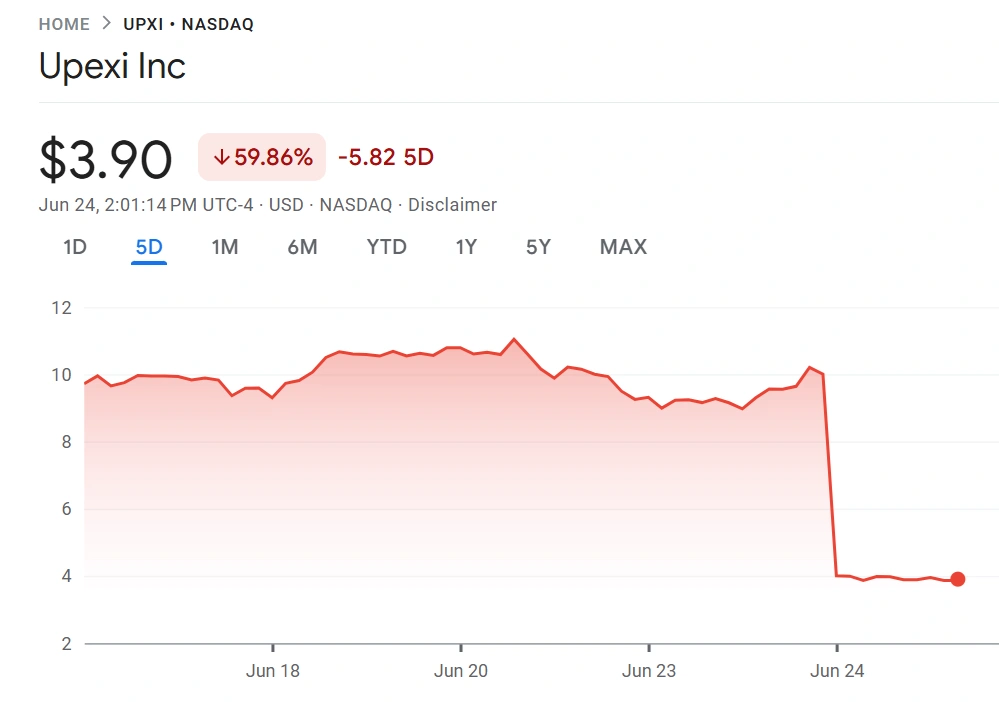

Upexi shares trading under the UPXI ticker were assaulted as the US market opened after investors registered 43.85 million shares for resale.

The shares fell about 60%, but the prospectus filed Monday shows that more offloading will occur as buyers want to offload 35.97 million shares and 7.89 million shares related to the pre-funded warrant.

UPXI stocks are down 60% as the market opened on Tuesday, June 24th. Source: Google Finance

upexi does not make a profit from stock sales

The prospectus filed Monday says Upexi will only collect $7,890 if the holder exercises a warrant and brings it back from a share sale.

“We are not selling common stock in this offer. We do not receive any revenue from the sale of shares by the seller shareholders.”

The Florida-based e-commerce startup has made headlines in the past by raising $100 million after outlining plans to set up Corporate Solana Treasury, hoping to reflect success from the Strategic Bitcoin Playbook.

New: upexi CEO says the company is doubled the crypto

“After many headwinds, with changes in management, it seemed like there was an opportunity for cryptography.”

Full quote from @theflynews 👇pic.twitter.com/b96xul1tmt

– upexi (@upexitreasury) June 5, 2025

The company purchased its first Solana Coin on April 29th. This purchased a total of 45,733 tokens a few days after completing its public funding efforts. A month later, the holdings reached a SOL of 679,677 following multiple purchases of discounted benefit coins.

Investment Bank Cantor Fitzgerald shared a $16 price target for Upexi shares in June. The high price target is consistent with Cantor's bias towards Solana, as Cantor analysts view Sol as superior to its main competitor, Eth.

Cantor bets on Upexi and other Solana Treasury Companies

Cantor analysts believe Solana “makes sense” as a financial asset. This is because there is plenty of room for growth based on market capitalization, lively developer activity and viral meme culture.

Last week, Matthew Sigel shared the launch of Canter Fitzgerald's three major Solana (SOL) Treasury Ministry coverage: Defi Development Corp, Upexi and Sol Strategies suggest bullish outlook.

Cantor will begin evaluations with Solana Treasury Companies (HODL CN, DFDV, UPXI).

The Solana-oriented balance sheet says it deserves a greater premium than BTC Co due to native revenue opportunities and higher volatility. pic.twitter.com/sc2educu1q

– Matthew Sigel, Recovering CFA (@matthew_sigel) June 16, 2025

“Cantor will begin its assessment at Solana Treasury Companies (HODL CN, DFDV, UPXI),” he writes. He then added that Kanter people believe that “Solana-oriented balance sheets deserve a greater premium than BTC Co due to native revenue opportunities and higher volatility.”

He shared an excerpt from a report highlighting Solana as a Layer-1 blockchain with superior throughput and lower transaction fees compared to its major rival, Ethereum (ETH).

This report compares Bitcoin and Solana and acknowledges that BTC is appropriate as a strategic reserve asset with established market acceptance. It also identified Solana's potential as a technical backbone of transactions and markets in the digital economy.

This suggests that Cantor analysts can view them as utility-driven blockchains rather than as valuable reservoirs like BTC or as MemeCoin chains like many degrees. The report argues that Solana's Treasury company is betting on a future where financial transactions and applications are primarily chained, and Solana is continually chained as the preferred blockchain.