The crypto market has shown signs of improvement, with its total market capitalization recently exceeding $3 trillion. This recovery suggests increased confidence among investors.

But the harsh reality is that as many tokens as listed this year have also died due to the lack of a sustainable growth method.

A venture capitalist who is responsible?

Venture capitalists are essentially killing the crypto space as they choose to fund new crypto products just to make a profit. This may not seem harmful anytime soon, but it will affect the long-term viability of the industry. David Phelps from Jokerrace explained how VC works with Crypto.

“Normally, VC money has come from the top for a few years now, but companies work to get it in the long run… but with crypto that didn't happen. Companies used it to use it to mint the token in VC-level ratings and worked to enhance the price of the token.

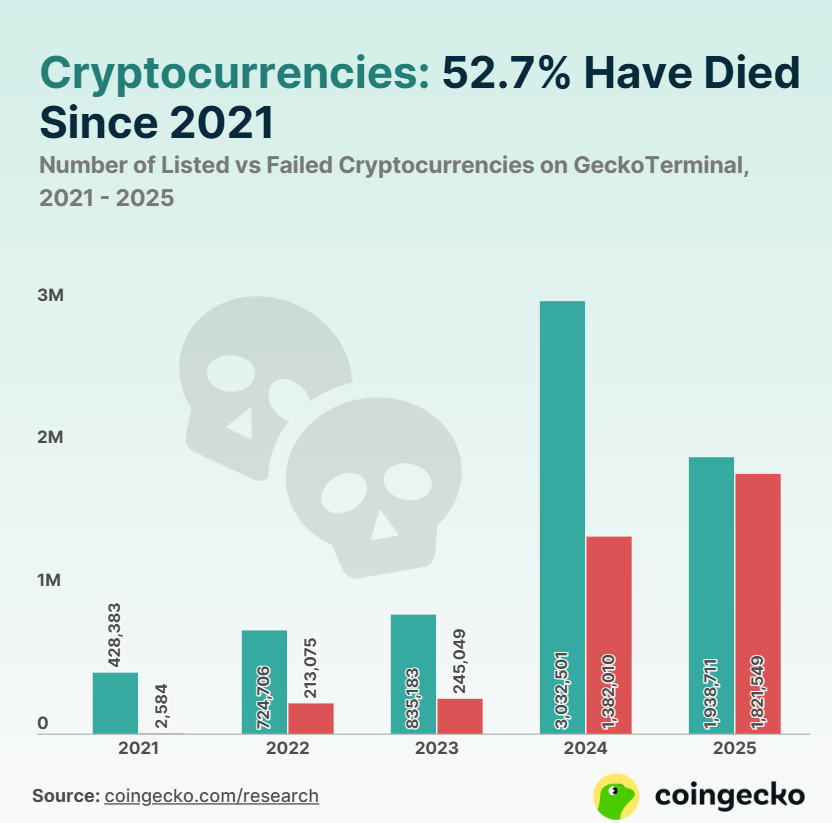

However, as market conditions worsen, VCS begins to pull back, and crypto projects are feeling an impact. A recent Coingecko investigation report revealed that over 1.82 million cryptocurrencies have failed in 2025 alone, but about 1.93 million have been successfully listed. This has been a huge increase since 2024 when only 1.38 million tokens failed, and is surprising considering 2025 is only halfway through.

Crypto Tokens is listed and dead. Source: Coingecko

The rise in obstacles highlights a shift in vision within the industry. What began as a financial revolution has turned into gambling for quick profits. This shift undermines the original purpose of cryptocurrency.

In an interview with Beincrypto, Hank Huang, CEO of Kronos Research, discussed how Crypto Projects can distinguish between fraud and a stronger position.

“Starting with a lower market capitalization will attract investors' attention and show that prices and market capitalization are not artificially expanding. We will set up the DAO model by focusing on achievable yet exciting milestones, building strategic partnerships and providing a clear roadmap. Long-term value through collective input and collaboration,” Huang said.

Find the way

One of the main reasons for tokens and project failures is its lack of focus on revenue. Many VC-led projects work with free money and offer free services until they run out of funds. This creates an environment in which investors are hesitant to pay for similar services, even if the alternatives are more sustainable.

The question arises: Instead of relying on token price manipulation and VC-driven hype, how can crypto companies create business models based on real value and user-driven revenue? According to Huang, the answer lies in the company itself:

“Crypto projects should avoid the inflated valuations driven by short-term hype and start with smaller, more manageable market capitalization. From token price incentives to real revenue models, fees, services, or user-driven growth, the focus is clear and achievable roadmap, which can slowly deliver in the long run, but can soften the overly extended value. I told Beincrypto.

Simply put, it is an important time for the Crypto market to reorganize for its original purpose. It is about creating economic independence. This change is necessary to prevent the crypto market from falling into a full-scale crisis.