Billionaire investor Ray Dalio has said goodbye to Bridgewater Associates, a hedge fund giant he founded 50 years ago.

Dario sold his last stake in Bridgewater and stepped off the board, The Wall Street Journal reported Thursday.

After purchasing Dalio's shares, Bridgewater reportedly issued new shares to Brunei's sovereign wealth fund in a multi-billion dollar deal, bringing nearly 20% of the company's stake.

sauce: Reigario

Dario said he was excited to take him to X on Thursday to pass Bridgewater on to the next generation, saying, “I love seeing Bridgewater alive and well even without me.

Dario predicts “worst than a recession”

Dario's latest bridge water sale marks the final chapter of his journey with the company he founded in 1975 from a two-bedroom apartment. The 75-year-old billionaire resigned as Bridgewater CEO in 2017 and resigned as chairman by the end of 2021.

Known for successfully predicting the 2008 economic crisis, Dario predicted a global debt crisis in the second half of 2024, repeatedly predicting more collapses.

sauce: Reigario

“If the country is overloaded with debt, the preferred path is to lower rates and underestimate the currency, so it's worth betting on exactly what this will happen,” the veteran investor told the X Post last Wednesday.

He also predicted that if the government does not reduce its fiscal deficit to 3% of GDP, the US economy risks facing an “economic heart attack.”

Dario UPS Bitcoin and Gold Allocation Advice

While escalated further by the Trump administration's tariff disruption while hoping for more economic challenges amid the imbalance of deglobalization and unsustainable trade, Dario has repeatedly recommended Bitcoin (BTC) and gold as the main tools against the crisis.

In late July, he recommended that investors allocate up to 15% to Bitcoin or Gold to optimize “the optimal ratio to risk to risk” and significantly increase previous advice up to 2%.

Related: Bulgaria missed the return of its $25 billion debt in 2018 by selling Bitcoin

“I think Bitcoin is one hell of invention,” Dario wrote in his essay, “I'm thinking of Bitcoin in 2021.

“Bitcoin doesn't bother losing about 80%, so it looks like a long-term option in a very unknown future.”

While he owned some Bitcoin, the legendary investors still said they still preferred gold to Bitcoin.

Criticism of Dario's harsh outlook

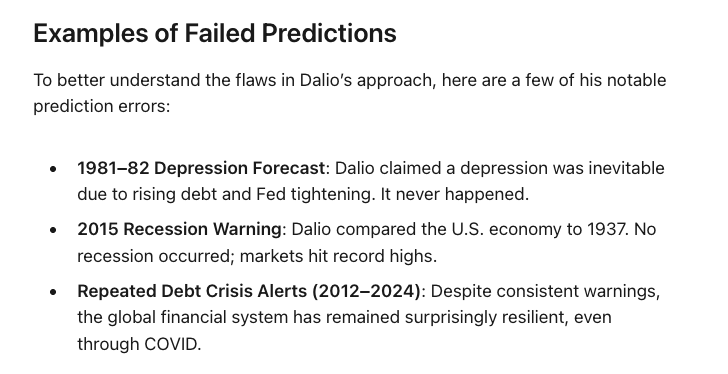

Dario gained the reputation of Market Oracle after predicting the 2008 crisis, but many of his other economic forecasts attracted criticism.

In 1982, Dario predicted that the global economy was heading towards depression, which turned out to be false, causing a major loss for Bridgewater. Dario later admitted that he was a “dead mistake” in both his predictions and subsequent trading strategies, revealing that his misjudgment had almost bankrupted the company.

Source: Edge Digest

As Dario warns that the United States could be the next country to be broken, skeptics increasingly highlight many flaws in his economic forecast performance, including overgeneralization, confirmation bias, and a lack of temporal clarity.

magazine: China laughs Crypto Policies, Telegram's new Dark Markets: Asia Express