Ethereum (ETH) shows mixed signals when whivering near critical technology zones, with traders looking closely at breakouts and breakdowns. On the one hand, Bbtrend was sharp and bullish, jumping to 4.99 after hitting -3 just a day ago.

Meanwhile, whale activity has continued to decline for seven days in a row, a potential sign of weakening institutional trust. As ETH is stuck between strong resistance of $2,900 and key support of $2,679, the next move could define the direction of the short-term market.

Ethereum bbtrend Flips Bullish: What 4.99 means price action?

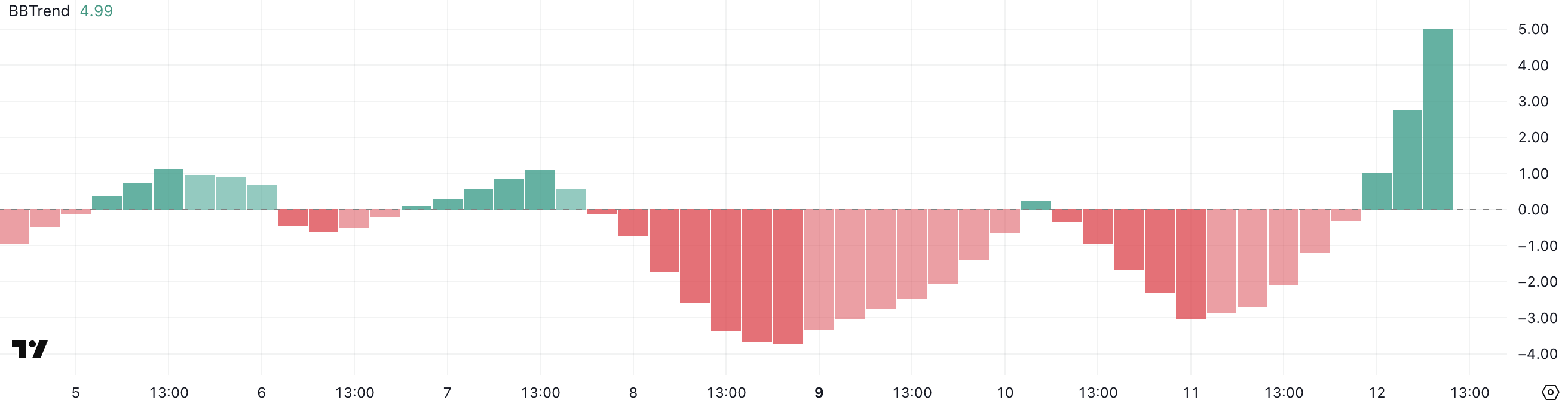

Ethereum's Bbtrend surged to 4.99, rising sharply in the past few hours after reaching a negative peak of -3 yesterday.

This sudden change in momentum suggests a potential reversal from bearish to bullish as the trend is correctly varied and is now approaching the upper threshold that represents a breakout scenario.

ETH BBTREND. Source: TradingView.

A Bbtrend, or Bollinger Band Trend, measures the strength of the direction of price movement over a Bollinger band. Values above 0 indicate upward momentum, while values below 0 indicate bearish pressure.

A measurement of around 4.99 indicates strong bullish momentum. If this trend is held or strengthened, it could rise further for ETH as traders interpret movements as changes in market sentiment and positioning.

ETH whales count decreases for seven consecutive days.

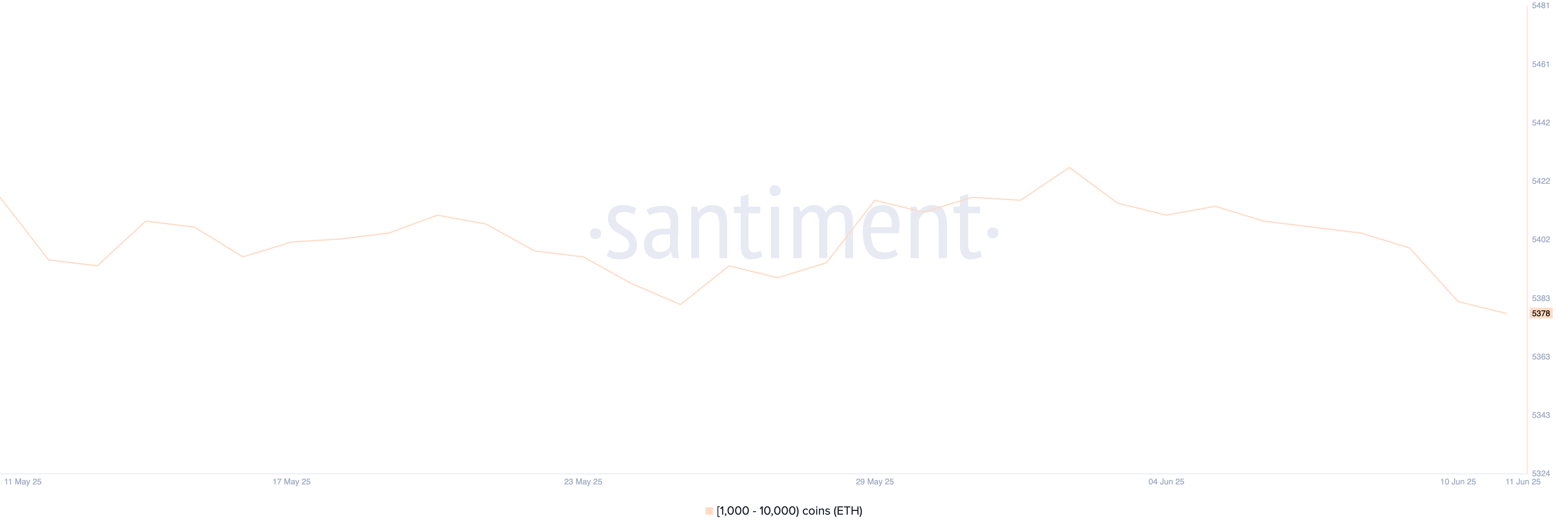

The number of Ethereum whales holding ETH between 1,000 and 10,000 decreased from 5,427 just 10 days ago to 5,378 from 5,400 three days ago.

This decreases for seven consecutive days. This could reflect cautious action among large holders despite Ethereum's future interest, which reached a recent record high.

These whales often measure the sentiment of institutional or high-end investors, and maintaining their numbers usually indicates either profit acquisition, risk reduction, or a decrease in confidence in short-term price behavior.

Ethereum whale. Source: Santiment.

Tracking whale activity is important. Because these large addresses have the power to influence market trends through transactions. As whales increase, it is often interpreted as accumulation and can demonstrate strong beliefs in future price growth.

Conversely, as we see now, a consistent decline indicates that key holders may offload positions or refrain from purchasing.

This behavior can weaken price support and lead to increased volatility. A downtrend in whale counts could put downward pressure on ETH, increasing the risk of pullbacks in the broader market.

Ethereum approaches critical support as it retains $2,900 in resistance

Ethereum has recently been unable to break through the nearly $2,900 resistance and is now approaching a critical level of support at $2,679. If this support is tested and not retained, the next negative target is $2,479, especially if bearish momentum is accelerated.

These levels are important. This is because the breaks identified under them indicate changes in the short-term market structure and could cause further sales pressure.

With whales becoming less active and market sentiment looking cautious, Ethereum is currently at a technical crossroads.

ETH price analysis. Source: TradingView.

Conversely, the Bbtrend indicator shows a strong bullish reversal, suggesting that purchasing pressure may be built. Once Ethereum regains momentum and retests and destroys $2,900 in resistance, a level that has not been seen since February 1st can meet at $3,000.

Such movements can reinforce bullish emotions and attract new attention from the bystanders.

However, for that scenario to unfold, the Bulls will have to first regain the lost ground and turn $2,900 into a solid support zone.