Bitcoin prices are on the coast today at $108,832 to $109,067, marking continuous strength with a continuous recovery trend. The market capitalization was $2.16 trillion and 24-hour trading volume was $23.733 billion, with Bitcoin fluctuating within the tough range of $107,591 to $109,067.

Bitcoin

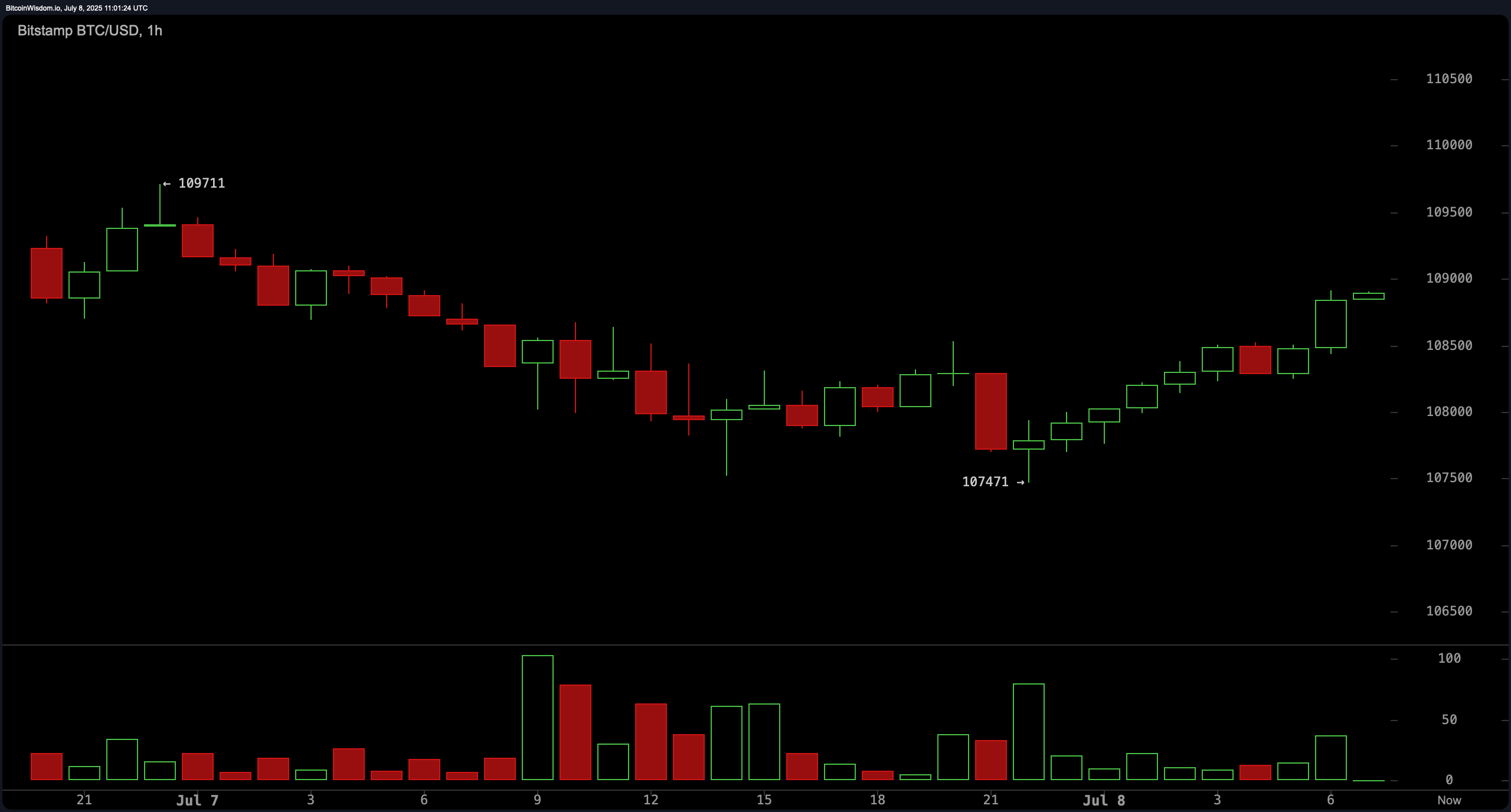

The 1-hour BTC/USD chart shows a short-term recovery after the recent sale. Bitcoin finds solid support at $107,471 and is testing short-term resistance around $109,711. Volume surges reinforce bullish momentum with these movements. Traders have found entry points between $108,000 and $108,500 during the miner dip and are targeting the exit as resistance is close to $109,500 to $110,000. This indicates the potential for a short-term breakout if pressure is maintained.

BTC/USD 1-hour chart via BitStamp on July 8th, 2025.

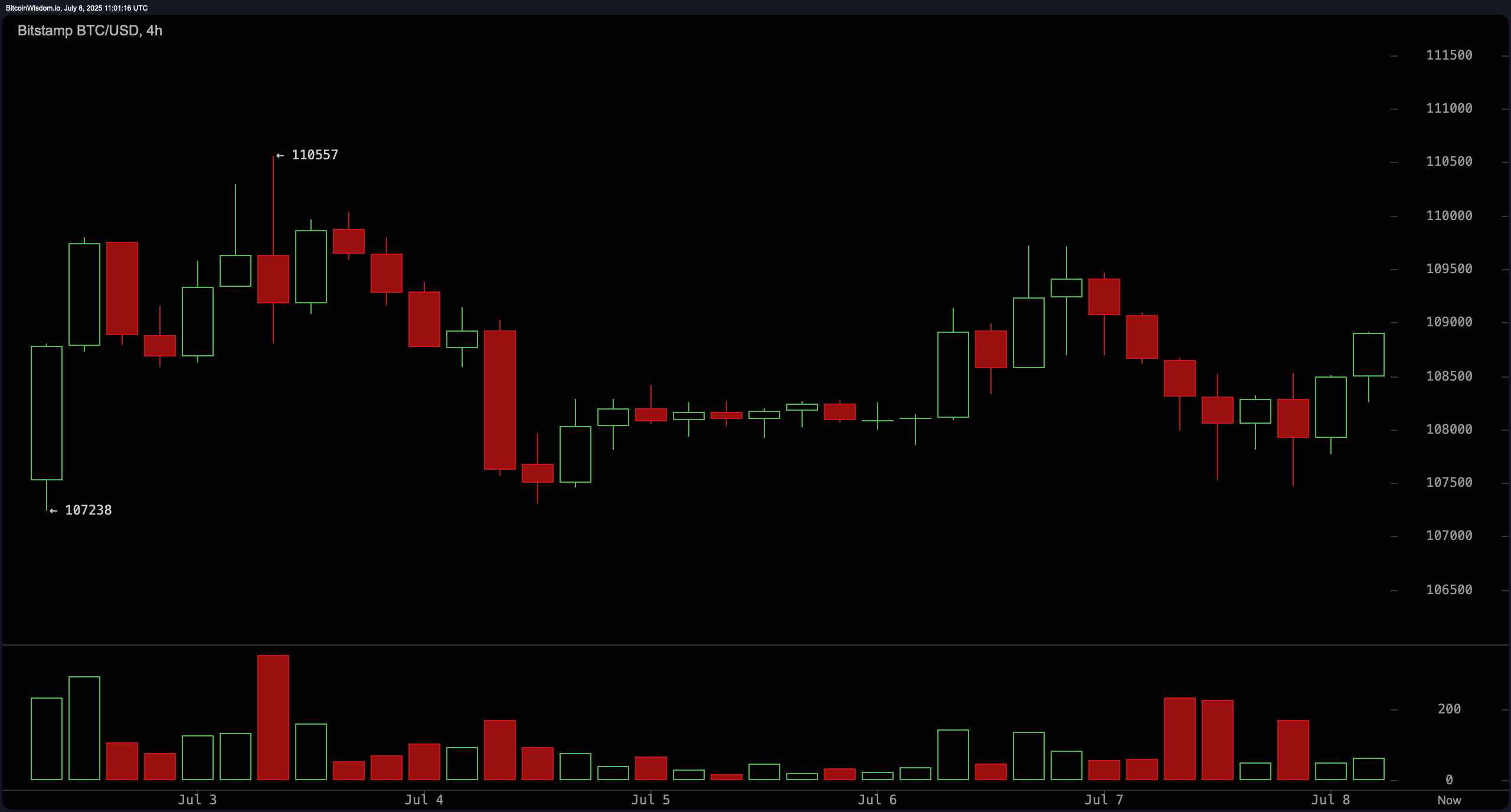

On the four-hour chart, Bitcoin appears to be integrated with a slight bullish leaps. The price is caught between $107,238 in support and $110,557 in resistance. The formation of candles from July 5th to July 7th has shown market indecisiveness, but recent attempts have shown underlying upward bias. A $108,000 retest with a robust volume examines long midrange positions, but exit levels are identified between $109,800 and $110,500 when momentum disappears.

BTC/USD 4-hour chart via BitStamp on July 8, 2025.

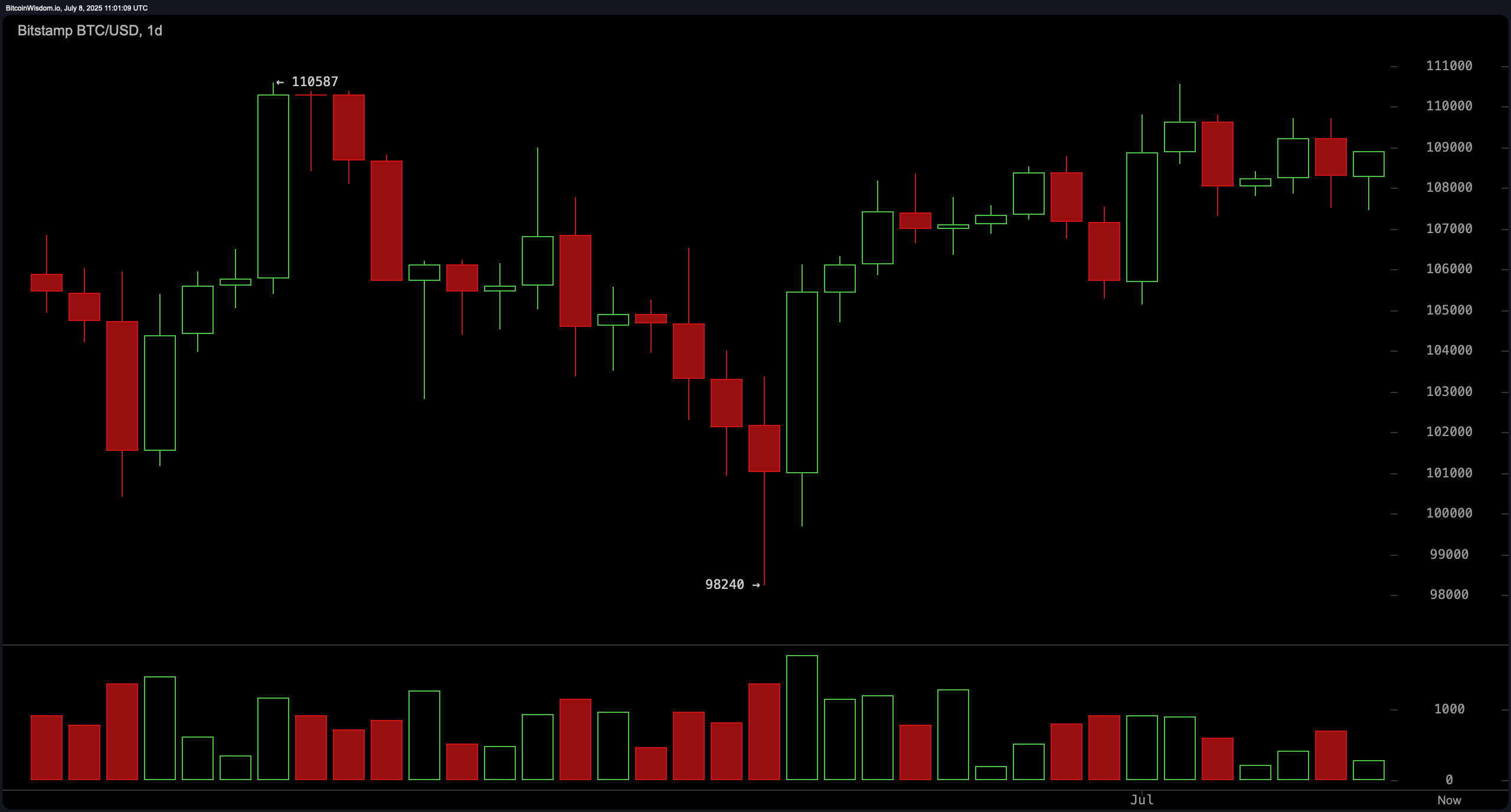

From a macro perspective, the daily chart shows Bitcoin is recovering from the bottom of $98,240. The track is uninterrupted, but remains upwards as he stepped near the $104,000-$105,000 support zone in late June. The key resistance of $110,587 remains unbroken, with traders carefully watching sustained moves above $108,000 to confirm bullish continuity. Going between $110,000 and $111,000 can result in sensible benefits close to historical levels of resistance.

BTC/USD 1-Day (24H) Chart via BitStamp on July 8, 2025.

The oscillator measurements show corrupt emotion from neutral to light. The relative strength index (RSI) is 56, probabilistic 73, the commodity channel index (CCI) is 65, and the mean directional index (ADX) is neutral. However, the momentum indicator shows a value of 1,494 (bullet signal), and the moving average convergence divergence (MACD) level is 926 (bullet signal), both suggesting the possibility of continuous rise.

Moving averages (MAS) further strengthen bullish attitudes. From the exponential moving average (EMA) and simple moving averages (SMA) for the 10-200th period, all major short- and long-term averages purchase signals. These offer strong technical support throughout the time frame, with EMA (10), SMA (20) at $106,705, EMA (50), $105,314 and SMA (200) at $96,521. Together, these metrics draw scenarios where bullish momentum could expand if prices are maintained above the main support threshold.

Bull Verdict:

Bitcoin's integrity of strong purchase signals across all major moving averages, combined with bullish entries on momentum and moving average convergence branching (MACD), suggests favorable conditions for further rise. If the price goes above $108,000 and breaks $109,500 on volume checks, the path to retesting $110,500 to $111,000 appears to be technically justified.

Bear Verdict:

Despite bullish bias, multiple oscillators remain neutral and the market has yet to break the key resistance at $110,587. A decline below $107,500 will negate bullish construction and open the door for a downside retest under the $105,000 support zone, especially if the volume dries and weakens momentum.