A closely followed crypto strategist believes another parabolic rally is available for this cycle of Bitcoin (BTC).

Pseudonymous analyst Jack told X's 268,600 followers that he doesn't expect the Federal Reserve to cut interest rates at Wednesday's meeting, despite oil falling below $60.

Oil is trading at $59.77 at the time of writing, with an opening price of over 22% in 2025, from $77.46. Crude oil prices crashes usually indicate a destruction of demand and a weakening of the global economy.

According to analysts, the dark macroeconomic background sets the “perfect deal” for BTC.

“How does Bitcoin work here?

The best guess is that it follows the stock, but it separates and recovers quickly. I'll take a picture of Gold as an example for March 2020. It's the beginning of the short, shallow crashes, and the steepest stages of that parabolic trend. It's a perfect deal and could be the basis for an incredible gathering. ”

In March 2020, gold lost almost 15% of its value before igniting a 43% surge in just five months.

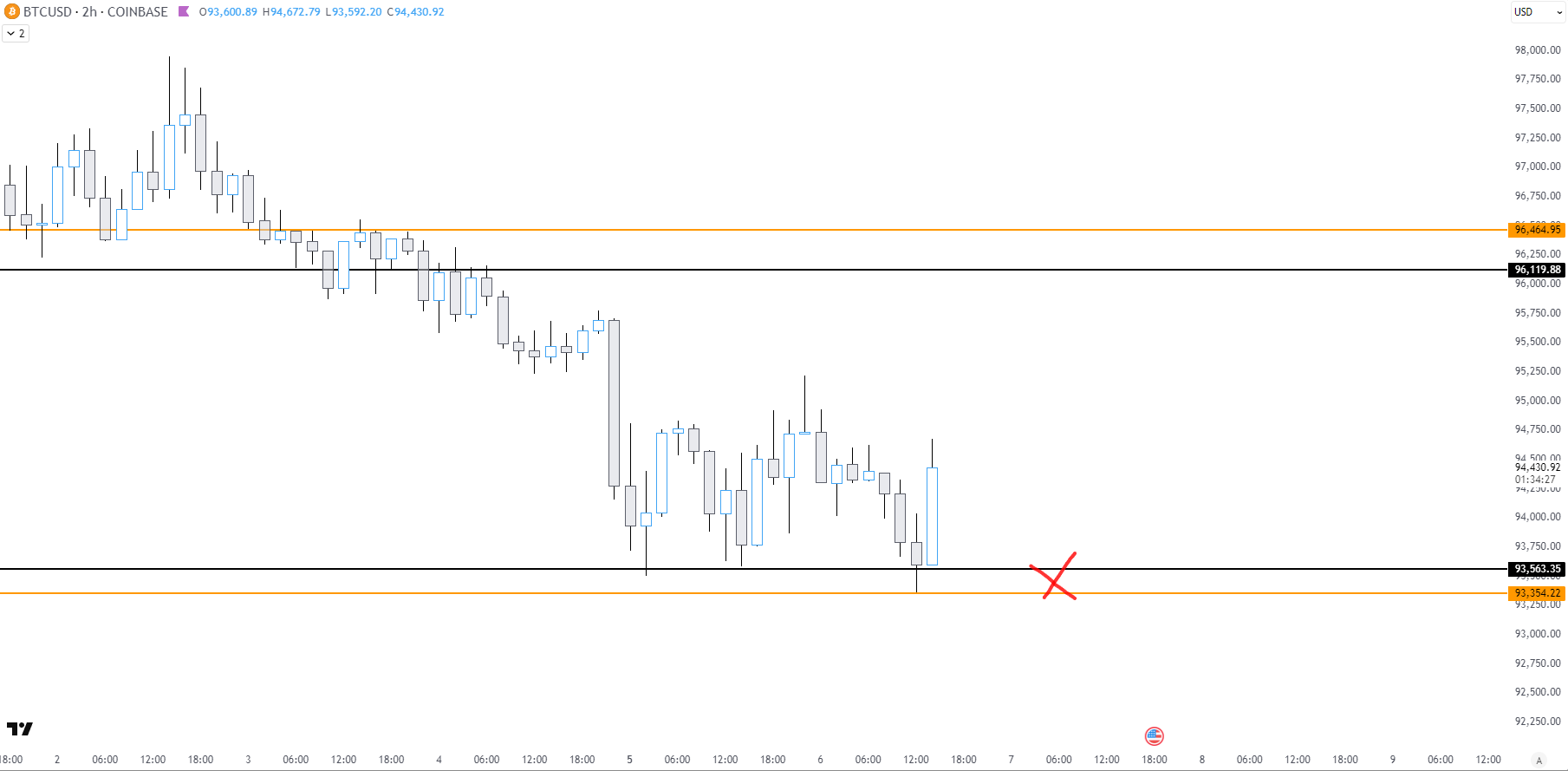

Jack zooms in on Bitcoin and says that BTC needs to go above $93,000 to avoid witnessing another corrective action.

“The low time frame BTC Bulls don't want to see the price again on the X. Otherwise, they're hoping for a flash.”

Source: Jack/X

At the time of writing, Bitcoin is trading at $96,791, an increase of over 2% over the past day.

Generated Image: Midjourney