Imagen Network (Images), a low-cap token built on the Solana blockchain, unexpectedly emerged as BlackRock's third largest crypto-holder, according to on-chain portfolio tracking data.

Despite the sudden price drop since its launch, the asset is currently only behind BlackRock's digital asset allocations, Bitcoin (BTC) and Ethereum (ETH).

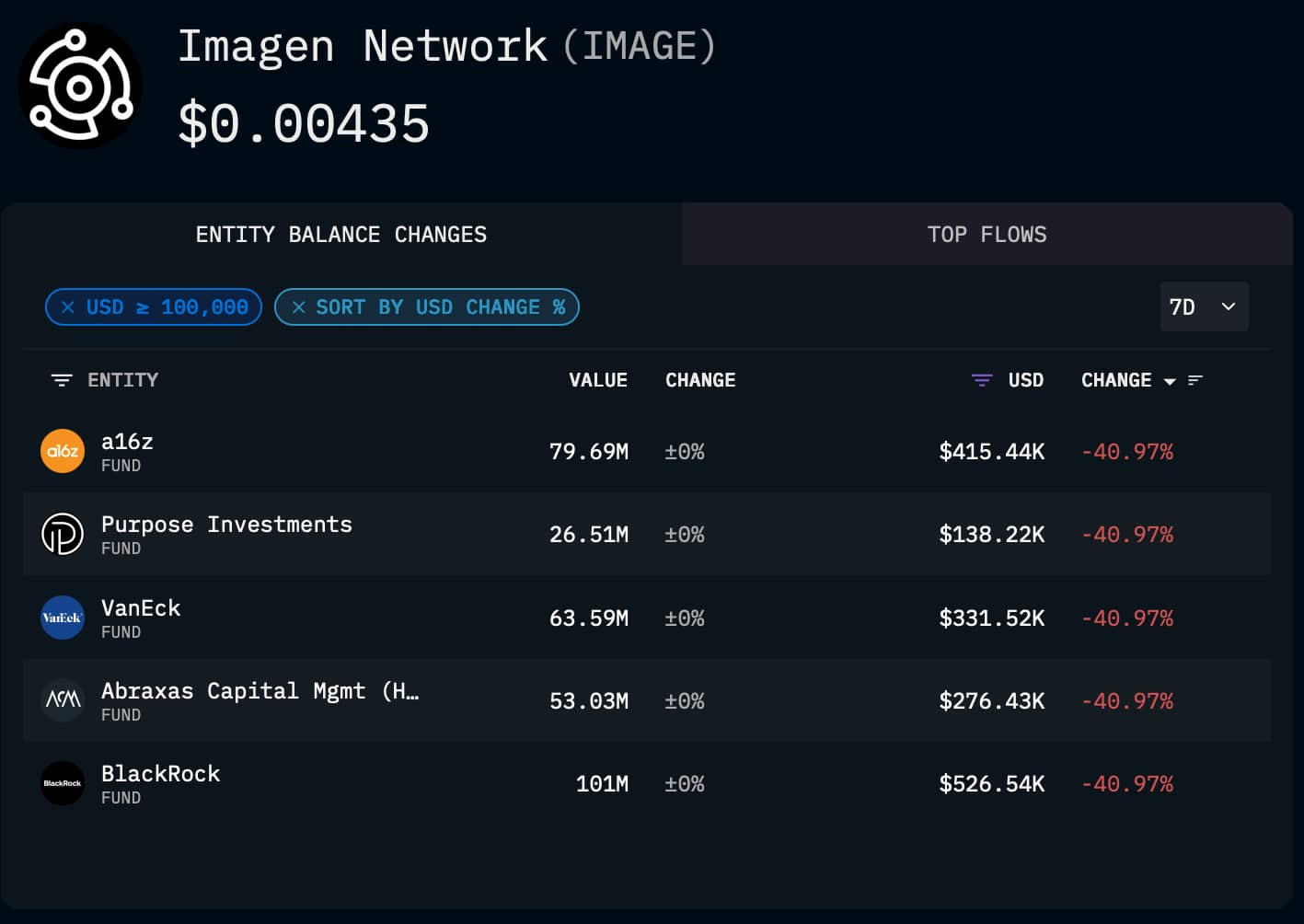

At the time of publication, Image was trading at $0.004,407, down 8.22% on the day, with a total market capitalization of just $22 million. In the past week, tokens have plummeted 45.65%, down more than 80% since their launch on June 12th. Images have fallen by 84.56% since the beginning of the year.

BlackRock holds over 100 million image tokens

Despite the sale, BlackRock currently holds 101 million image tokens, at around $445,920, making it the company's third largest crypto position just ahead of SPX. The fund's Crypto portfolio is still dominated by Bitcoin, with over 720,000 BTC worth $85.6 billion, Ethereum valued at ETH of 2.14 million at $79.1 billion.

Other major entities such as A16Z, Vaneck, Purpose Investments, and Abraxas Capital also retain important image positions. However, in the past seven days, each of these funds has dropped nearly 41% in the USD value of image retention, as emotions around the token have cooled down.

The appeal of tokens appears to lie in their underlying high-tech stack and early institutional benefits, but the sudden decline highlights the low-liquidity of the crypto space and the volatility risks associated with new assets.

Built on Solana, Imagen Network is sold as a decentralized framework for identity and content origin, but it is still unclear whether fundamentals will catch up with early support enthusiasm.