Today, Ethereum suffers from double-digit price drops as it escalates geopolitical tensions between the trust of Israeli and Iranian rattle investors across the global market.

On-chain data reveals that a sharp decline in ETH has caused a surge in short positions across the futures market, indicating that many traders are now betting on further price losses.

ETH crashes amid the turmoil in the Middle East

The airstrike launched by Israel on Friday intensified fears of wider conflict in the Middle East, sending shockwaves through both traditional and digital asset markets.

ETH, the second largest cryptocurrency by market capitalization, has been hit harder, with traders falling more than 10% in the last 24 hours as they respond to rising geopolitical uncertainty.

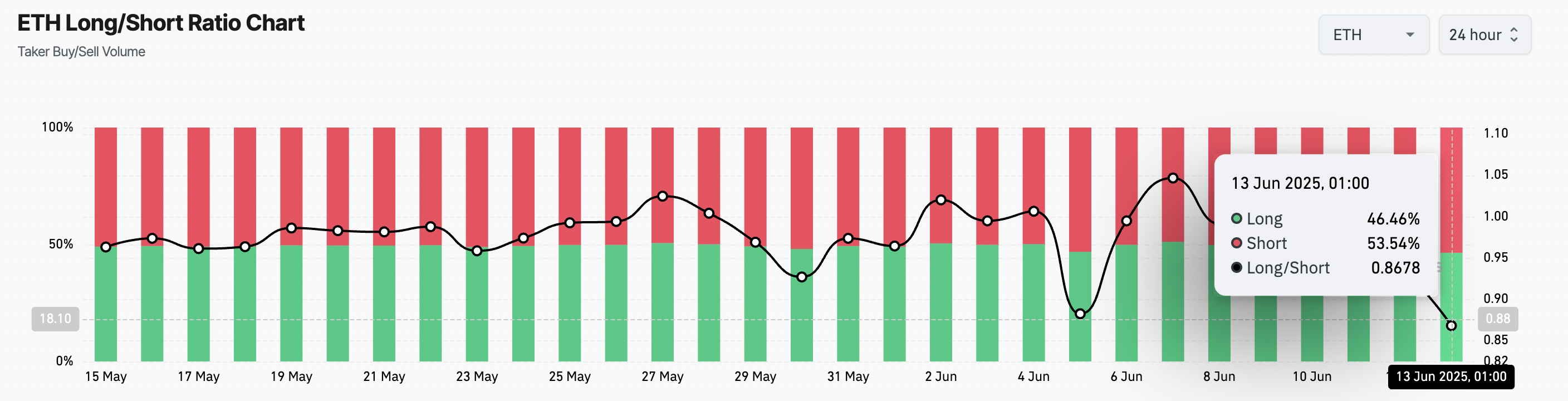

On-chain data suggests that many traders expect this price dip to continue, as reflected in measurements of long/short coins. At the time of the press, this is 0.86, indicating that more traders are betting on Altcoin.

ETH long/short ratio. Source: Coinglass

This ratio compares the number of long and short positions in the market. If the long/short ratio of assets exceeds 1, it can be longer than the short position, indicating that the trader is primarily betting on price increases.

Conversely, as seen in ETH, ratios below one indicate that most traders are positioned for price drops. This shows a rise in bearish feelings and a growing expectation for continuous decline.

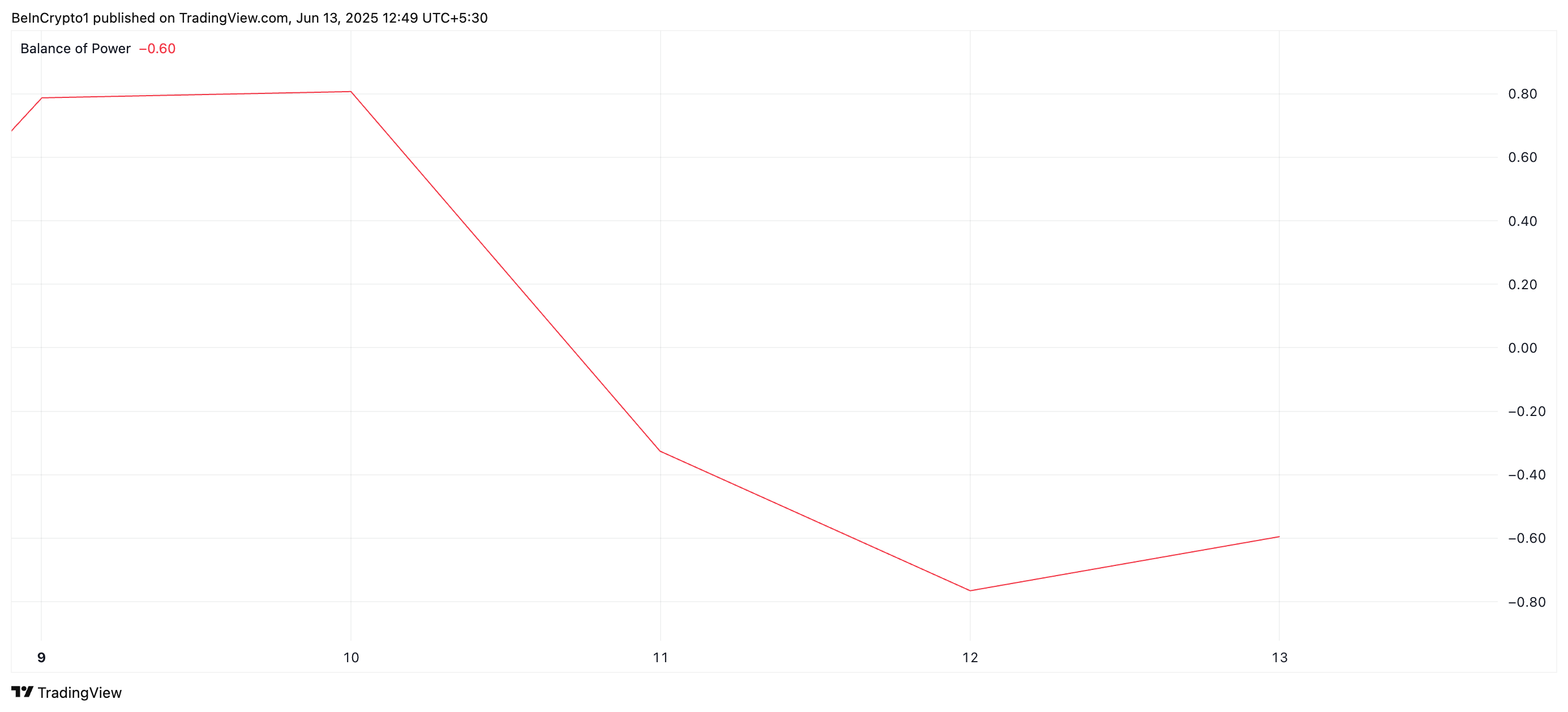

Additionally, ETH's negative power balance (BOP) supports this bearish outlook. At the time of pressing, this momentum indicator was -0.69, confirming the decline demand for major Altcoin among market participants.

eth bop. Source: TradingView

The BOP indicator measures the strength of buyers and sellers in the market. Negative BOP readings suggest that sales pressures dominate, indicating a high probability of lack of fresh demand and a continuous price drop.

The market is waiting for ETH's next move

At press time, ETH trades for $2,523 and holds $2,424 just above the support floor. If the sell-side pressure is increased, the coin could break under this floor, potentially dropping further towards $2,027.

ETH price analysis. Source: TradingView

Conversely, a new wave of shopping could negate the bearish outlook. In that case, the ETH could rebound and ralliate towards $2,745.