After bounced back from a weak low at $2,200 earlier this week, Ethereum prices today are trading nearly $2,485, a sharp recovery from recent losses. The recovery is technically clean, with ETH regaining the keemas and disabling the recent bearish structure (BOS). However, prices are currently approaching the lower limit of the stubborn supply zone between $2,500 and $2,600. This is an area that previously caused multiple sales.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

Recent Ethereum price action has been characterized by a rapid recovery from the liquidity block between $2,200 and $2,240. The daily chart shows ETH forming a bullish surround candle on June 25th, and has since continued above 50 EMA. The move has reversed the short-term trend in favor of buyers, particularly as it closes its $2,470 demand area every day.

ETH Price Dynamics (Source: TradingView)

The 4-hour chart shows a structure fresh break (BOS) that exceeds $2,480 after several failed attempts, but the Smart Money Concepts tool shows a clear bullish option around the same region. ETH is currently being pushed into a local supply zone between $2,500 and $2,560. If this level is broken on volume, the next leg can test the weekly FIB 0.5 zone, close to $2,746.

In terms of historical importance, the $2,420-$2,480 cluster also marked a breakout area in May, making this retest even more important. Prices are back above the ascending trendlines lost last week.

Why are Ethereum prices rising today?

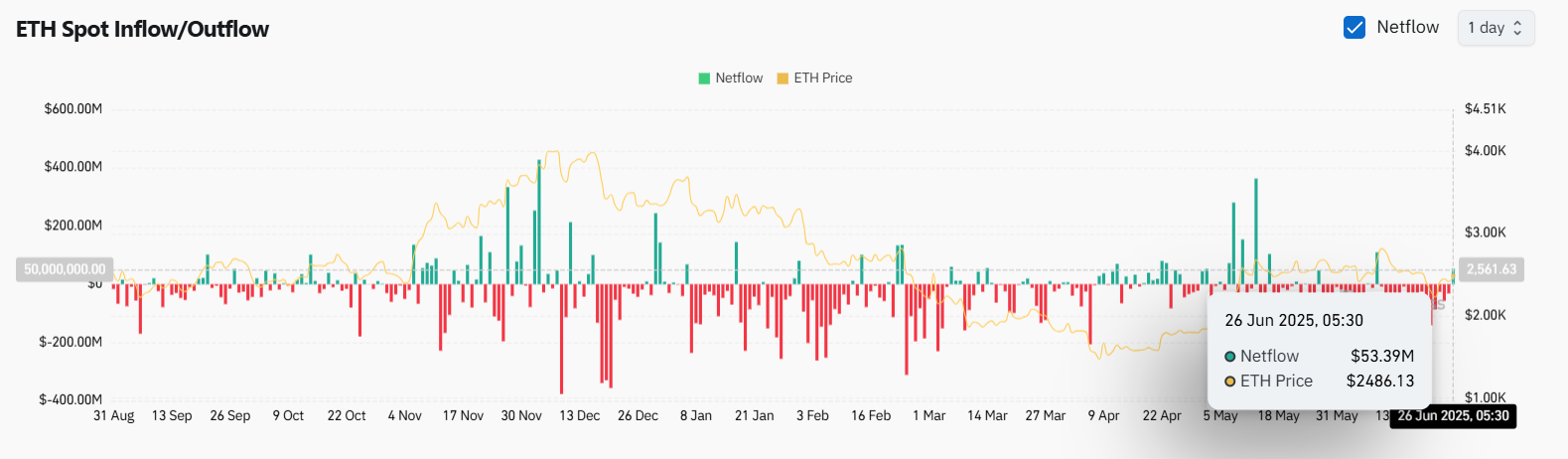

ETH Spot/Inflow (Source: Coinglass)

As shown on the ETH Netflow chart, the main reason for Ethereum prices rising today is strong spot demand returns. On June 26th, net inflows exceeding $53 million were recorded, marking one of the largest daily inflows in weeks. This coincides with the collection patterns of daily and 4 hour structural charts.

ETH Price Dynamics (Source: TradingView)

Additionally, Ethereum recovered 20/50/100 EMA clusters on its 4H chart, with current prices at $2,485 over all short-term moving averages. From the point of view of indicators, the 4H Keltner channel band expands upwards with the ETH on the top channel, confirming strong momentum. The 4h Bollinger band has also been expanding, suggesting building Ethereum price volatility in the $2,500 zone.

ETH Price Dynamics (Source: TradingView)

The 1D chart Bullmarket Support Band (previously served as a resistance of around $2,380) is reflected in support with ETH closed on top for the first time in a week.

Ethereum price indicators show significant retests in the $2,500-$2,560 zone

ETH Price Dynamics (Source: TradingView)

On the four-hour chart, the price was entered into the first test of the red supply block from $2,500 to $2,560. The region rejected three previous attempts at rising in June. This retest can determine whether ETH will resume bullish trends or boosts in macros.

The True Strength Index (TSI) on the 1D chart is beginning to bend upwards from deep, negative territory in a pending bullish crossover. This further strengthens the continuation debate if the breakout is successful.

ETH Price Dynamics (Source: TradingView)

Meanwhile, Ethereum's weekly FIB retracement chart approaches $2,637 for the 0.382 level and $2,746 for the 0.5 mark.

However, traders should be aware of the presence of equal highs and low-frame bearish chok zones near $2,560. Without a strong bullish confirmation, this area could again act as a reversal trigger.

Ethereum price forecast: Short-term outlook (24 hours)

ETH Price Dynamics (Source: TradingView)

As long as ETH is above the $2,420 support band, the Bulls are in control. A four-hour candle over $2,500 shows short-term breakout intensity, with the next upside level seen at $2,560. If it is cleared, $2,637 and $2,746 will be the radar.

On the downside, a denial of less than $2,470 will cause the door to reopen towards $2,425 and $2,300 will resume. The 4H 200 EMA is located at $2,305 and could serve as a strong dynamic support if the price cannot maintain a bullish structure.

Spot spills are beginning to slow down, so bulls may need sustained momentum or breakout attempts may shine. Given the increasing volatility in key zones, the short-term bias remains bullish for Ethereum prices, but cautious.

Ethereum price forecast table: June 27, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.