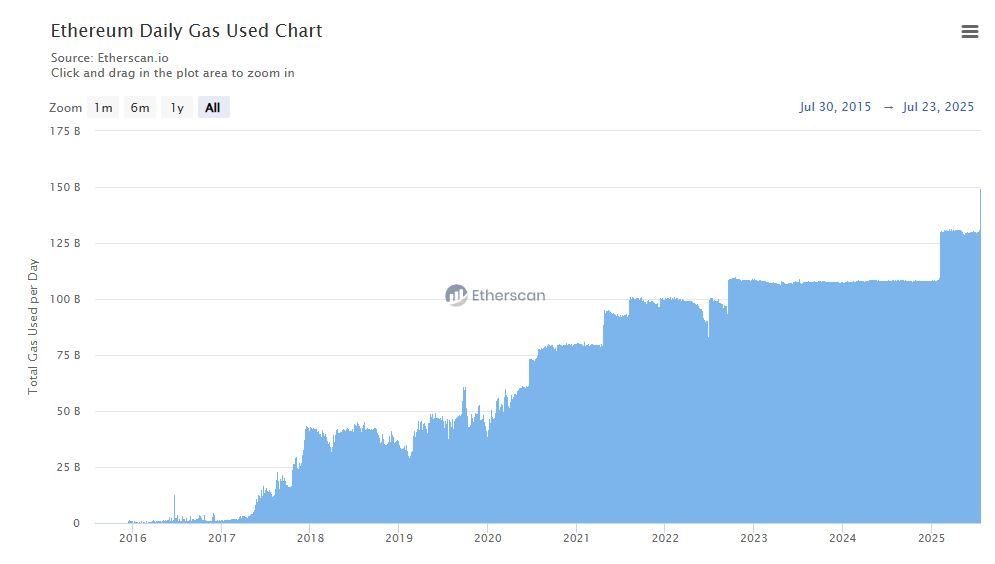

The Ethereum Network is showing unprecedented demand, showing a new record of recent daily gas use. The metrics indicate chain activity on the peak, but individual transactions remain relatively inexpensive.

Activities have been featured in the past few days, bringing daily gas use to record levels. The metrics reveal that Ethereum is key to on-chain activity, with users returning in a bull market for multiple apps and use cases.

ETHEREUM's gas usage has skyrocketed to records over the past few weeks, combining whale purchases, retail demand and overall hype for gatherings in the ETH market. |Source: Etherscan

The network has approximately 1.6 million transactions every day, originating from over 500,000 active wallets every day. The activities focus on USDT and USDC Stablecoin transfers, and raw ETH transfers.

Network activity already surged to a higher level in early 2025, when ETH approached $4,000. This time, gas usage was repeated to a new range based on generally elevated on-chain activity rather than abnormal. Gas usage is not linked to special events, but reveals increased resistance and transfer.

ETH returns to 2021 level, but no hype

Despite record usage, regular transactions are still under $0.15, and NFT transfers are the most expensive at $2.48. Unlike previous periods of ETH usage, transactions are not prohibited.

Recent increase in usage raises the question of scaling networks beyond the existing L2 chains. ETH illustrates its combined use case as a valuable collateral and as a utility token for active transfers.

The current level of activity and gas usage at Ethereum is close to the 2021 activity spike. Previous bull markets were linked to Peak NFT mania paired with web3 games, memes and defi.

After a long bear market, activity in the chain has recovered, improving infrastructure and liquidity. The biggest change comes from Defi, where the project built a tool to avoid liquidation.

The rise of Aave unlocked additional liquidity on the network and set the gold standard for lending. Aave expanded its locked value to over $20 billion, but the entire network carried over $820 billion locked. The chain carries similar fluidity as early 2022 before a crash triggered by FTX.

Stablecoins boost Ethereum activities

Ethereum still carries over 80% of Stablecoin traffic and benefits from increased supply in 2025. The chain is powered by $12.85 billion in stubcoins, with around 2.5 million active addresses specialized in stubcoins activities.

Ethereum also has the largest amount in terms of value introduced, with significant stocks derived from whale trading. For the past three months, Stablecoins have been part of a very active influx into the network.

Increased usage and liquidity, and bridges from unused L2 chains, meant that Ethereum added $200 billion over the past three months. The chain was the leader of the influx as activity returned to the L1 chain.

Even in record-breaking uses of bases like the L2, some of the revenues were ultimately bridged to Ethereum. Multiple chains showed that the link between DEX and regular exchanges allowed the bridge to lock the gain and revert back to the original ETH ecosystem.

Ethereum will supply Arbitrum, Polygon, Unichain and Base in liquidity, based on Artemis data, while receiving the largest returns from bases and Arbitrum. Over the past week, the L2 chain has sent a net total of $144 million to Ethereum. $1.7 billion Total inflow. Continuous transfers indicate that Ethereum remains a key hub for revenue, especially stable integration.