According to the on -chain data, the Ether Leeum network has seen a sharp rise in the weekly whale volume.

Ether Leeum large trading volume was the highest since 2021

In the new post of X, Sentora (previous INTOTHEBLOCK), an Institutional Defi Solutions provider, talked about the latest trends in Ether Lee, a large trading volume.

Here, the “large trading volume” indicates an indicator of the amount of total volume moving from the ETH network by a transaction of $ 100,000 or more.

In general, only whale -sized investors can move the amount of a single transfer, so the amount associated with this movement can be assumed as an expression of the activities performed by a large amount of money investors.

If the value of the metrics rises, it means that whales are increasing their trading activities. This trend may be a signal that interest in assets is increasing. On the other hand, if the indicator goes down, it means that a big holder can lose interest in cryptocurrency.

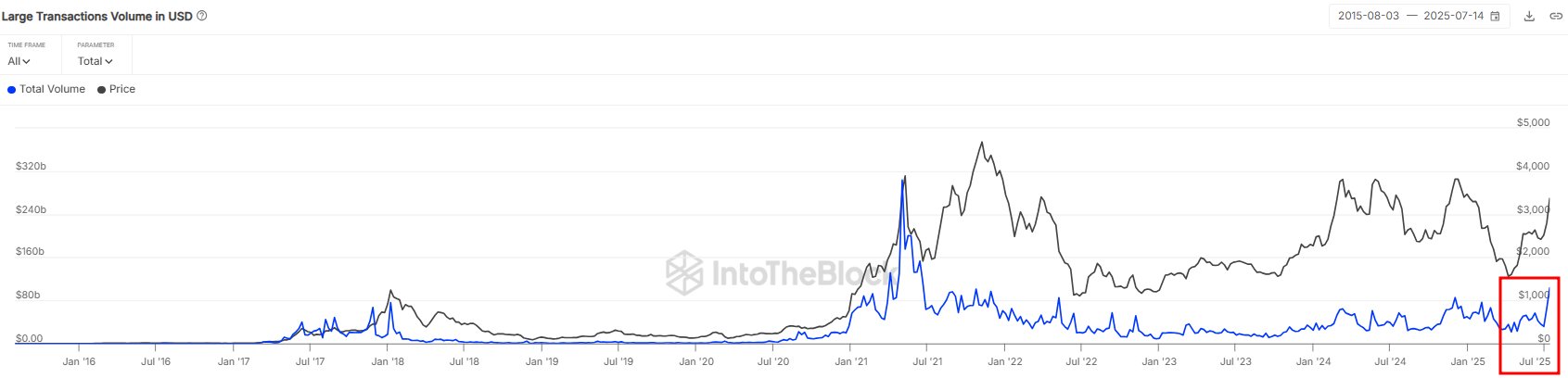

Now there is a chart that shows the trend of Ether Leeum's large trading volume for the history of coins.

The value of the metric appears to have been rising in recent days | Source: Sentora on X

As shown in the graph above, the Ether Leeum large trading volume has recently observed some rapid growth and suggests that whales have greatly increased trading activities.

Last week, this metrics' value is over $ 100 billion, the highest daytime level since the 2021 fire. The wave of this latest activity of the whale has raised the current price to $ 3,000 with ETH's brake out.

This is certainly a signal that increases the interest of the true reality, but it is difficult to say whether it is positive. Since large trading volume does not contain information about the division between purchases and sales movements, the spike does not say anything about which behavior is more dominant, and these holders are creating a kind of movement.

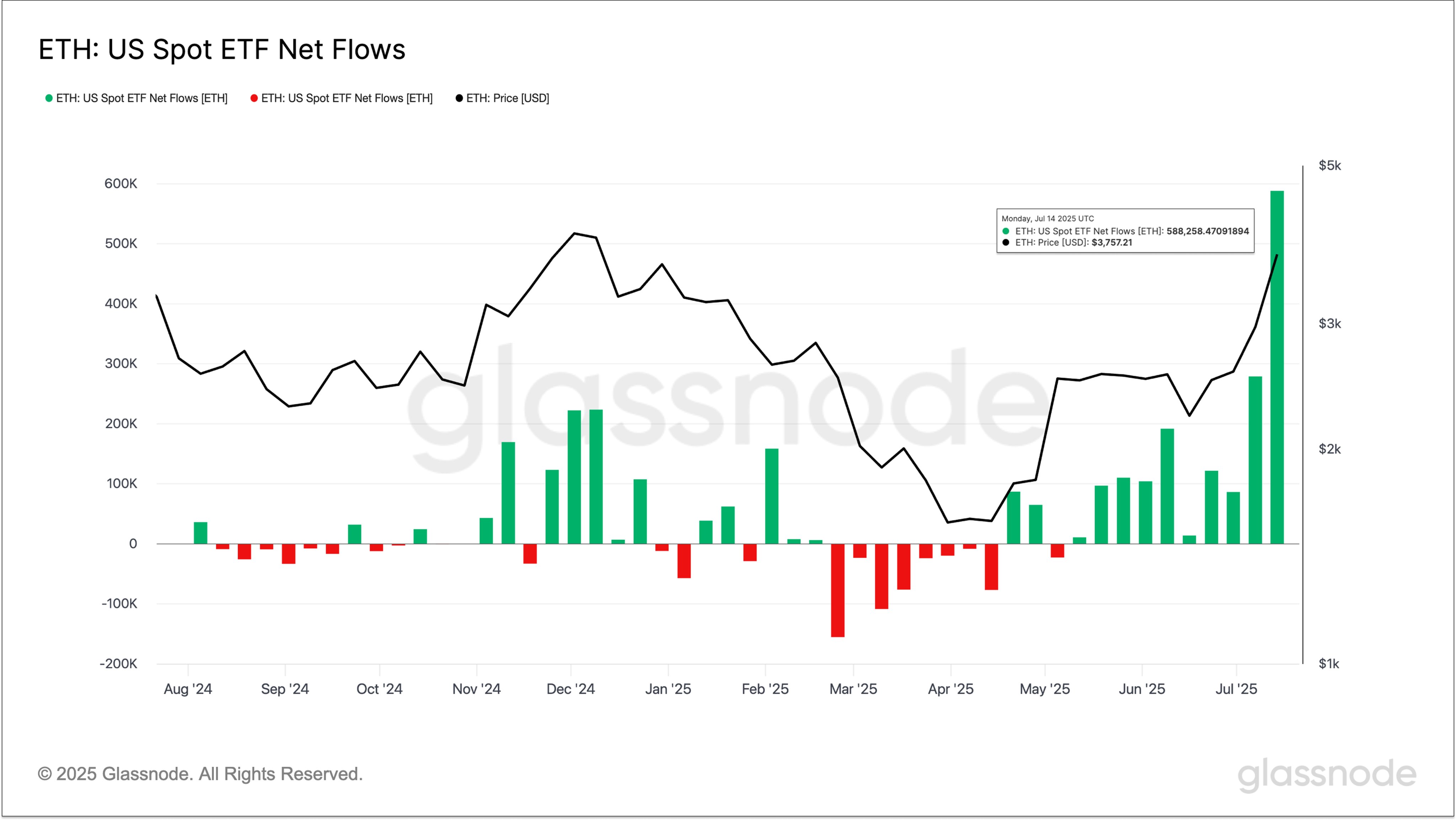

In other news, as the analysis company GlassNode pointed out in the X Post, US Ether Rige Spot Exchange-Traded Funds (ETF) blocked the record week.

The trend in the netflow associated with the US ETH spot ETFs | Source: Glassnode on X

In this chart, Etherrium Spot ETF has seen green states for a while, but the latest is noticeable at the size of the sighted inflow.

GlassNode said, “Last week, Etherum Spot ETF has seen more than 588K inflow.

ETH price

At the time of writing, Ether Lee is trading about $ 3,730 last week.

Looks like the price of the coin has been climbing up recently | Source: ETHUSDT on TradingView

DALL-E, GlassNode.com, INTOTHEBLOCK.COM, TradingView.com

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor's team. This process ensures the integrity, relevance and value of the reader's content.