A relatively new ruble religious token, A7A5, shows signs of use for dollar liquidity and potential access to money laundering. The token carried a $9.3 billion swap, which originated primarily from whale wallets.

The newly launched Stablecoin A7A5, backed by the Russian ruble, shows a substantial amount derived from whale wallets. Although assets still have relatively low supply and volumes, they may be used to shift assets to USDT, unlock dollar-based liquidity and bypass embargo on the Russian capital.

In the early trading phase, the A7A5 only has a single UNISWAP V2 trading pair, in addition to being used on the newly launched Grinex platform. Grinex came just months after US authorities seized another suspicious exchange asset that is frequented by Russian traders. garantex.

Tether, Inc. was also involved, frozen $23 million in USDT tokens. The possibility of freezing assets led to the creation of new, possibly non-censored tokens. The A7A5 comes in both the Tron and Ethereum versions, but the main use case is to swap it for USDT.

Is A7A5 a money laundering asset?

The A7A5 token was created by the Russian company A7. There, Moldovan oligarch Iran Scholl holds a majority stake. Shoal fled Moldova after being convicted in 2019 of a billion-dollar bank fraud. The businessman is currently a Russian citizen living in Moscow. Shor is also linked to attempts to buy votes in the latest Moldovan election.

The remaining shares of Company A7 are held by Promsvyazbank (PSB), a state-owned financial company. The bank is also facing sanctions to serve Russian military industrial complexes. The A7 company was created in October 2024, but the A7A5 assets appeared in January and recently won an additional list.

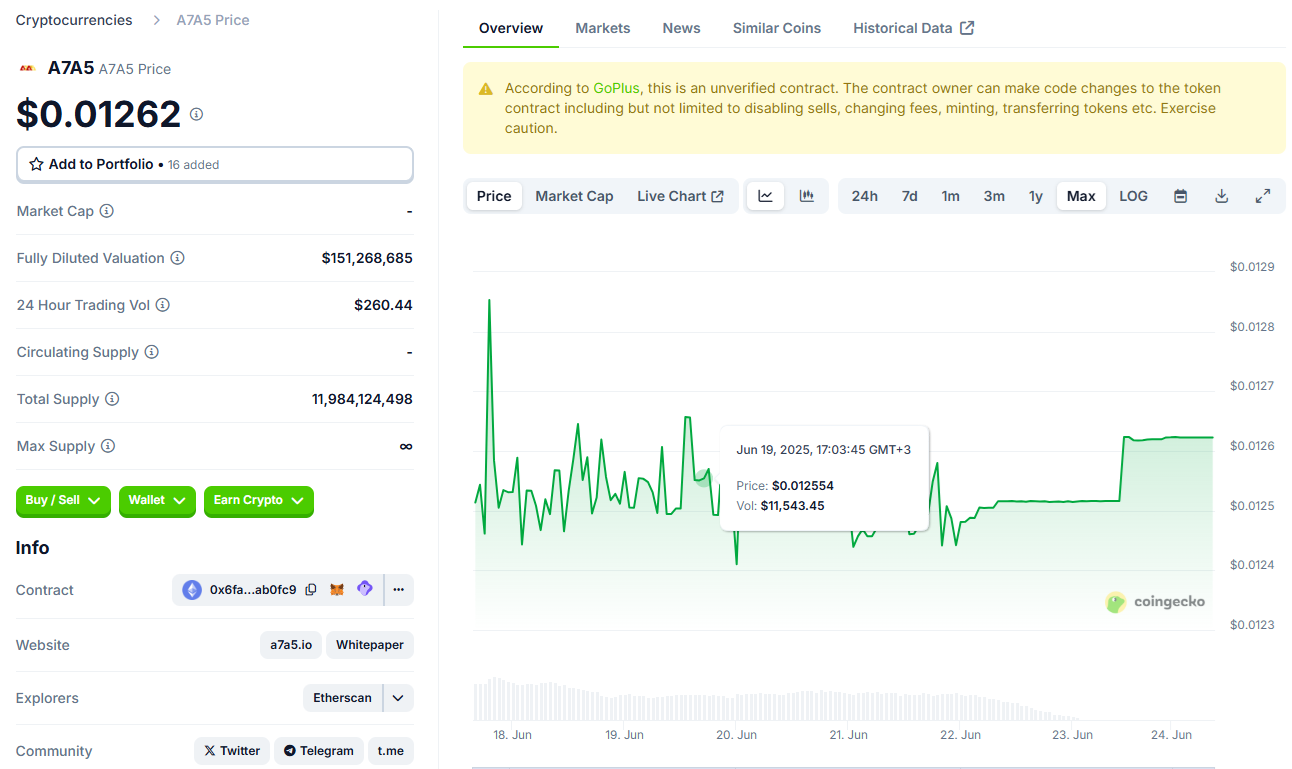

The A7A5 recently added a UnisWap pair, but previously relied on Grinex Exchange, it was released almost at the same time as the token. |Source: Coingecko

The ownership behind the token has recently led Report From the Center for Information Resilience, it further supports the theory that the A7A5 aims to exchange whale wallets and travel in the capital. As of June 2025, the A7A5 was heavily clustered, with most of the supply being held in parts of the main wallet. Based on Bubblemaps data, tokens are held in both large wallets and multiple small but connected addresses.

The A7A5 shows important clustering and transfer between connected whale-sized wallets. |Source: Bubblemaps

The A7A5 itself creates a social media presence and promotes support from the sediment generated in PSB's Ruble.

Chain and chain off-chain research suggests that A7 companies could have built a ramp to move globally without restrictions or sanctions due to the goal of large-scale remittances to Russia. The suspicion of sanctions avoidance becomes more complicated by mixing Fiat-based and crypto strategies.

A7 could create a shared digital infrastructure and potentially link Shor's impact trade and political activities in Moldova with general crypto use. In addition to multiple domains proposing new trading platforms, A7 also has connections with Seychelles and registered companies in the UAE.

The A7A5 team claims to be completely independent

The A7A5 team claims that allegations of connection with the original company are not true. The team responded to a Financial Times request and said that Stablecoin is currently working as a source of volatile trading opportunities and is leveraging Ruble's unpredictable performance. The Token team is active on social media, but refuses to connect with the original company.

'In the early stages, we worked with the “A7” technical team, but in May we decided to separate them completely due to a different vision of our development strategy. Today, the “A7A5” is a completely independent and autonomous project.'I answered the team.

However, Shor has documented that Crypto is one of the available payment gateways for the A7, particularly offering the A7A5 to its company clients.

A7A5 shows a suspicious whale size swap

Most of the A7A5 supply is on the Tron network of tokens over 11B. The token supply of assets is around 12b supply, worth just $156,000. However, the asset is engaged in large swaps, moving back and forth between Tron-based USDT and A7A5.

Based on FT reports, tokens have been used to move up $9.3 billion. Most of Tron's Stablecoin activities are also linked to eight identified wallets linked to Grinex Exchange. Wallets often move a significant amount of money and pay high gas fees primarily for access to Tron's dollarized USDT.

At the same time, in uniswap, a7a5 is right away $56 million Locked liquidity is used for minor exchanges of hundreds of USDT.

The A7A5 now claims that some of the large wallets are mainly used in the form Defi yieldwithout showing any additional details. Tokens were recently added to Debank and could be viewed in depth when spread across cryptographic ecosystems. So far, the A7A5 has limited potential for Defi impact and is separated into the project's Tron ecosystem.

The Stablecoin team also posted regular preliminary reports to Rubles, stating the potential tokens yield. Currently, the A7A5 has minimal volume compared to other Defi Hubs, but poses additional risks to be linked to Russian money laundering.