Ethereum continues to rise steadily, trading nearly $2,600 now, after bounced back the $2,220 demand zone in late June. The asset is currently testing strong supply areas while maintaining its structure, suggesting that bullish momentum is still working. However, you need to be careful near current highs.

Technical Analysis

Shayan Market

Daily Charts

ETH is currently hovering the nearly $2,600 mark, as the daily chart shows, after a strong rebound from the $2,220 demand zone. The price can regain the 200-day moving average, located around the $2,400 mark, slightly above that, a key sign of medium-term strength.

Previously, recent rally stalled to nearly $2,800. There, ETH made a sharp turnaround after a clear fluid hunt, forming a short-term low high. Now, the assets are once again below the $2,800 supply zone and are about to break through. The structure remains bullish unless ETH falls above the 100 and 200 moving averages below $2,400.

Plus, while momentum is slowly building, you need clean daily cleans of over $2,700 to confirm. The RSI is held around 57-60, reflecting a moderate bullish momentum with no signs of fatigue. If the current integration resolves upside down, ETH could revisit the $2,880 high and challenge the $3,000 zone. However, if you don't break into the top, you could be denied the $2,400 support range.

4-hour chart

On the four-hour chart, this becomes a high-stakes integration, as ETH forms a rising wedge just below the bearish order block formed around the $2,700 mark. Prices are tapped on the order block and pushed against the wedge limit. The 4H RSI is also close to 61, showing bullish momentum, but breakdowns are always a risk if the Bulls are unable to push resistance when the wedge formation rises.

The important daytime levels to watch are in the areas of $2,500-$2,550, which coincides with the recent low and lower boundaries. If ETH breaks with strong volumes under this zone, it could indicate a decline towards a gap between the $2,300 liquidity pool and fair value. Conversely, a clean breakout of over $2,700 when volume increases will disable the wedge breakdown scenario, opening up an additional $2,900 height and a path that goes even further.

On-Chain Analysis

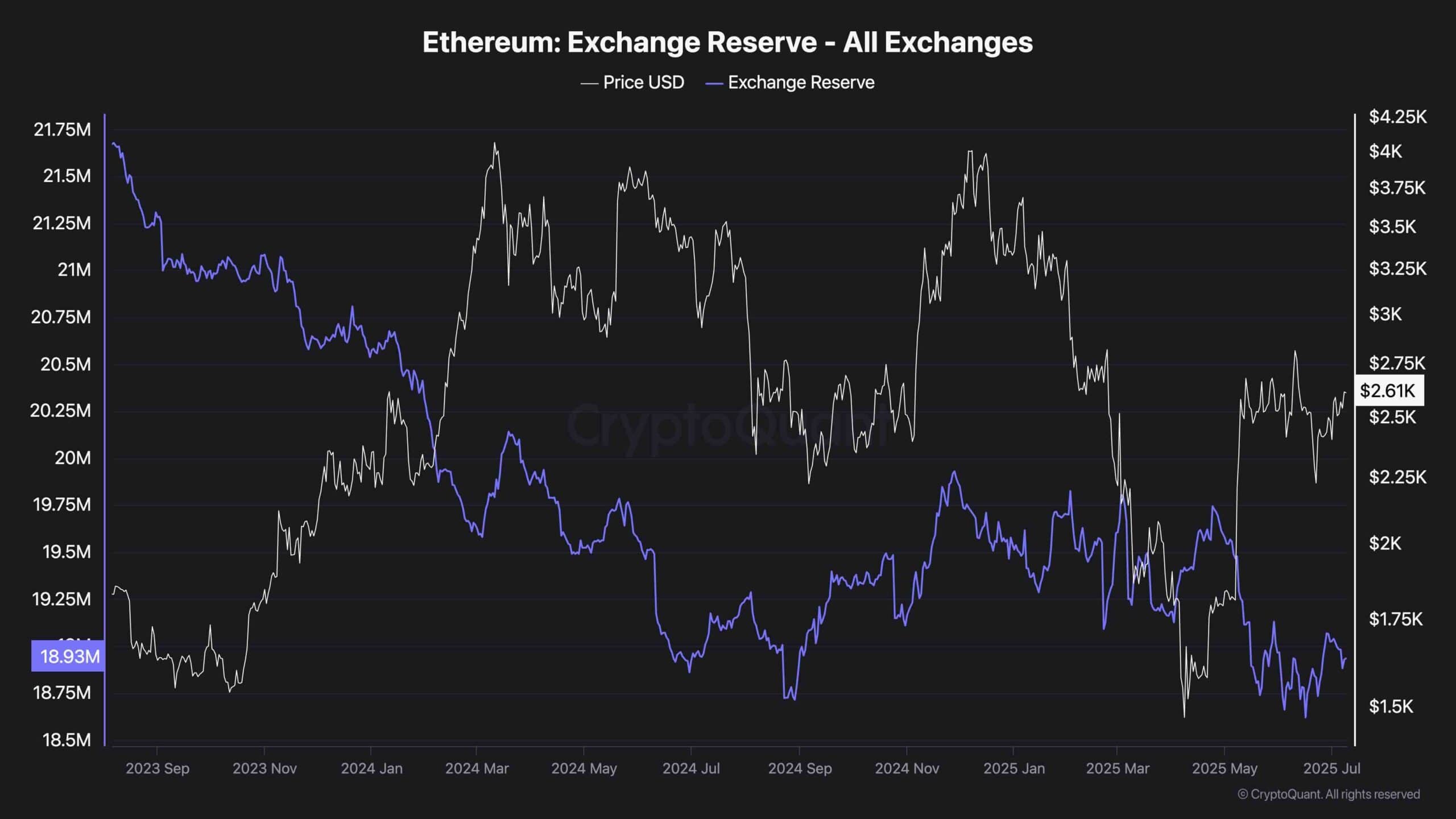

Ethereum Exchange Reserve

Ethereum's on-chain data remains supportive. The exchange reserve fell to 18.93m, reaching one of the lowest levels in recent years. This indicates a continuing trend of accumulation and independence, reducing immediate sales pressure from centralized exchanges. Historically, such a decline in exchange balance has been consistent with bullish price stages, subject to macro-essence alignment.

Market sentiment has become slightly bullish, and ETH has regained its critical moving average and funding rates to remain neutral. However, the lack of explosive demand from retailers and whales suggests that breakouts are likely to require a catalyst in the form of a short liquidation cascade to increase prices in the short term, with demand in the spot market.