Data on the chain shows that a small number of investors are gradually re-entering into the space, which increases retail participation in the Bitcoin (BTC) market. This updated activity is often a sign of increased confidence in your assets, and the next leg could serve as a catalyst to raise prices.

Bitcoin witnesses are increasing in retail participation

According to a recent encrypted quick take post by on-chain analyst Carmelo Aleman, retail investors, defined as wallets holding $10,000 in BTC, are steadily returning to the market. These participants are usually the most responsive to market movements.

Aleman said that retail investors don't always take the market as effectively as institutional players, but their actions are a key barometer of broader market sentiment. As more retail investors participate, they tend to create a positive feedback loop, strengthen bullish narratives, and encourage increased purchasing pressure, attracting even more participants.

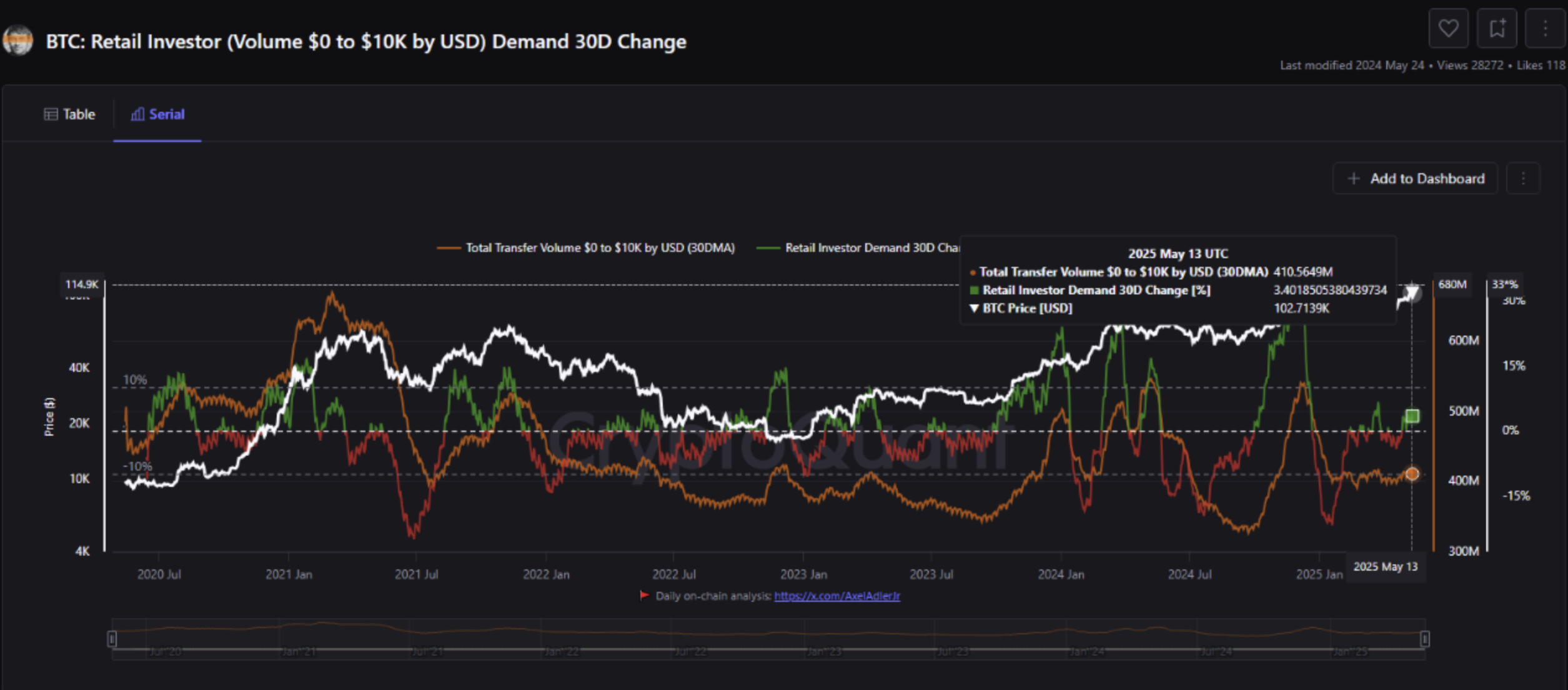

BTC: Retail Investor 30 Day Change Indicators reflect this trend. Since testing positive on April 28th, the indicator has seen a 3.4% increase in retail purchases until May 13th, indicating a strong resurgence in small investors' activities.

Aleman added that if Bitcoin continues to have an upward momentum, the broader crypto market could benefit as retail investors could start diversifying into other assets in search of higher returns. He wrote:

This could benefit the entire crypto space, as small investors are likely to diversify into other projects, such as debt, staking, the future, and other instruments. All signs indicate that this shift in retail behaviour is the beginning of a new wave of mass adoption in the cryptocurrency market.

Aleman also highlighted monitoring of other on-chain indicators, such as active addresses, umpent transaction output (UTXO) counts, new addresses, and amount of transfers.

Some warning signs for BTC

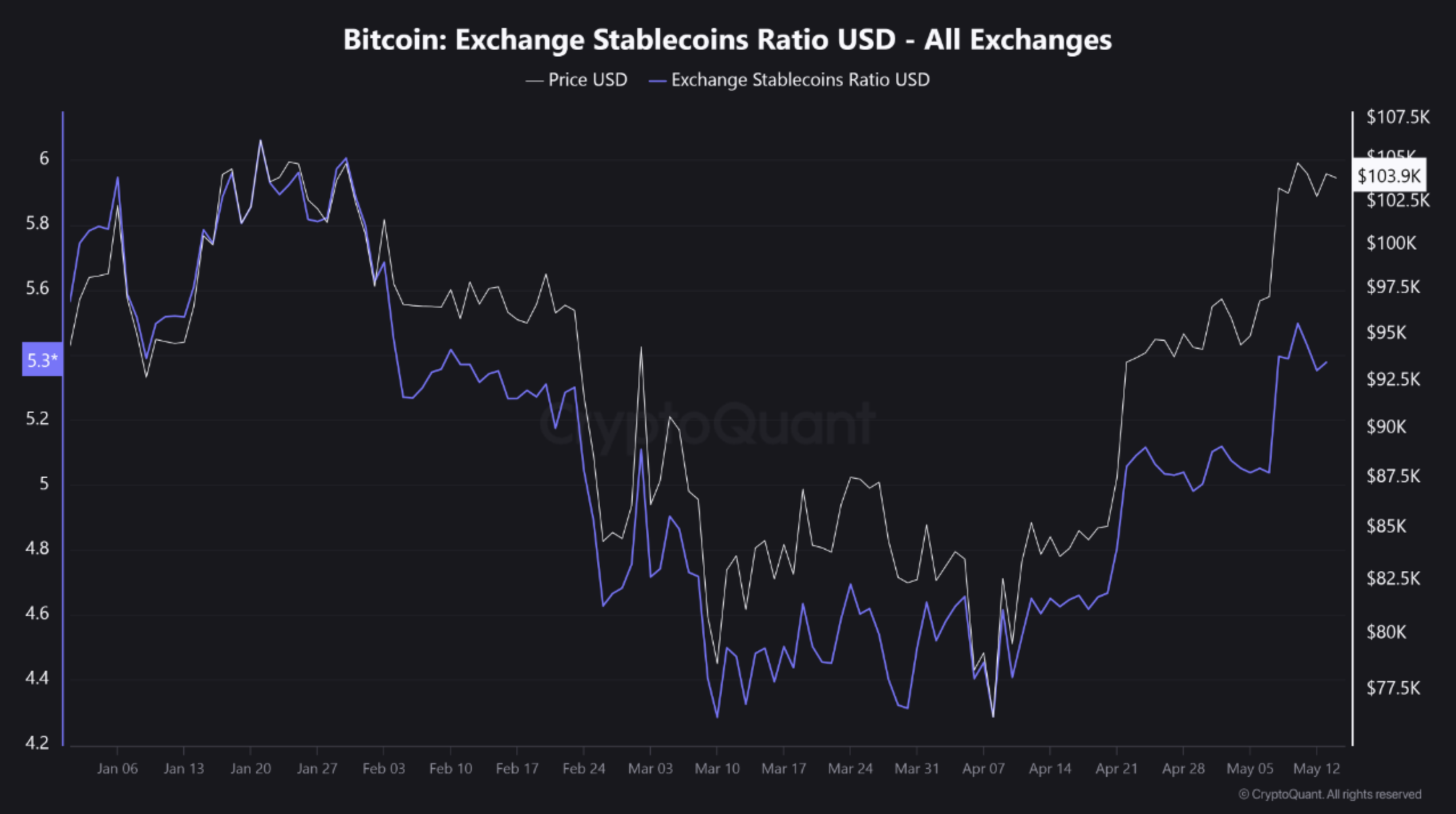

The growing interest in retail is encouraging, but some Red flag I suggest some caution. In particular, the Exchange Stablecoins ratio (USD) recently rose to 5.3 during Bitcoin rallies. This suggests that BTC will book on the exchange. It suggests that the Stablecoin balance is currently exceeded.

According to encrypted contributor Egypthash, readings above 5.0 are historically important. A surge similar to January's 6.1 was followed by a sharp price adjustment, indicating that investors may be returning from BTC to cash.

Despite some caveat indicators, Bitcoin continues to be on display Bullish momentum. Probabilistic rsi is display Updated strength, and other technical signals, suggest that the gathering can continue. At the time of pressing, BTC has been trading at $103,993, up 0.3% over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts