While many companies now hold Bitcoin as a reserve asset, the market is concerned about how it will be held, Nansen's report shows.

Bitcoin (BTC) is rapidly becoming a core part of the traditional financial system. A recent report by Nansen shows that new regulatory standards and macroeconomic factors have changed how companies view Bitcoin exposure. This has created the largest company with over 700,000 BTC.

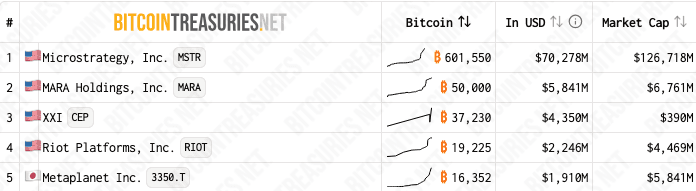

Collectively, Strategy, Marathon Digital, 21 capitals, riot platforms, and Metaplanet own approximately $81.9 billion worth of Bitcoin. The previous micro-tactics controls the share of these holdings of lions at 601,550 BTC.

Still, not all of these companies see the same impact on stock prices. Specifically, the strategy trades almost twice the valuation of BTC holdings. In contrast, Marathon Digital, where BTC accounts for 85% of its market capitalization, trades on par with Bitcoin Reserve.

The 5 largest corporate Bitcoin holders' BTC holdings and market capitalization | Source: Bitcointreasuries

Strategies leverage debt to outweigh BTC

This suggests that the market cares about how companies structure their BTC holdings. The strategy uses debt to allow you to consistently accumulate Bitcoin and act effectively as a leveraged bet on its price.

You might like it too: Bitcoin vs Strategy Stock: Which is the better purchase?

This will provide both greater volatility than Bitcoin, providing both greater extremes. For example, in December 2024, Strategic stocks fell 21%, while Bitcoin fell just 2%. However, strategic stocks are better than Bitcoin in the long run.

“Investors deal with micro-tactics similar to leveraged Bitcoin ETFs to amplify their exposure to Bitcoin price movements. As a result, the stock usually exhibits volatility of 2-3 x Bitcoin,” reports Nansen.

Japanese company Metaplanet trades the value of its BTC holdings at a multiple of 3.5 times. Nansen points out that traders support the advantage of their first appearance in Asia. Like its strategy, Metaplanet also issues debt to buy Bitcoin.

read more: Michael Saylor boasts the “indestructible balance sheet” of strategy