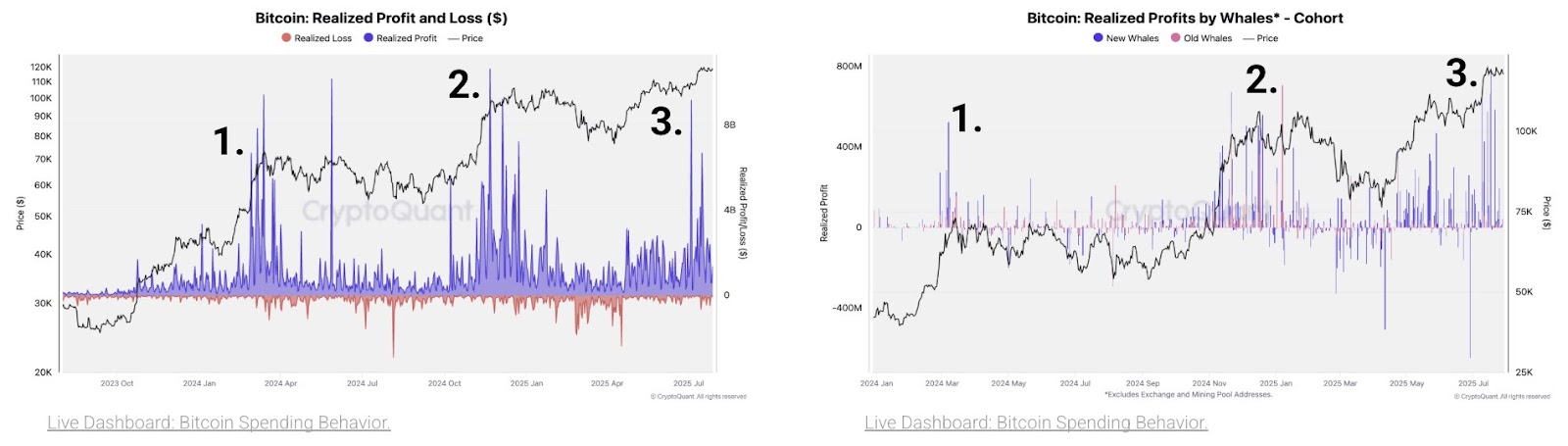

Bitcoin's failure to exceed $120,000 has accompanied a surge in sales from large owners, marking what analysts call “the third major profit acquisition for this bull run.”

Realized profits from Bitcoin (BTC) reached between $6 billion and $8 billion in late July, according to Onchain Analytics company Cryptoquant.

This latest sale was driven by “new whales,” which began to recognize profits after BTC surpassed the $120,000 mark, Cryptoquant noted.

When encrypted, the whale is an entity that holds at least 1,000 BTC. Many of them accumulate early and are known to affect market movements. In contrast, the “new whales” have recently accumulated BTC wealth, increasing the likelihood of institutional investors and businesses being included.

The new whales are behind the third profit phase of Bitcoin's current market cycle. sauce: Encryption

The previous two profit-taking waves followed the launch of US Spot Bitcoin Exchange trading funds and the inauguration of President Donald Trump. Both periods were followed by expanded cooling phases in Bitcoin and the broader crypto market.

However, the cooling phase escalated to a full-scale sale in early 2025 after Trump's tariff agenda rattled investors and raised concerns about economic growth and inflation.

Still, Bitcoin and the broader crypto market have been bounced sharply since early April, with BTC hitting a new all-time high of over $123,000 in July.

Related: Bitcoin Price retargets $119K as the Treasury purchases 28k BTC in two days

Old whales are resurfaced

Cryptoquant's analysis highlighted the new whales as the leading driver of recent profit acquisition, but the long-term entity, which accumulated 80,000 BTC during Nakamoto Atoshi's era, recently achieved a profit of $9.7 billion.

As reported by Cointelegraph, the transaction was run on multiple tranches via Galaxy Digital, and sales were sold through major exchanges such as Binance, Bybit, Coinbase, Bitstamp.

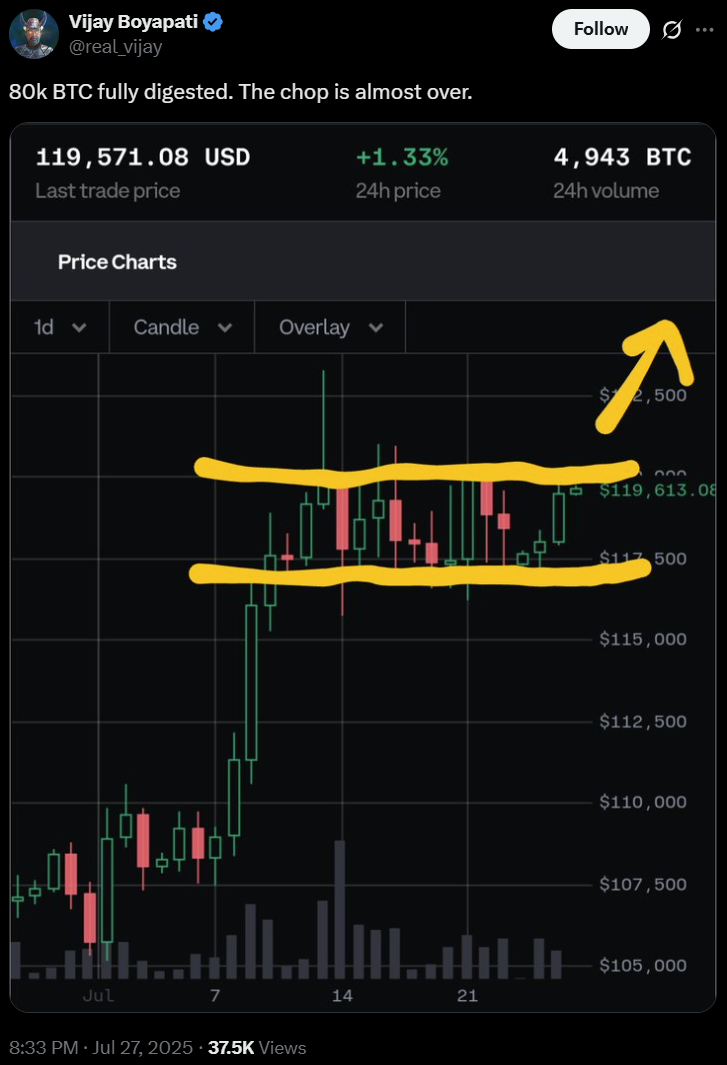

Despite a short 4% drop in Bitcoin prices after sale, the market recovers quickly, suggesting strong demand and absorption capacity in the face of large-scale liquidation.

sauce: Vijay Boyapati

Bitcoin's performance this year outperforms most other assets, including the stock market. The S&P 500 hit a record high last month, but as measured in Bitcoin terms, it's down 15% per year. Bitbo data shows that since 2012, the benchmark index has been 99.98% below Bitcoin.

magazine: Crypto Traders “deceives themselves” with price predictions: Peter Brandt