valuation is still rising.

Strategy (MSTR) Equity Performance. Source: Google Finance

At first, this may seem like a conundrum. The strategy has received intense criticism of the Bitcoin program as critics feared forced liquidation.

However, BTC prices are steadily rising, and Michael Saylor's company is growing in addition to that. MSTR has risen nearly 50% since its low in March, with stocks currently surpassing BTC and major tech companies.

Compare MSTR 1-year returns on other major US stocks and assets. Source: X/Bitcoin Maxi

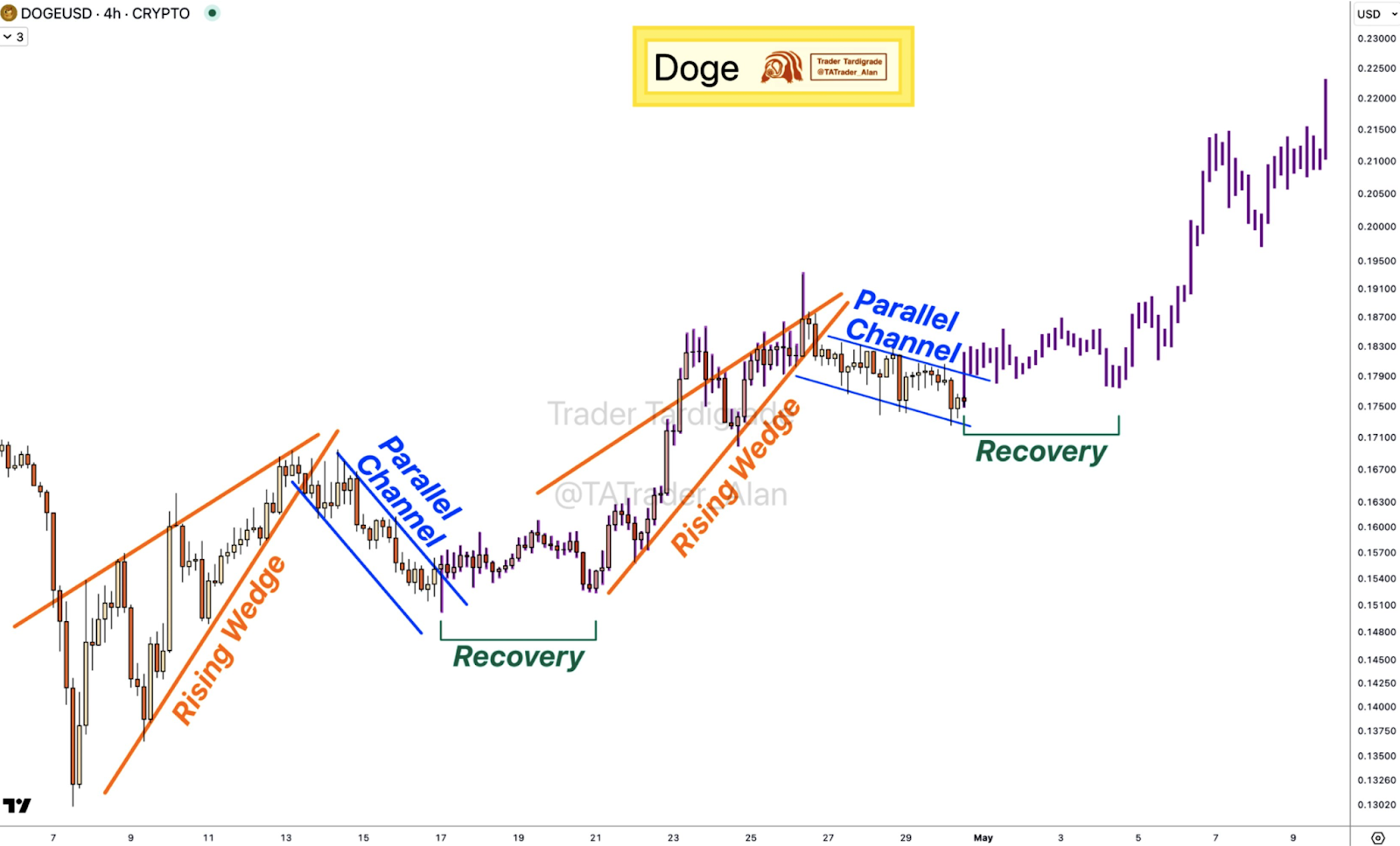

Several factors contributed to the company's strong performance. Trump's tariffs led the crypto market to sign a contract for several weeks, but the market is now showing more positive signs. During this period, the strategy continued to buy Bitcoin at a consistent rate.

Doing so has become a pillar of Bitcoin's confidence for the crypto community. This defiant attitude has earned prominent adorable people such as Eric Trump.

Still, a lot is in flux now. The market is very confusing and false rumors have been moving on several recent occasions. The BTC reached $100,000 due to the UK-US trade agreement, but this moment may not last.

The strategy links its entire future to Bitcoin, leaving the company's debt out of control. The company's stocks exceed BTC, but are not stable.

But to be clear, the company has posted very consistent profits over the past month. Rumors of forced Bitcoin liquidation were strategy-making, but this did not slow the momentum of its advance.

For now, Bitcoin and its biggest corporate holders could continue to grow like this in the near future.