Bitcoin rose above $108,000 on Wednesday, reaching its highest level in weeks. Traders ignored new uncertainties in the Middle East and ignored US stock markets, which were below the record high.

Even if altcoins like Ether and Solana were slightly soaked in the afternoon, the world's OG codes hit the peak of day without hesitation.

Meanwhile, Washington, D.C. lawmakers and regulators have made noise that could fuel even more momentum. Federal Reserve Chairman Jerome Powell appeared earlier in the day before the Senate Banking Committee and said Stubcoin “is a long way.”

Powell's approval on the same day that Crypto is not just a sideshow, but the head of federal housing finance institution Billy Pulte began reviewing how to oversee Fannie Mae and Freddie Mac and use Crypto Assets to obtain a mortgage.

Billy's family founded Pulte Group, one of the nation's largest home builders, and his impact on the housing sector is substantial. That directive may be considered a green light for digital assets in US real estate financing.

Trump's NYSE Crypto ETF faces decision window

Within the New York Stock Exchange, authorities are pushing for proposals related to President Donald Trump's true social platform. The exchange has submitted a rule change request allowing a list of Bitcoin and Ethereum ETFs directly linked to Trump's company.

If the Securities and Exchange Commission gets it, it will be released within 90 days, expanding the stewardship of its managers and bringing Crypto closer to Wall Street. Now returning to the White House, Trump is speaking out about making Crypto a bigger part of the US financial system, and the ETF will mark one of the most important steps ever.

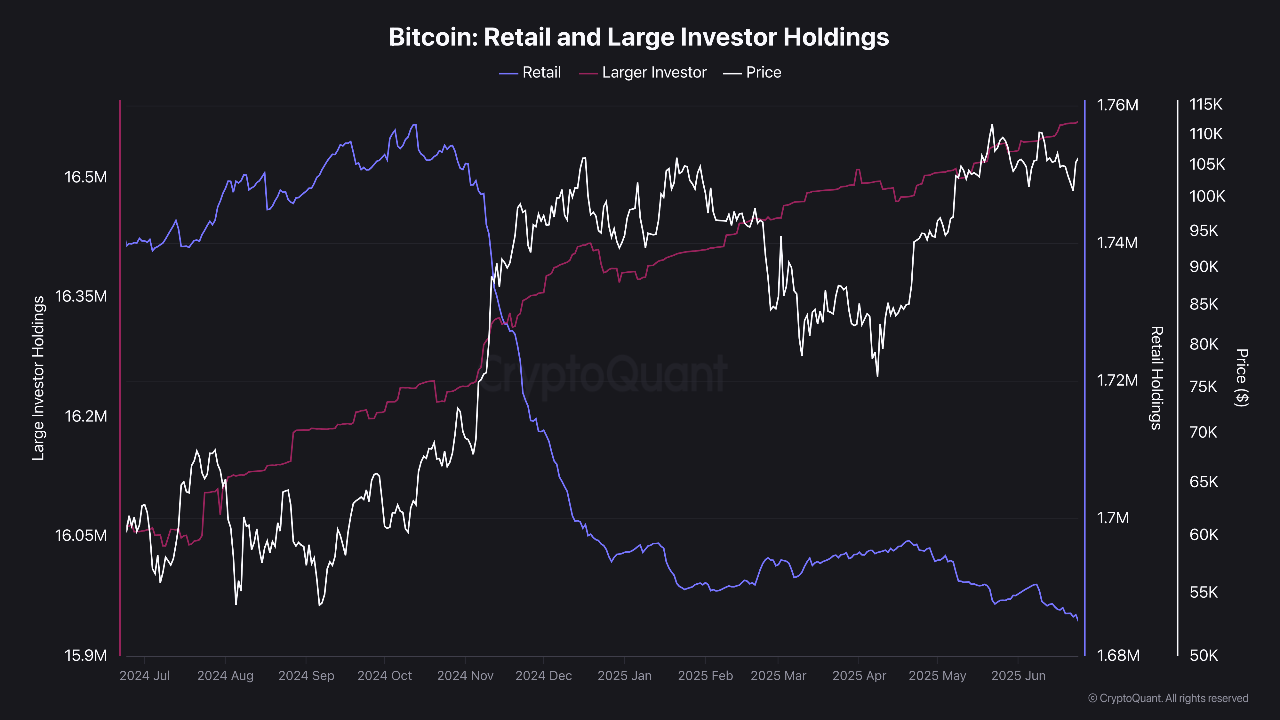

On-chain analysis shows a dramatic division in market behavior. Wallets and wallets less than 1 BTC are sold consistently. These addresses fell to 1.69 million BTC, a decline of 54,500 BTC from the previous year, with daily spills averaged 220 BTC.

Over the past 12 months, these wallet movements have been correlated with price –0.89. In other words, the more they were sold, the higher the price went. At the same time, after adding over 507,000 BTC in a year, a large wallet holding at least 1,000 BTC has now controlled 1,657 million BTC for those holding at least 1,000 BTC. These wallets absorb about 1,460 BTC per day, showing a +0.86 correlation with the price. In other words, the activity tracks upward movement.

That imbalance is sharp. The institution has earned almost seven times the amount retail owners are giving up. It combines that with the fact that only 450 BTC mined daily after half a year will be mined, revealing pressure on the supply. But the difference this time is that little traders haven't returned.

There is no retail FOMO yet. Instead, individual holders are still out and suggest that the current gathering may not even be near its peak.

Binance, Stubcoin, and key support levels show what comes next

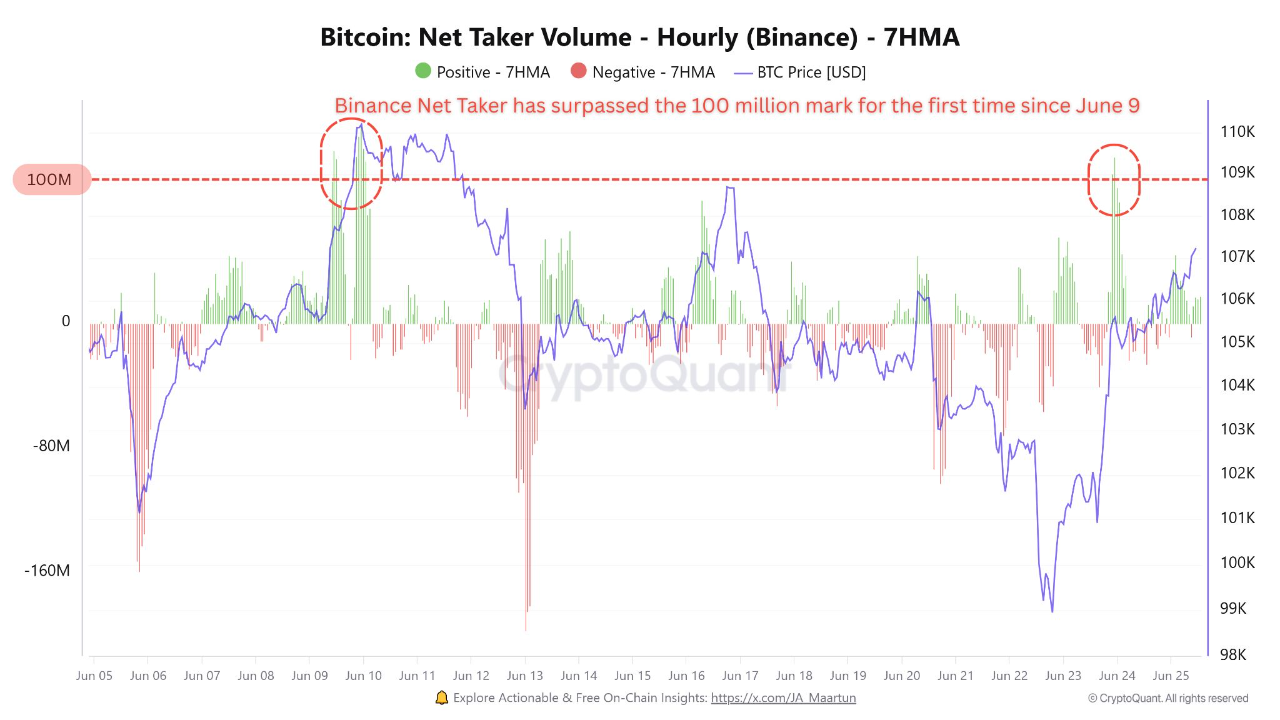

A big move took place on June 24th in Binance. Nettaker volume exceeded $100 million. This has not happened since June 9th. It is usually seen when excessively reduced shorts are wiped off or when retailers are stacked up at once. These bursts can promote short-term purchases, but do not guarantee permanent demand, and in addition, activity occurred along with a stable $1.25 billion outflow from the largest derivative exchange since mid-May.

Another figure that traders are closely looking at is the realized price, also known as the cost-based for short-term holders (STH). These wallets are held for less than six months and account for more than 40% of Bitcoin's total market capitalization. This makes the entry point important.

Currently, the wallets for the week to month group are held at $106,200, while the range is between $95,000, and the wallets for 3 to 6 months are $93,300. If these values are weighted, the average cost base is about $97,700.

That's where things become more fragile. The current price of Bitcoin is hovering at nearly $100,000, an emotionally and technically important level. If prices fall below $97,000, the market could be hit by a chain reaction of panic sales, especially from the already tense STH. It's a narrow and dangerous range.