According to the Financial Times, China has focused on the yuan (aka Renminbi) Stablecoin both internally and externally used, but no one knows how it works, and why the Chinese Communist Party (CCP) is keen to create it, as even in the Financial Times articles reveal.

The work reveals that the CCP “subject to the success of dollar-backed tokens solidify the domination of US currency in the global economy,” but it cannot determine whether the tightly controlled yuan stabrecoin exists or how it hinders the continued global hegemony of the US dollar over the financial system.

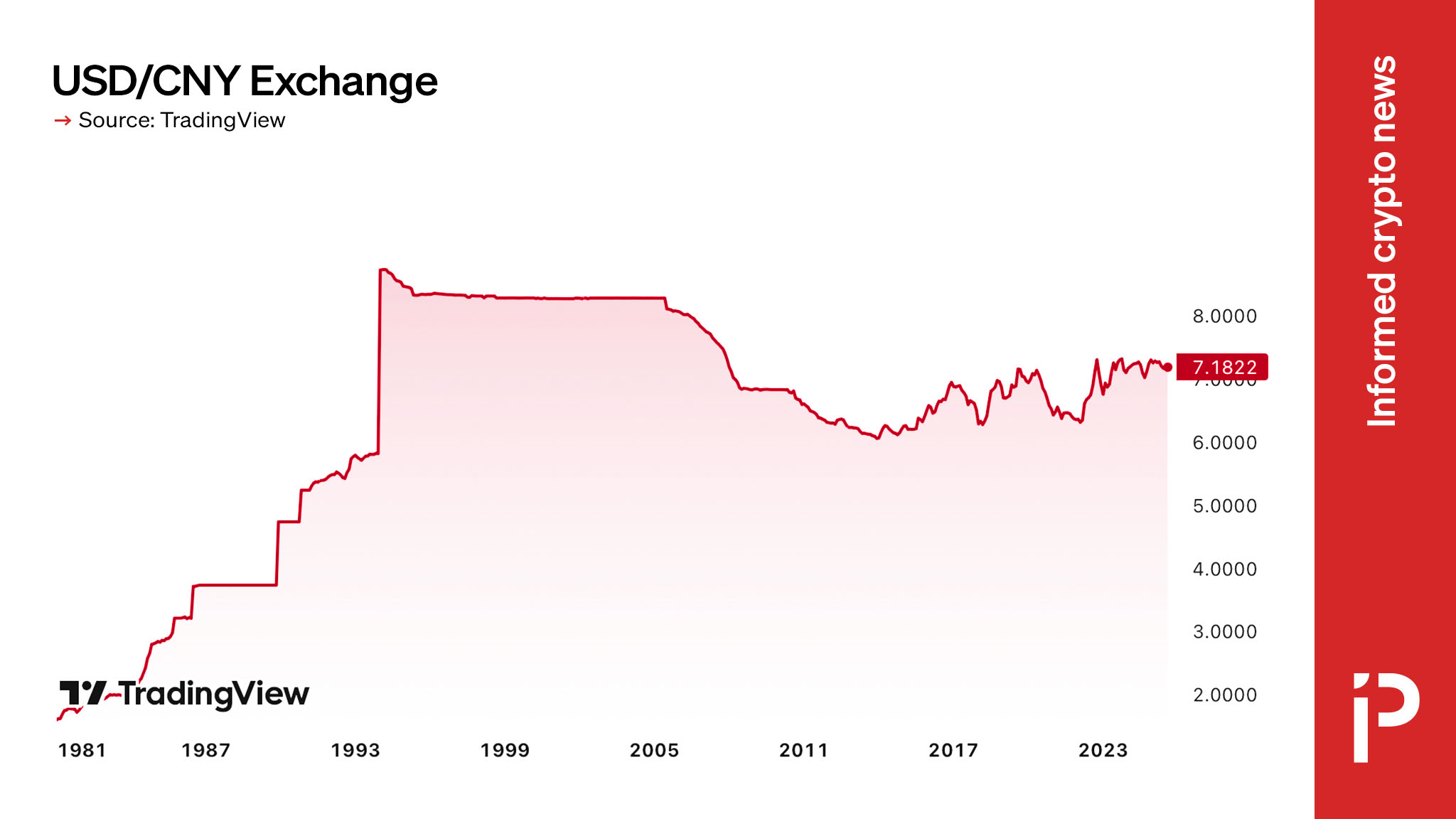

Unless you understand the independence of China's central banks and how the Yuan is constructed to keep China's exports cheap, the Yuan is a strange currency. This means that there are actually two Yuans. One is for domestic use and offshore markets, and they trade at slightly different values (written, CNY, or domestic original time, at 7.189 per dollar, while CHN, or Offshore Markets Yuan trades at 7.193 per USD).

Furthermore, you can learn that anti-laundry methods for customers and money are substantial penalties in China. And, almost everyone uses the Yuan digitally, and the People's Bank of China has full control over all aspects of the currency, allowing the Yuan to use individuals, businesses or countries much more effectively than the US dollar.

This allows the CCP to ensure similarity in price management, but has led to a considerable amount of capital flight, hunting ways for many Chinese citizens to withdraw currencies of more useful international currencies, such as the US dollar and the euro. China also has not seen its original widespread use outside mainland China, even war-torn allies like Russia and Iran.

I already have the original stub coin

For those familiar with Tether, the world's largest cryptocurrency company and the stubrecoin with the highest market capitalization and the highest volume, they may know that Tether issued Offshore Euan Stubcoin in 2019.

Since then, the Chinese citizens who helped them create stubcoins and find some early demand, Zhao Dong, known as the old OTC king, was arrested and sentenced to several years in prison. Since his arrest, there have been few tethers that Ewan has not been cast.

This suggests that not only does there exist inherent problems in the ability of Chinese citizens and foreigners to access Chinese stables, but it also demonstrates the lack of strong demand for yuan religious stubcoins.

Less control or less demand

China faces a narrow bridge that must intersect while continuing to use Hong Kong as a testbed for all stubcoins and cryptocurrency ventures. It loosens the price and capital controls of the currency, and takes away the air of euan more useful or normality, from businessmen to criminals.

It appears that the People's Bank of China could become a global powerhouse competing with the US dollar in international markets, or to win yet another example of a CCP that maintains strong price control to ensure domestic self-satisfaction.