- TD sequential signals could be trend fatigue near $2,500 after the recent ETH rally

- Holds $2,500 in support in a flat volume, with resistance seen near $2,530

- ETH is 48.68% below ATH despite rebounding from the $1,800 level earlier this month

Ethereum's recent upward momentum may be losing its strength, and technical indicators suggest possible short-term revisions. The sales signal triggered by the TD sequential indicator on the 3-day chart has attracted attention from analysts as ETH trades beyond the main support level following a short rally.

Analyst @Ali_Charts shared a chart showing the “9” counts completed with the TD sequential indicator on May 17, 2025. This signal is usually associated with trend fatigue and may indicate a local top. The warning fell 2.6% after Ethereum rose earlier this month, from under $1,800 to a recent high of $2,648.68.

#ethereum $eth can be bound by a short revision as the TD sequential indicator presents sales signals on a 3 day chart! pic.twitter.com/6o1knj93f6

– Ali (@Ali_Charts) May 18, 2025

The chart also marked Fibonacci's retracement level as its main price range. Ethereum temporarily surpassed the 1.272 Fibonacci expansion level at $2,746.63 before retreating. The bearish candle is currently at $2,403.81 just above the 0.786 retracement level, suggesting that the recent highs could serve as a region of resistance.

The combination and rejection of TD sequential “9” from Fibonacci's extended level may indicate a weakening of bullish tendencies. Strong resistance in this price range could affect Ethereum's ability to maintain its recent momentum.

After a short rebound, price movements stall

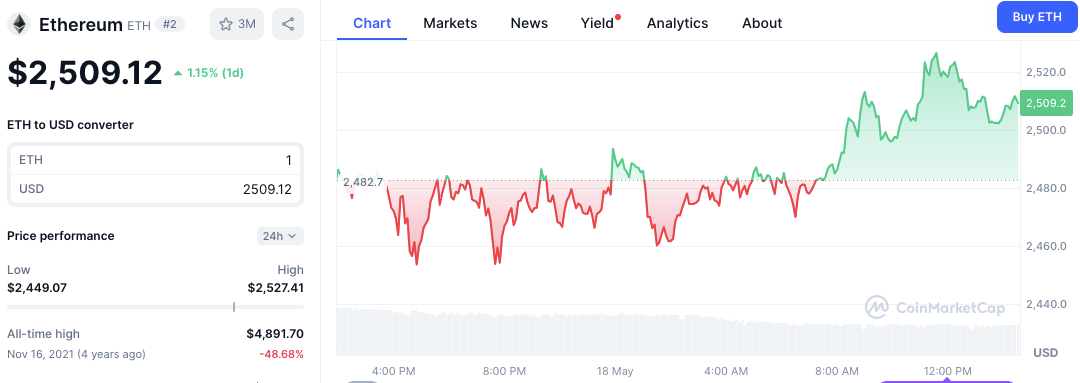

As of press time, Ethereum was trading at $2,509.12, reflecting a 1.15% increase over the past 24 hours, according to CoinmarketCap. Assets fluctuated between a high low of $2,449.07 and $2,527.41. The modest profits lasted a relatively flat session overnight, with price action consolidating around $2,482.

Source: CoinMarketCap

During the morning session, ETH saw pickups of purchasing activities and outperformed the price at the $2,500 level. However, the red trading zone remains dominant on the short-term chart, suggesting continued sales pressure or lack of solid bullish convictions.

Despite the rebounds recorded on November 16, 2021, Ethereum is 48.68% below its all-time high of $4,891.70 despite the rebounds. Current price transfers are being monitored closely to determine whether the $2,500 mark serves as a solid support level or whether the assets are poised for further declines.

Key focused support and resistance

The $2,500 to $2,530 range is closely monitored by people participating in the market for important short-term movements. While $2,530 is forming resistance, $2,500 could serve as a key support for Gold's recent success.

Trading levels show a moderate pace. That is, the market has no decision on where to move next. Check if Ethereum is calm in the near future or if it continues to respond to the current signal.