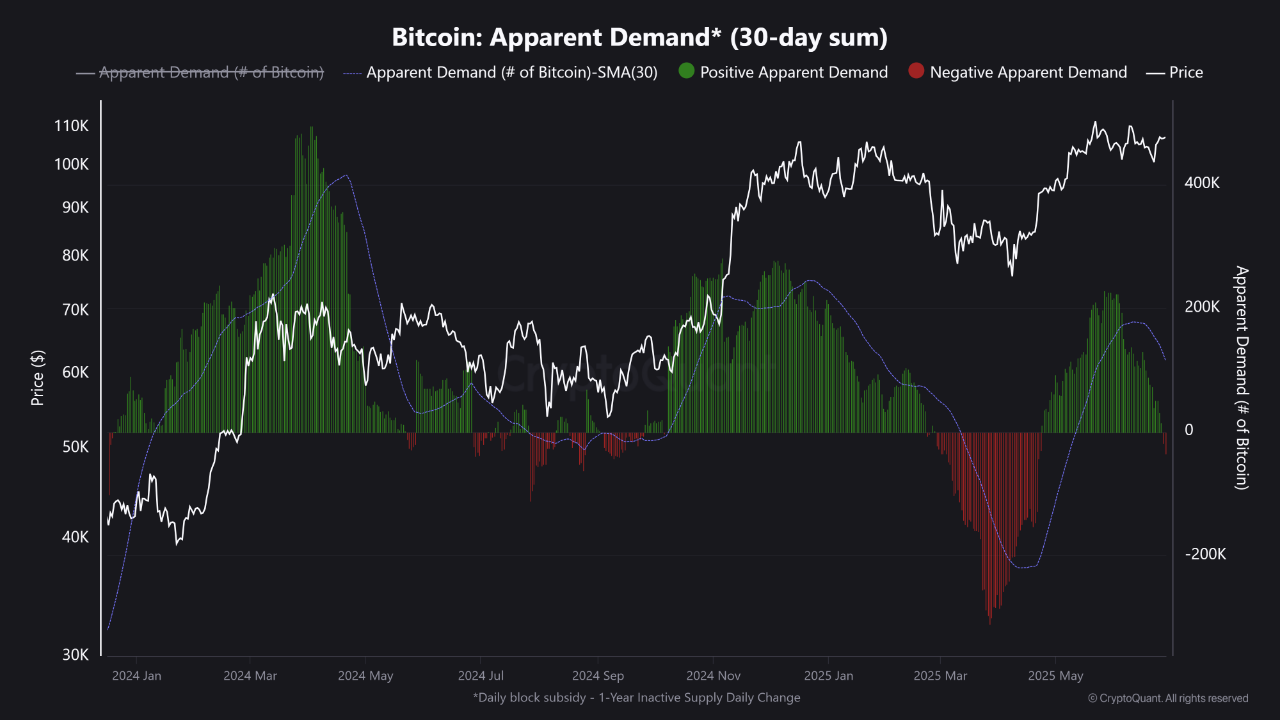

- Bitcoin demand had fallen from BTC above 200,000 BTC in early 2024 to -200,000 BTC by March 2025 amid rising supply.

- A $122 million liquidation event favored the bull as the short positions were wiped out 1,533% more than the longer positions.

- FHFA proposed a new rule to include Bitcoin in mortgage valuations, indicating changes in financial asset valuations.

After the recovery in June and May 2025, demand for Bitcoin has declined significantly. Data shows that demand for Bitcoin rose above 200,000 BTC between January and April 2024, with prices rising from $40,000 to $70,000. However, this decline was accompanied by a price adjustment of less than 60k, as demand fell below -200,000 BTC from late 2024 to March 2025.

However, the obvious demand is a metric that shows the difference between the interest of new buyers and the amount of coins in circulation. These consist of newly mined Bitcoin and a circular supply of coins sold by Long-Term Holders (LTHS) back into circulation. Negative measures indicate excessive supply.

sauce: Encryption

As mining is underway and LTHS sells profitably, current supply outweighs demand. These long-term holders are usually considered experienced market participants. Their sales activities are subject to much pressure in the market, particularly without relative activity from buyers, indicating a weak market situation. Current terms reflect uncertainty about Bitcoin's price direction in the short term.

As the bull controls, a short liquidation dominates

Meanwhile, the market has experienced an unusually large liquidation imbalance. Bitcoin had a total liquidation of $102.35 million during one session, according to data provided by Coinglass. Of this amount, $95.96 million came from short positions, but the long liquidation totaled only $6.38 million.

Furthermore, this sharp contrast produced a 1533% bias against long position imbalances. Numerically, the shorts were settled at 15 times faster than the long one. However, data analysts have revealed that this momentum is the Bulls are highly favored. This type of liquidation pattern usually occurs after a sudden change in price levels, where traders sell leveraged short positions.

The squeeze is rough on shorts, indicating the current bias of the market. Despite low demand, the supply metrics show that traders are holding short positions against Bitcoin, which has recorded a major loss. This result implies a setting with a temporary bullish momentum despite generally low demand.

FHFA will compare and consider Bitcoin with mortgage eligibility rules

The Federal Housing Finance Agency (FHFA) has introduced a new proposal that will allow Bitcoin to be used in mortgage valuations. The agency confirmed it would investigate how cryptocurrency holdings could be included in mortgage eligibility assessments. This step can be seen as a change in the treatment of digital assets by US financial regulators.

Commenting on the proposal, Bill Prute indicated that it is to confirm the meaning of crypto assets for mortgage eligibility. The new proposal will allow Bitcoin and other digital possessions to be included in financial assets, meaning potential borrowers can submit crypto portfolios without converting them into fiat money.

Furthermore, in the case of implementation, such changes could potentially introduce cryptocurrencies into formal financial valuations, especially within the housing market. The fact that FHFA chose is consistent with a broader interest in perceiving digital wealth in traditional financial systems. Until now, crypto assets have existed beyond mainstream credit ratings.