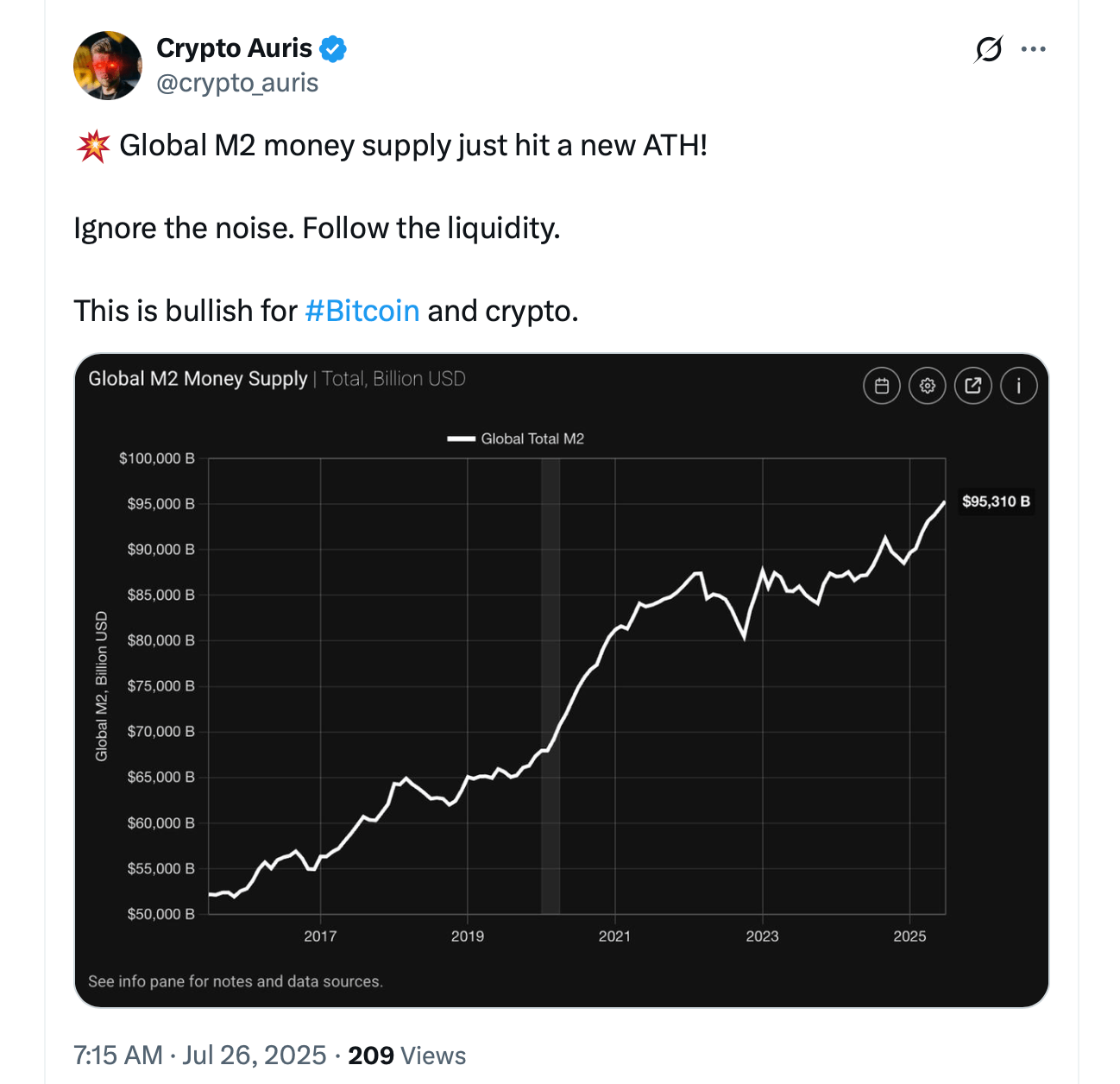

Global M2 Money Supply has risen from $96 trillion to $96 trillion in the last 24 hours, a record high of $95 trillion to $96 trillion, with Bitcoin trading between $117,800 and $118,102.

M2 Money Boom: Why Bitcoin Prices Raise amid Liquidity Flood

Many Crypto fans have cited the bank in the idea that the balloon M2 will give a big lift to the digital currency space. This concept regularly creates rounds on platforms like Reddit and X, where users share posts that allow users to rotate threads and analyze exactly how this unfolds.

Posts on R/cryptocurrency linking Bitcoin to Global M2 have recently made a round of floods and one of X.

Essentially, M2 represents a wide range of money supply in the economy, including physical currencies in circulation, demand deposits in current accounts, savings deposits, money market funds, and other very liquid near assets.

Unlike narrow measures like the M1, which focuses on cash and deposit checks, M2 acquires funds that are readily available for spending and investment, providing insight into economic liquidity and potential inflationary pressures. In other words, M2 provides a clear window into global liquidity.

Globally, M2 tallies these figures from major economies and converts them to US dollars, with recent data showing that the world's largest central bank, the US Federal Reserve, the European Central Bank, the Bank of Japan and the People's Bank of China to new highs.

This measure serves as a barometer of monetary policy effectiveness. Central banks influence M2 through tools such as interest rate adjustments, open market operations, and reserve requirements. This expands or contracts the money available in the banking system.

In R/Bitcoin, many people bet that M2 growth paves the way for Sky High Bitcoin prices.

As M2 grows, it will improve liquidity and allow for more lending, spending and investment, but excessive expansion can lead to inflation as it chases the same goods and services.

The current rise in Global M2 is attributed to the revival of government stimulus and liquidity businesses, including quantitative easing programs in which central banks purchase assets to the economy and provide direct financial support such as infrastructure spending and subsidies.

These policies have been accelerating since 2020 during post-growth post-post or slowdown, adding indications that central banks around the world will balance their way to counter economic disruption.

China's financial expansion has fuelled its efforts to strengthen domestic growth, support exports and maintain financial stability amidst domestic trade tensions, with its M2 exceeding $44 trillion.

This aggressive growth has averaged over 8% per year in recent years, and has contributed significantly to global growth as China's policy spreads through international markets through trade and investment channels.

Historical data reveals a strong correlation between M2 expansion and rising asset prices, including stocks, real estate, and cryptocurrencies, including stocks, real estate, and cryptocurrencies.

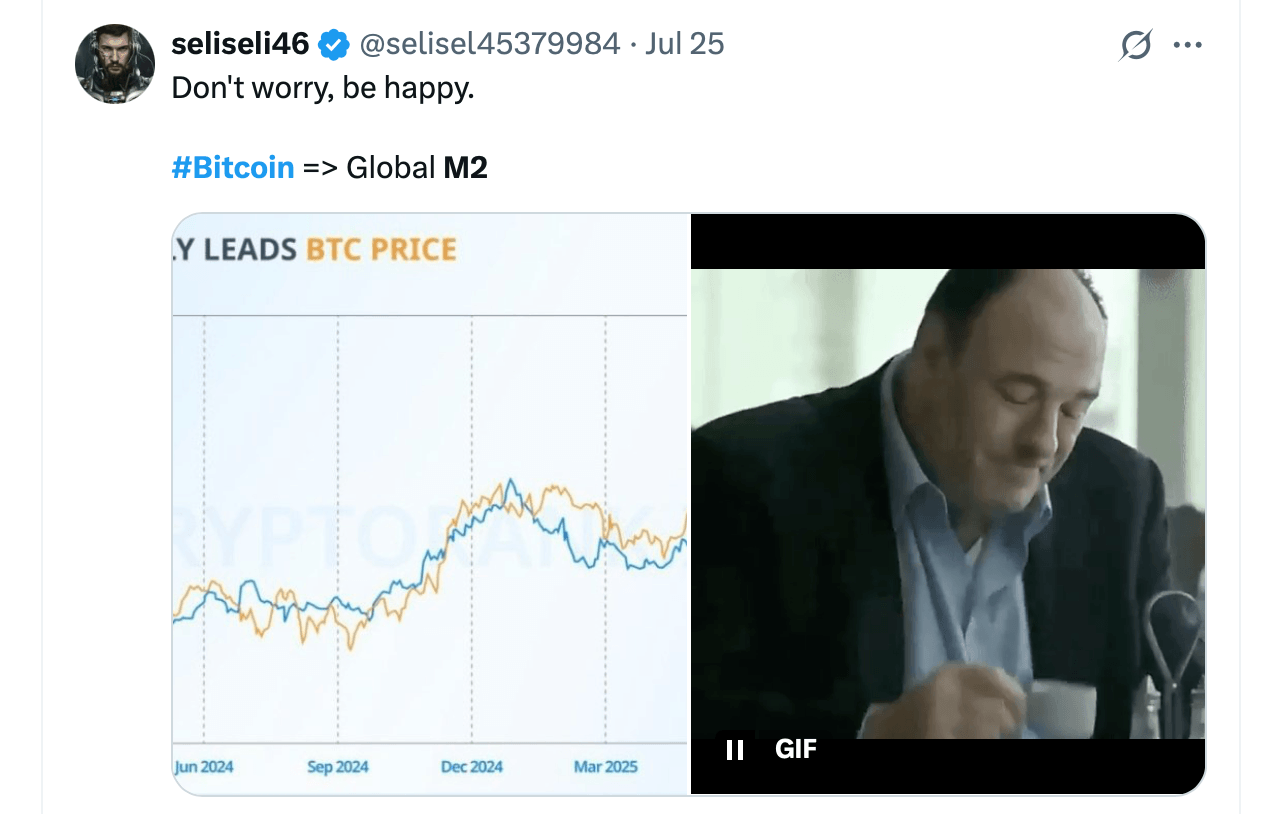

In particular, for Bitcoin, the analysis shows an average correlation of 0.65-0.89 on M2 growth in M2 leading M2 leading M2, leading M2, to eliminate the demand for rare assets like Bitcoin, where an increase in money supply is considered a hedge against infringement.

Social media posts linking M2's growth to Bitcoin's rise are appearing throughout X. “Global liquidity is rising rapidly,” one X user said on Saturday. “M2 supply explosion. Bitcoin charts are being copied in stages. Ignore the noise. Follow liquidity. Because when liquidity floods, BTC won't wait. Liquidity leads. Follow price,” X Account added.

For example, between 2020 and 2021, global M2s surged by more than 25% amid the pandemic stimulus, with Bitcoin rallies moving from under $10,000 to nearly $69,000. With the M2 sitting at record levels, some cryptanars are asking BTC to tap $150,000 on the next liquidity flash.

Currently, the Global M2 is a record high and is projected to grow by 8% to 10% each year until 2025, so Bitcoin is amplified very well as it has historically increased its price sensitivity, increasing thousands of trillions to the new M2. Meanwhile, the Trump administration is pushing the Fed's interest rate cuts strongly, hoping that the amount of easing will shake the economy.

For many Bitcoin advocates, this dynamic lasts despite its short-term volatility. Bitcoin's cap supply of 21 million coins is in contrast to Fiat's expansion, placing it in 2025 to gain an increased share of global liquidity.