Ethereum has recently recovered from its monthly lows, sparking new hopes for profit. As a result, short-term holders (STHs) may be driving holdings in exchange to take advantage of the rise of Ethereum.

This increased sales activity has put the market in question the possibility of a golden cross as it shows signs of tension due to increased sales pressure.

Are Ethereum investors cashing?

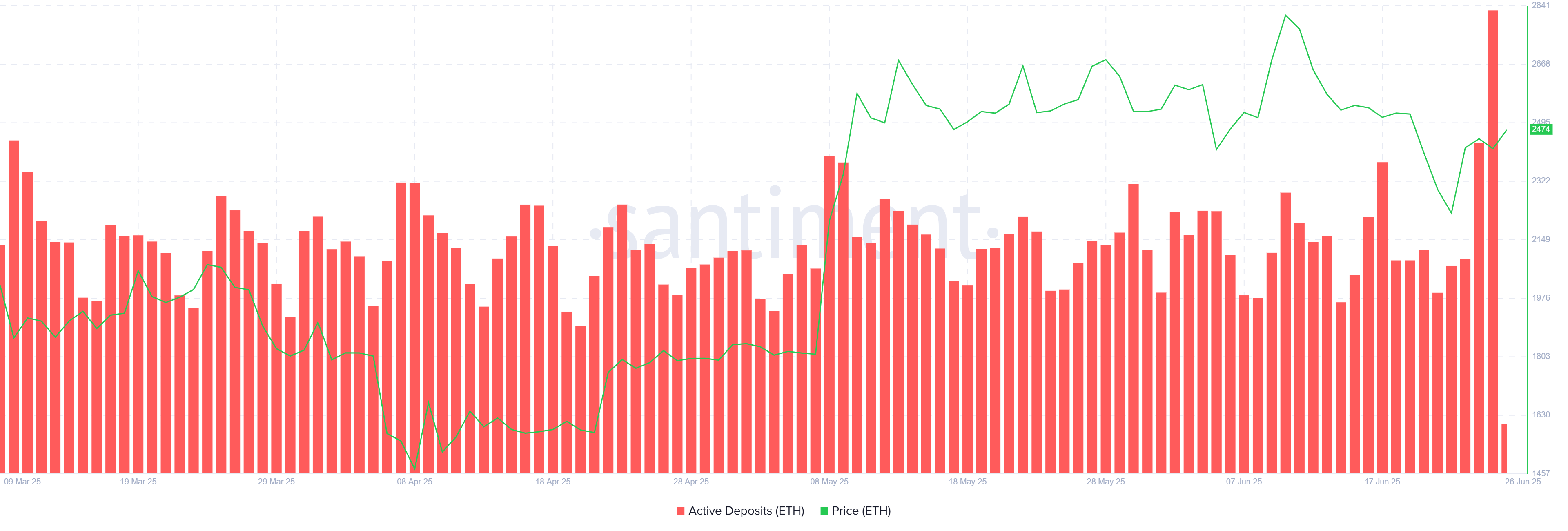

Active deposits on the Ethereum network have increased significantly over the past 24 hours, reaching five months' heights. This surge in deposits shows investors, particularly short-term holders, are keen to book profits from Ethereum's recent price rise. These are short-term holders who are likely to take advantage of this week's Altcoin profits.

Despite the increased potential sales activity from STHS, long-term holders (LTHS) are not actively selling as the coin day has been destroyed (CDD) metric has not risen. This suggests that LTHS holds Ethereum and sales pressure is primarily from short-term investors.

Ethereum Active Deposits. Source: Santiment

Plus, Ethereum is on the brink of a potential golden cross. This is a technical indicator that is often considered a bullish signal. Altcoin is being closely monitored for this crossover. This usually indicates that the market is moving towards a sustained upward trend. However, recent surge in sales activities could slow or put this golden cross at risk, as sales pressure could undermine Ethereum's upward trajectory.

Golden Cross, which could mark the end of a long-term death cross that has lasted for the past four months, may take some time to come true if this sales activity continues. While Ethereum is about to recover, the market is in a delicate balance, and the cross of death is still looming.

Ethereum Emma. Source: TradingView

ETH prices rise under threat

Ethereum prices are up 11% this week and are trading at $2,473 at the time of writing. Altcoin is trying to support and support a $2,476 resistance to solidify its recent profits. Ensuring this level is important for Ethereum to maintain its current upward trajectory and build investor trust in the short term.

However, Ethereum can see the drawdown when rising sediment from short-term holders turns into active sales. Failure to maintain upward momentum could potentially bring Ethereum back below $2,344 or back to $2,205. This potential decline will reverse current profits and pose a major threat to the bullish prospects of the altcoin.

ETH price analysis. Source: TradingView

Meanwhile, if Ethereum supports $2,476 and calms sales pressure, Altcoin could push beyond $2,606. A break above this level will test $2,681 with Ethereum set on the course. This helps to invalidate bearish papers and show an even higher price. This scenario could mark a strong recovery for Ethereum.