The Crypto ETF controls the launch of new funds, attracting billions as investors flock to regulate Bitcoin and Ethereum exposure, overturn traditional products and reconstruct the Wall Street growth narrative.

Wall Street relies on crypto ETFs as investors demand regulated exposure

Cryptocurrency Exchange Trade Funds (ETFs) have attracted billions of dollars to investor capital since early last year and have emerged as the dominant player in newly launched markets of funds. Nate Geraci, ETF Prime host and president of Novadius Wealth Management, co-founder of ETF Institute, said on social media platform X on August 10th.

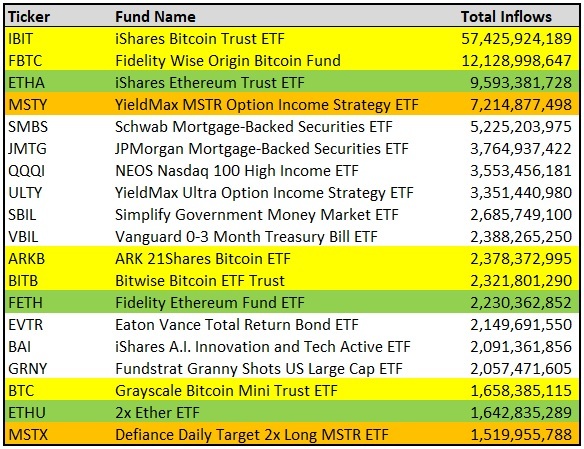

Over 1,300 ETFs have been on sale since the beginning of their last year…10 of the top 20 are crypto-related (along with the top 4).

He added that five of them are spot BTC ETFs, two are spot ETFs, two are MSTR ETFs and one is leveraged ETH ETFs. His analysis showed that all the top four performers were crypto-related, with the iShares Bitcoin Trust ETF (IBIT) at $5.745 billion and the loyal, wise Origin Bitcoin Fund (FBTC) at $12.13 billion and the Ishares Ethereum Trust ETF (ETHA) at $959 billion.

Top ETF performers have been released since last year. Source: Nate Geraci

Traditional bond and equity products such as Schwab Mortgage-backed securities ETFs and JPMorgan Mortgage-backed securities ETFs have appeared in the rankings, but have lagged behind the Crypto surge. The AldeMax MSTR Options Revenue Strategy ETF (MSTY) came in fourth with an inflow of $7.21 billion. MicroStrategy (NASDAQ:MSTR) is a business intelligence software company known for its significant investment in Bitcoin, and is held as a major Treasury reserve asset.

Other high-ranking digital assets offered included $2.38 billion ARK 21-share Bitcoin ETF (ARKB), Bitwise Bitcoin ETF Trust (BITB) at $2.32 billion, and Fidelity Etherium Fund ETF (FETH) at $2.23 billion. The small but notable inflows came to $1.66 billion for the grayscale Bitcoin Minitrust ETF (BTC) and $1.64 billion for the 2X Ether ETF (ETHU).

Market observers say these figures highlight the growing institutional and retail demand for crypto exposure via regulated investment vehicles. Advocates emphasize that ETFs can enable investors to access Bitcoin and Ethereum without direct asset custody and leverage established market infrastructure.