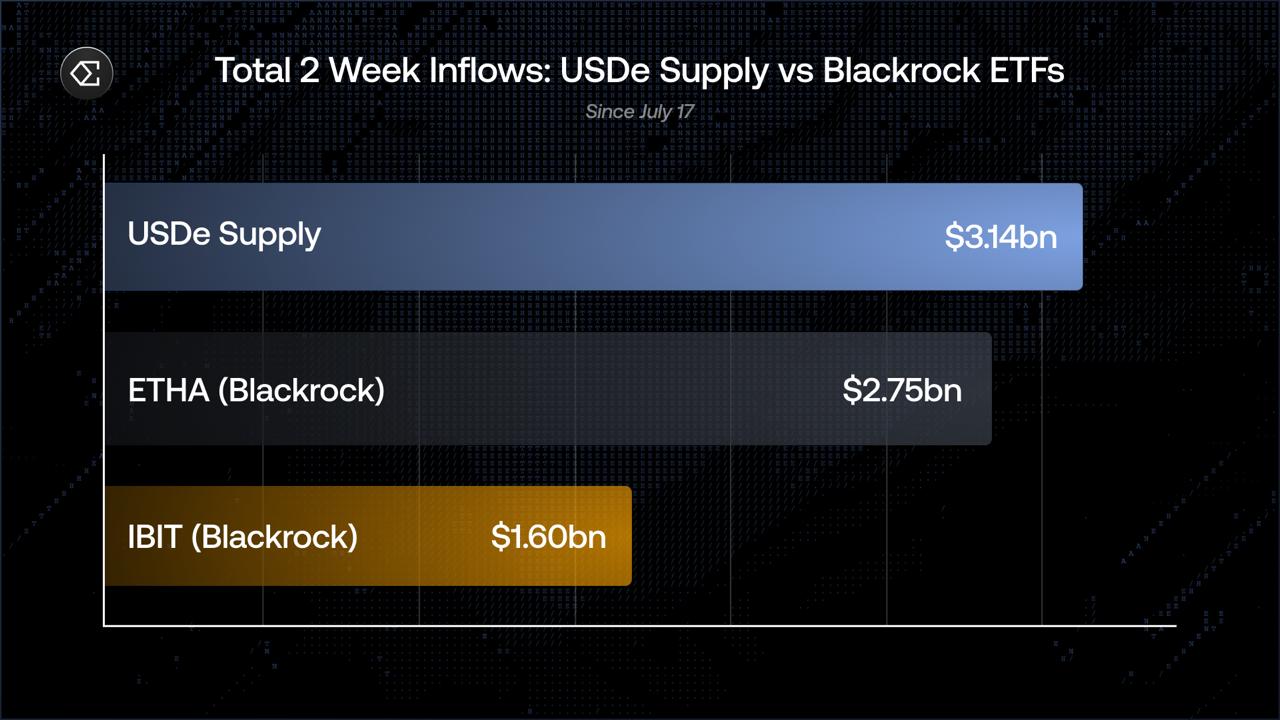

Ethena's Synthetic Stablecoin USDE has exceeded $8.4 billion in supply, adding more than $3.14 billion over 20 days, a surge that has flowed to BlackRock (BLK)'s Bitcoin and Ether Exchange-Traded Fund.

According to on-chain data curated by the Ethena community, supply growth since July 17th is the fastest period of growth since the February 2024 protocol was launched.

The inflows into stubcoin, including harvest, have exceeded the $2.75 billion added to BlackRock's ether ETF (ETHA) and $16 billion to Bitcoin ETF (IBIT) over the same period, making the stubline of the fiscal industry the biggest magnet for capital in both the off-chain market in recent weeks.

This rally spilled on Esena's governance token ENA. This has more than doubled in the past month, but it has dropped by 12% over the past 24 hours as traders hope that the much-anticipated fee switching will soon become active.

This protocol exceeds most thresholds required to distribute revenues to ENA owners. The ultimate benchmark, the spread of yields that are more favorable than rivals, is expected to be met soon.

USDE's Reflective Loop

Recent growth in USDE reflects the strong reflective loop built into the core design, as Nansen explained in a recent research report on the Ethena ecosystem.

As Bitcoin and ether prices rise, the permanent funding rate is increasingly positive. Ecena captures this fund via a delta neutral hedge and distributes it as real-time yield to Susude holders.

Its high yields attract more users, bringing better USDE issuance, hedging, and more protocol revenue.

Last month, Ethena generated nearly $50 million in feed and $10 million in revenue, according to data from Defillama. This makes it the sixth best performance protocol for monthly fee revenue, according to data aggregators.

The ENA is currently trading at $0.58.