Bitcoin prices today are trading nearly $118,400 as they couldn't hold above the $120,000 breakout level. Momentum from the early July rally pushed BTC to a fresh high in 2025, but recent candles have shown signs of fatigue beneath the boundary above the key ascending triangle. This deceleration of structure is accompanied by a dominance of mixed derivative signals and fade, suggesting that bulls are facing increased resistance.

What will happen to Bitcoin prices?

BTCUSD Price Dynamics (Source: TradingView)

On the 4-hour chart, Bitcoin price action exceeds the 20/50/100/200 EMA cluster. This is currently lined up between $116,420 and $113,653, suggesting that buyers still have medium term control. However, Price has struggled to close the Bollinger Band midline at $118,727, but the band, close to $122,056, continues to refuse to rise even further. Recent candlesticks show signs of lower cores and reduced body size, buyers' hesitation near key resistance.

BTCUSD Price Dynamics (Source: TradingView)

On the daily charts, BTC recently broke out from a long-term ascending triangle, but now stalled near horizontal resistance at $120,000. This zone has previously been untapped since December 2024, causing consolidation despite a clean trendline break. Vertex compression patterns usually result in aggressive breakouts, but if Bitcoin fails to do not exceed $120K, the bullish momentum weakens.

The Chande Momentum Oscillator shows a value above 64.8, but it has begun to bend slightly downward. There is often an early warning of fatigue in strong trends. Traders are looking closely at the solution as prices are compressed between Bull Market Support Band (now $100,297) and rising wedge resistance.

BTCUSD Price Dynamics (Source: TradingView)

Parabolic SAR, meanwhile, falls below prices, suggesting a continuing trend. However, the balance volume (OBV) indicator is flattened at 1.84m to reflect stagnant inflows.

Why is Bitcoin price dropping today?

BTCUSD Price Dynamics (Source: TradingView)

Why the price of Bitcoin is falling today is largely due to its decline in momentum across multiple indicators and weakening BTC's control. The weekly BTC dominance chart shows a sudden drop in RSI to 50.98 and breakdowns from rising wedges. MACD also identified bearish crossover areas, suggesting a potential risk-off rotation from BTC to Altcoins.

BTCUSD Price Dynamics (Source: TradingView)

The Smart Money Concepts (SMC) chart saw a recent Structure (BOS) break (BOS) followed by a weakly height sweep of 119.2K. The price then cannot be held above the liquidity zone, suggesting that the latest height can be slower long distance traps. The major liquidity pools remain uncontrolled with the approximately $100,000 and $100,000 pools, which will strengthen the negative side risk if BTC loses its current structure.

Indicators and derivatives suggest incoming volatility

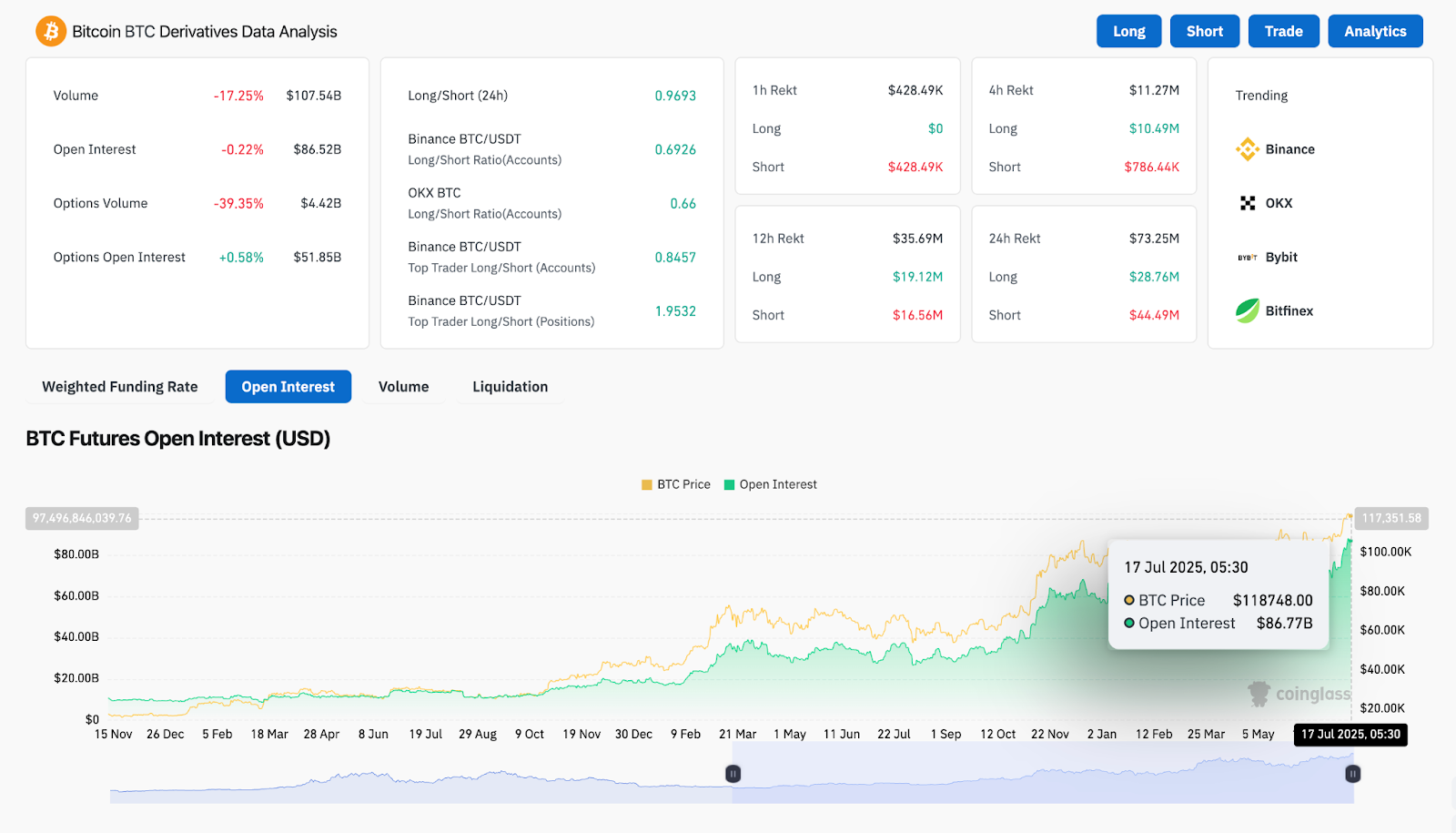

BTC Derivative Analysis (Source: Coinglass)

Derivative data draws mixed pictures. According to Coinglass, Bitcoin's 24-hour volume has dropped by 17.25%, while optional volumes increase by 39.35% to $4.42 billion. However, open interest on options has risen slightly at $51.85B, while open interest on futures remains rising at $8.677 billion.

The long/short ratio is near parity (0.969), indicating market indecisiveness. In particular, Binance's top traders have maintained a long-standing bias (1.95), suggesting that despite wider cooling, the institution may still be positioned upward.

The technical compression is also clear on the Bollinger bands, especially on the 4-hour charts. With the bandwidth close to $118,000, the market is preparing to expand its volatility. Whether it's up or down depends on the Bulls' ability to regain $120,000 in volume.

BTC price forecast: Short-term outlook (24 hours)

BTCUSD Price Dynamics (Source: TradingView)

If today's Bitcoin price is not crucial to clear $120,000 in the next session, there is likely a breakdown of $116,000 and $113,600. Bollinger Band's support for the $115,398 on the four-hour chart remains at the short-term level until viewing, with downside targets of $108,000 and $103,400 near the liquidity cluster.

However, once the Bulls regain $120,500 on confirmation, the upward target is $122,700 (upper band extension), followed by $125,000, working with the Fibonacci extension and historic rejection zone.

Despite trend support from EMA and parabolic SAR, weakening of OBV and increasing volatility risk could support short-term corrections before sustained breakouts. Traders should closely monitor zones between $118,000 and $120,000 as direct battlefields.

Bitcoin Price Prediction Table: July 18, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.