Recently, market analysts have turned their attention to key bitcoin (BTC) metrics – coin days have been destroyed (CDD). The metric jumped sharply in July 2025, and analysts now fear that Bitcoin prices will soon drop significantly.

Some explanations about the spike seem reasonable, but analysts still warn about the risk.

Bitcoin Coin Days destroyed in July (CDD) spike

Coindays tracks the movement of Bitcoin, which has been destroyed and has been “double” for a long time. Analysts calculate the number of Bitcoins that move by the number of days that remain untouched.

This metric is important as it highlights what long-term holders are doing. These investors usually have a good understanding of the Bitcoin market cycle. When a CDD jumps, it often means that it is being sold by an older holder.

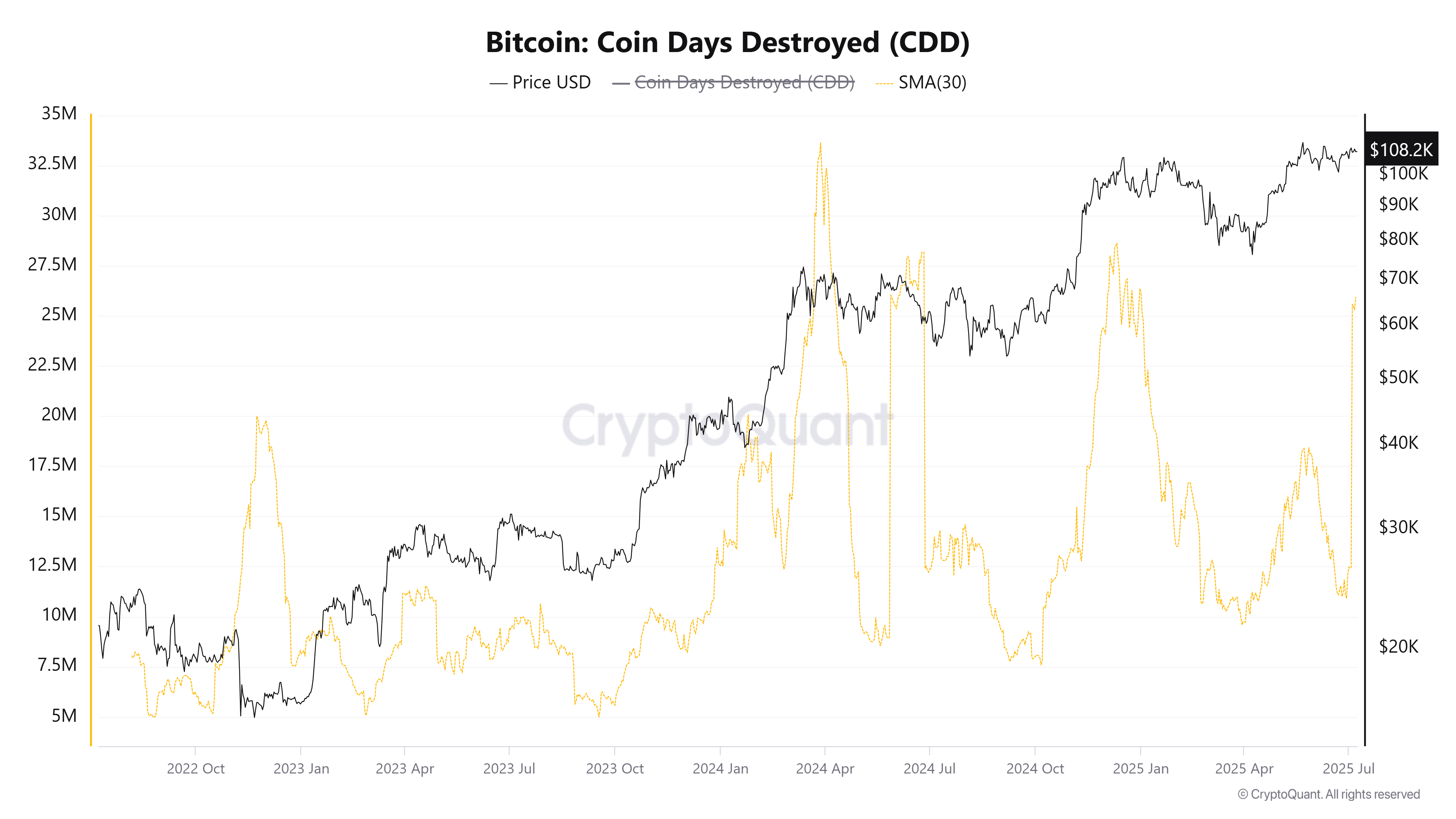

Data from Cryptoquant shows that CDDs have only exceeded five times as much as 2022 to the present. All four previous instances coincided with major market slump. This latest spike is the fifth instance.

Bitcoin Coin Days has been destroyed (CDD). Source: Cryptoquant

A historic deal took place at the beginning of July 2025. Over $8 billion, 80,000 btc has been moved from a “sleeping” wallet (around 2011) that dates back to the early days of Bitcoin. According to a report by Beincrypto, this is considered one of the biggest moves ever recorded for the coin over a decade.

The transaction included eight wallets each holding 10,000 btc, and was performed by an anonymous individual or entity. If these Bitcoins were originally purchased, the total cost was around $7,800 (based on the 2011 price of $0.78 per BTC). This shows the enormous profits the owner has earned.

What the analyst says

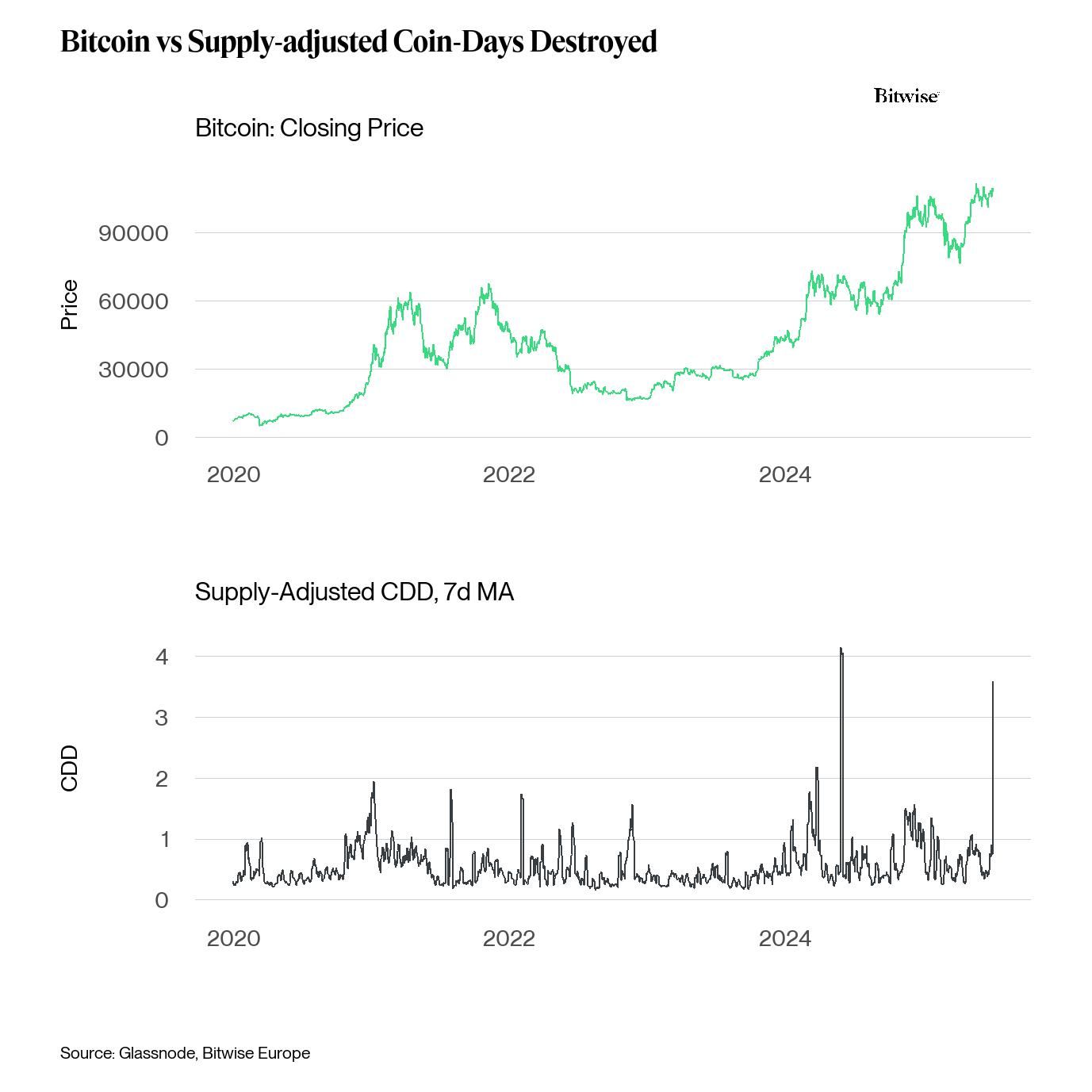

Bitwise analyst André Dragosch pointed out that the transfer led to the second largest spike in the CDD ever recorded.

Bitcoin and Supply Adjustment Coin Days have been destroyed. Source: Bitwise

The Bitwise Chart compares the closing price of Bitcoin with the Supply Adjusted CDD (7-day moving average) and clearly shows the correlation. Bitcoin prices steadily rose between 2020 and 2024. However, the peak of CDDs often appeared just before price adjustments.

A recent event in July 2025 created an unusually high CDD peak, raising concerns that the market could face a sale soon.

“These 80,000 BTC movements have resulted in the second highest spike of coin days (CDD) ever recorded. The movement of large numbers of old coins usually tends to be a bearish signal for Bitcoin,” Andre Dragosch said.

Additionally, Galaxy Research's Alex Thorn added that other days with high CDDs will include asset distributions from Mount Gox Hack and a recovery of stolen Bitfinex funds by the US government. Both of these events saw a sharp drop in Bitcoin prices.

“We haven't heard all of these 80,000 BTC yet…and maybe never,” said Alex Thorne.

There may be reasonable explanations for the July CDD spikes (like wallet restructuring and security improvements), but history shows that Bitcoin is seeing a significant price drop after similar events.