Ripple CEO predicts Stablecoin Market will grow from $250 billion to 2T, spurring increased regulatory and institutional demand.

Ripple's RLUSD will surpass the $500 million cap and will gain custody of BNY Mellon as recruitment accelerates and Transak integration.

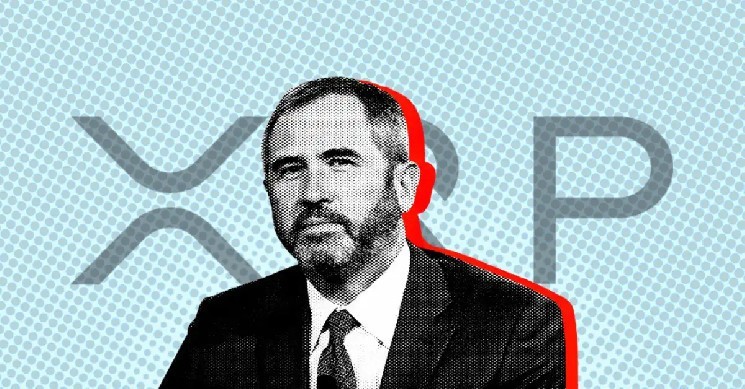

The stubcoin sector, once a quiet corner of the crypto world, is now stealing the spotlight. Ripple CEO Brad Garlinghouse predicts the market will be about ten times higher than $250 billion to $2 trillion in just a few years. Talking to CNBC, he calls the shift “deep,” pointing to growing institutional demand and years of clarity on regulations.

This forecast reflects US Treasury Secretary Scott Bescent. He recently said that dollar-linked stubcoins have reached $2 trillion, potentially playing a key role in strengthening the US dollar's global domination. With widening bipartisan support in Congress, stable expansion seems inevitable.

Ripple enters the race with RLUSD

Garlinghouse acknowledged that Ripple may have been in the Stablecoin race more than others, but emphasized that the decision was strategic. Ripple has been using third-party Stablecoins for years and has only chosen to launch its own RLUSD after realising the growing demand for enterprise-ready, compliant solutions.

🚨 Huge: bny melon has become the main custodian of $rlusd stablecoin on @ripple

This is not just another crypto partnership. This is a 240-year-old Wall Street giant who basically says, “Stubcoins are legal.”

What this means:Traditional banks are finally accepting…pic.twitter.com/4Srvm9aidg

– Paulbarron (@paulbarron) July 9, 2025

Released in late 2024, RLUSD has already made great strides. This week it surpassed a $500 million market capitalization milestone and is now detained by traditional financial giant BNY Mellon. RLUSD received a huge boost as Transak integrated into the platform. Currently, 8.3 million users of Transak can purchase RLUSD using a variety of Fiat currencies to expand its reach and accessibility. Tether (USDT) and Circle (USDC) still lead the Stablecoin market, but new developments have led RIPPLE's RLUSD gaining traction with a fresh approach and increased institutional support.

Regulations bring momentum

One major factor that unlocks this growth is the recent passing of the Genius Act. This provides a clear framework for issuing and regulating stubcoins in the US industry leaders.

- Read again:

- Ripple vs SEC: CEO celebrates the victory in the XRP lawsuit, but here's why this isn't completely over

- ,

Apollo Capital's Henrik Andersson supports this outlook, noting that companies like Amazon and Walmart are beginning to explore Stablecoin-based payments.

Ripple is also moving further. I applied for the National Bank Charter and the Master Account of the Federal Reserve, with the aim of linking traditional finance closely with blockchain. Continuing pushing for clear laws and other bills is gaining even more momentum towards clear legal standards.

Cryptographic reaction

As regulations promote trust, the crypto market is responding. XRP skyrocketed 7% this week, with a seven-week high of $2.42. Ethereum reached $2,771, while Solana rose to $157. This highlighted how Stablecoin's advancement across the crypto space is driving new enthusiasm.