As ETH recovered from the weekend dip, Ether Shloves continued to buy cryptocurrency in large numbers.

“Someone is buying a ton of ETH,” blockchain analytics firm Arkham Intelligence said on Sunday, accumulating $300 million worth of ether (ETH) from commercial (OTC) transactions on Galaxy Digital.

The whale currently has 79,461 ETH, worth approximately $282.5 million.

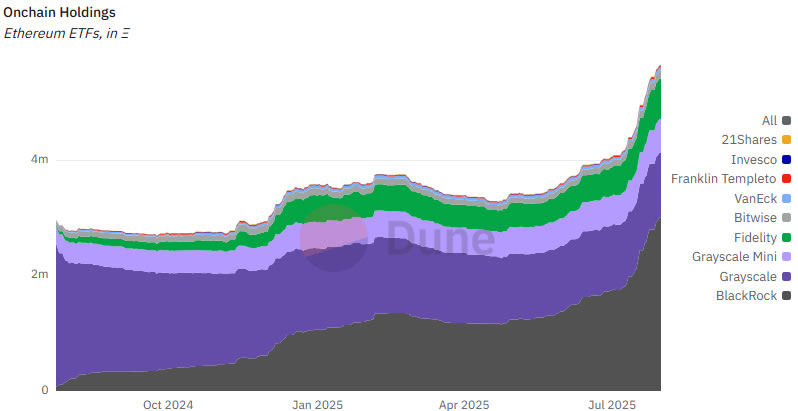

BlackRock is also piled up at ETH, with its Ishares Ethereum Trust ETF seeing $1.7 billion inflows on its last 10 consecutive trading days.

According to Dune Analytics, Exchange-Traded Funds' Onchain Holdings in Exchange-Traded Funds in This Monise has skyrocketed by more than 40% over the past 30 days.

ETF's ether holdings skyrocketed in July. sauce: Dune analysis

ETH Mega Whale Loads

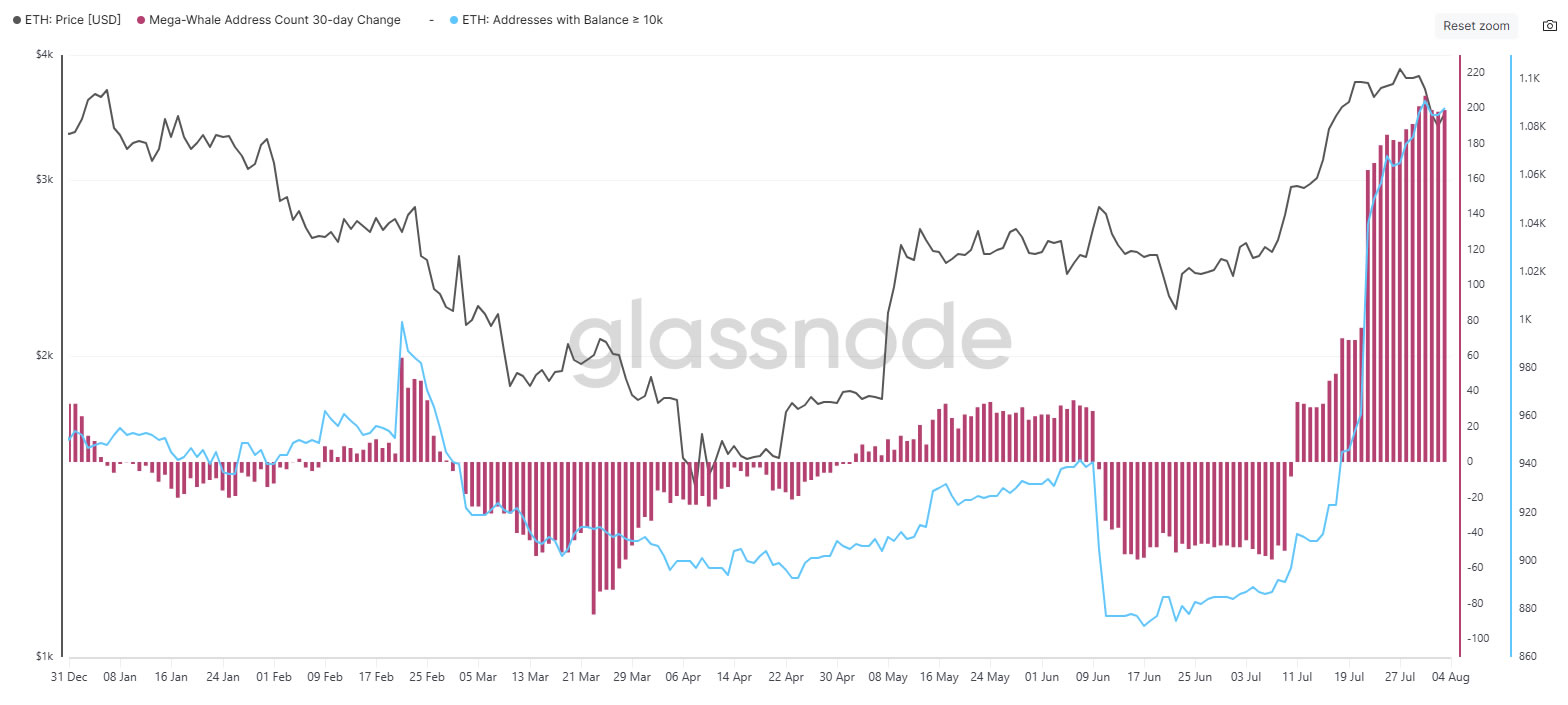

According to GlassNode, ether “mega whale” addresses have also increased sharply over the past 30 days.

The mega whale cohort is defined by addresses holding more than 10,000 ETHs, with over 200 added since the beginning of July.

These whale addresses include those that are actively accumulated exchanges, large custodians, and those held by exchange-sold products.

ETH “Mega Whale” address count surge. sauce: Glass Node

It's already recovered

Ether prices were cooled at dips below $3,400 over the weekend, but showed signs of recovery Monday by recovering $3,560.

Related: Ethereum “Mega Whale” is piling up more vigorously than the 2022 pre-95% rallies

“In the beginning, the labour market cooling trends surprised investors, but the increased possibility of financial easing could quickly reverse the sale.

It's weak in August

Like Bitcoin, which was bearish in the eight of the last 12 months of August, Ether has seen losses in August over the past three years.

According to Coinglass, assets fell double digits in August 2023 and 2024, but in August 2021, the year of the Bull Market, a whopping 35.6% rose.

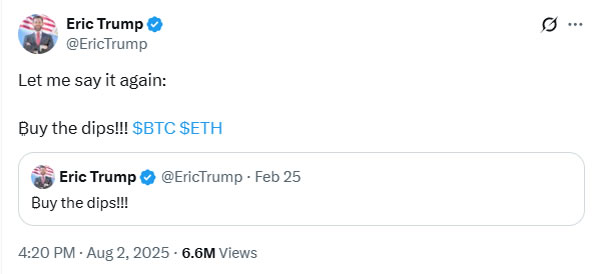

Over the weekend, Eric Trump, the son of US President Donald Trump, told his X-followers to buy ETH dip.

sauce: Eric Trump

Meanwhile, CNBC labeled Ethereum as “the invisible backbone of Wall Street” in its article on Saturday.

magazine: China laughs Crypto Policies, Telegram's new Dark Markets: Asia Express