Ethereum's recent pullback appears to be pausing near the important Fibonacci confluence zone and mid-channel support. After briefly touching on a weekly weekly high of nearly $3,576, Ethereum Price trades at around $3,535 today, with mixed metrics suggesting indecisiveness ahead of the breakout decision.

Ethereum price forecast table: August 5, 2025

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

On the weekly charts, Ethereum prices are once again responding to long-term trendline resistance of nearly $3,540, consistent with the 0.382 Fibonacci level from the 2021-2022 high range. After tagging this level, the price was denied neatly. This also overlaps with the historic weekly rejection zone, and is the main structural barrier for bulls to overcome.

ETH Price Dynamics (Source: TradingView)

In the daily time frame, ETH floats just above the strong support zone of nearly $3,500, leading to a rapid rally in previous demand. This level coincides with the top of the previous breakout wedge and the reverse head and shoulder neckline for several months. Unless it falls below the $3,320 Neckline Retest area, bullish bias remains structurally intact.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

Ethereum prices today may best be explained by long-term resistance and rejection from short-term excesses. The price was spiked to $3,576, but failed to close above the resistance band by more than $3,540-$3,565, causing profits.

On the four-hour chart, the Bollinger band is shoved into the upper band during a failed rally, followed by contraction and rejection. This coincides with a bearish supertrend flip of $3,639 and the downward trend intensity of the Direction Motion Index (DMI) when the -DI exceeds +DI and ADX begins to fall, indicating a weaker bull drive.

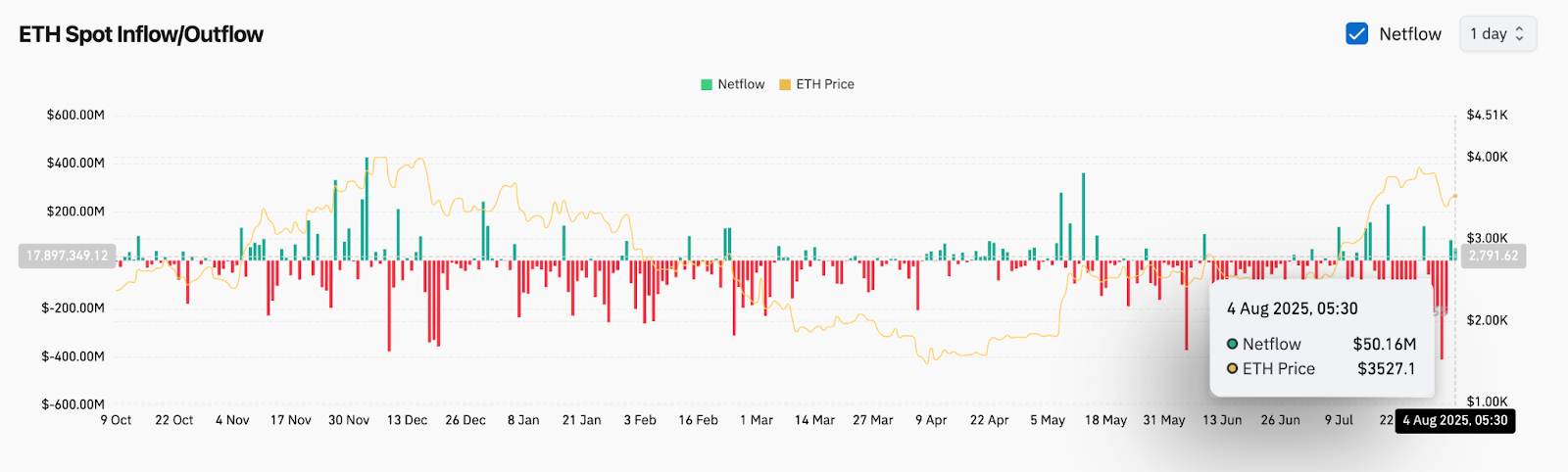

ETH Spot Inflow/Outflow Data (Source: Coinglass)

Spot influx also reflects mixed emotions. As of August 4, net inflows to the exchange had risen to $50.16 million, suggesting that some holders could be located at short-term exits near resistance levels. These movements usually precede local peaks unless offset by strong volume absorption.

As ETH integrates, momentum indicators mix

ETH Price Dynamics (Source: TradingView)

The 30-minute chart shows Ethereum price action that has been rolling out within the upward channel, which has been high and higher lows since the August 2nd reversal. However, the RSI began to cool down at nearly 62 and retreated from the acquired territory. The MACD histogram has also been flattened, with signal line crossovers appearing tentatively, suggesting a loss of momentum.

ETH Price Dynamics (Source: TradingView)

Meanwhile, on the four-hour chart, Price recovered 20 and 50 EMAs for $3,542 and $3,566, respectively. However, the candle remains under the red supertrend flip zone ($3,639), and we are paying attention to aggressive long entries. 100 EMA ($3,617) is the next immediate hurdle. This level of recovery could validate a new breakout push into the region between $3,700-$3,750.

The weekly RSI remains in bullish territory and is about to establish a higher pattern. The 0.618 FIB level from the weekly structure ($3,067) remains a strong mid-cycle anchor, with the next decisive breakout level being $4,106 (FIB 1.0 zone).

ETH Price Forecast: Short-term Outlook (24 hours)

If the Bulls were able to cut Ethereum prices above $3,565 with follow-through, the next zone of resistance would be at $3,680 and $3,750. Clearing off $3,750 brings you to the psychological $4,000 mark. However, failing to play $3,565 could lead to a retest of 200 EMA ($3,339) on the 4-hour chart, potentially immersing in the FIB support zone of nearly $3,250.

Given the mixing technology and long, long position, Ethereum could remain in the range between $3,480 and $3,620 until a critical catalyst emerges. Traders should be careful about Bollinger Squeeze Breakout and MACD checking for the next directional movement.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.