Strategy (MSTR) removes some form of financial alchemy. Using Bitcoin, a historically unstable asset, we create something very similar to stability.

It is designed to keep the company's $2 billion “stretch” preferred stock (STRC) offer with a fluctuating 9% dividend and keep the stock price close to $100.

According to a recent NYDIG report, the offer is not directly exposed to Bitcoin to investors, but is supported by mental and structural assets.

The strategy holds $71.7 billion in Bitcoin and just $11 billion in debt, giving it room for revenue even if crypto prices drop, the report notes.

Historically, Bitcoin has returned at least 3%-4% per year on a five-year stretch, but its average return is significantly higher.

The strategy bets that it can use this return profile to maintain high payments without touching crypto stashes, essentially turning long-term Bitcoin viewing into monthly cash flow.

“The STRC looks like a high-yield Bitcoin-backed, financial market style vehicle designed to trade PARs of nearly $100, despite its diverse liquidity profiles, while offering much higher yields than traditional short-term instruments,” writes Nydig.

That premise has proven popular. Investor profits have encouraged a strategy of quadrupleting the size of offerings from $500 million to $2 billion.

STRC could be a remade Bitcoin for traditional financial income investors, not just harvesting vehicles. A kind of money market fund remixed with a code under the hood.

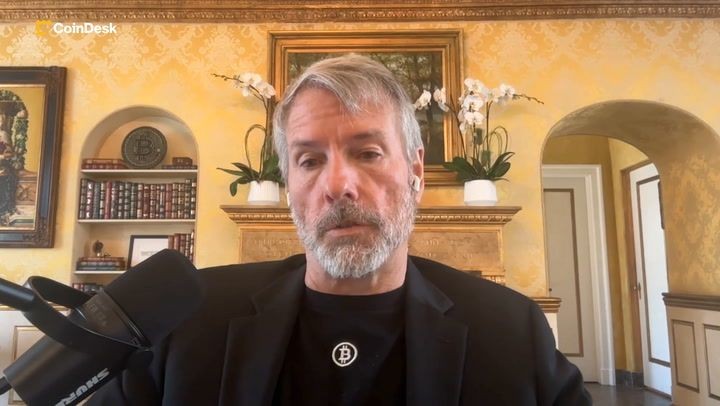

Read more: Michael Saylor builds his own yield curve with upsized preferred stock sales