The BNB chain and XRP ledger (XRPL) position themselves as the forefront of the real-world asset (RWA) sector. Both reported a significant increase in RWA values, leading growth in August.

However, this growth comes amid a wider decline in sectors, with RWA still reaching behind other blockchain sectors.

BNB chain and XRPL lead RWA growth is declining in broad sectors

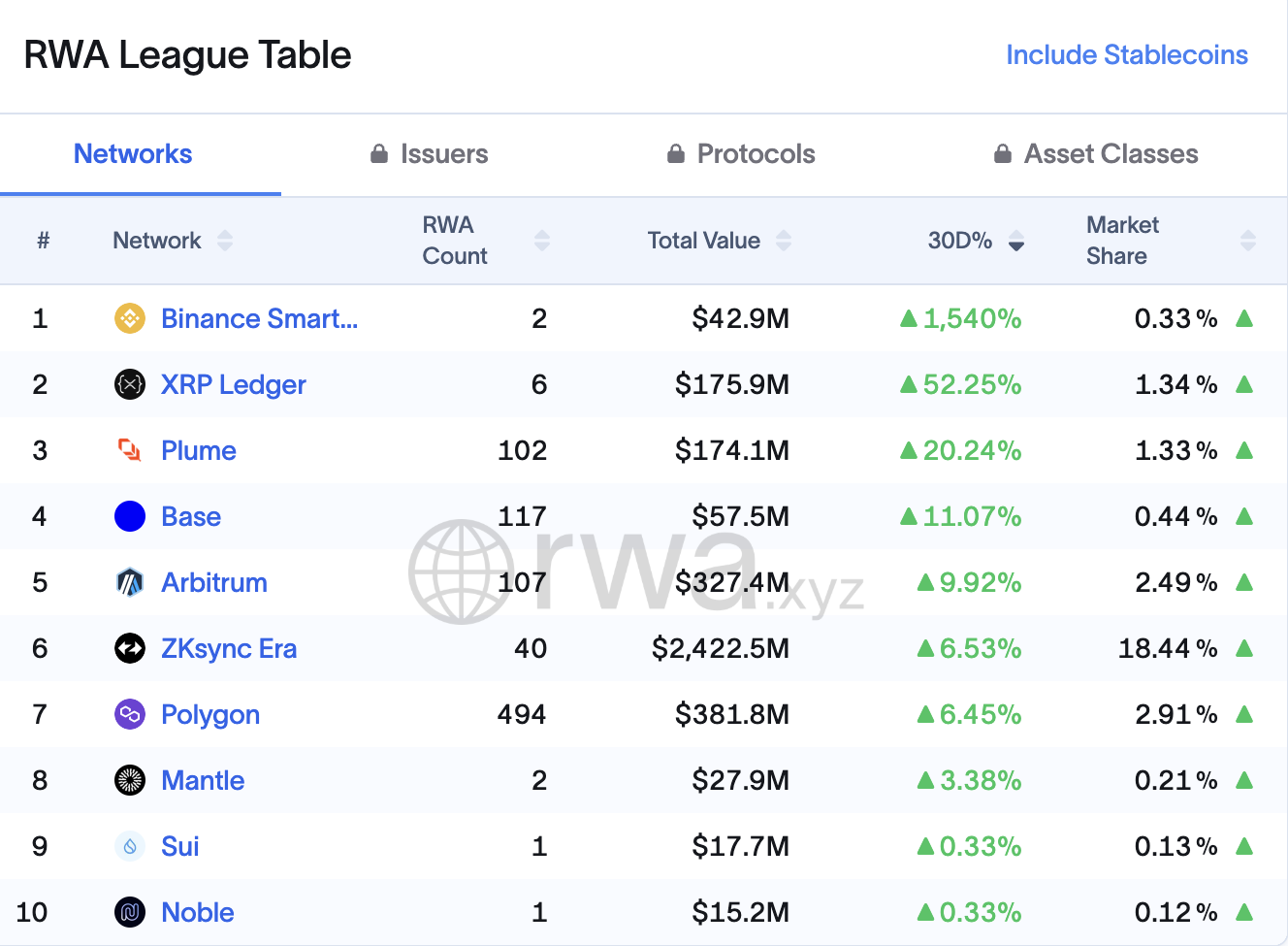

According to data from RWA.xyz, over the past 30 days, RWA values on the BNB chain have skyrocketed by 1,540%, making it the best winner. Following the network was XRPL, which rose 52.2%.

In contrast, top protocols by value including Ethereum, Aptos, Solana, Stellar, and others all lost value in the same time frame.

Major RWA networks from a growth perspective. Source: rwa.xyz

The BNB chain currently holds 0.33% of its market share. Furthermore, the main catalyst for its growth is the Vaneck Treasury Fund (VBill).

Vbill is Vanek's first tokenized fund. It can be used on multiple blockchains, including BNB chains, Avalanches, Ethereum, and Solana. Provides chain access to short-term US Treasury bills.

Similarly, the RWA growth in XRPL was led by the Openeden Tbill Vault.

“@openeden_x provides smart contract vaults managed by regulated entities, providing 24/7 access to US Treasury invoices (T Buildings) through open Tbill safes, analysts explained.

Meanwhile, Easea co-founder Phil Kwok also believes he has grown into Ripple's RLUSD Stablecoin. Beincrypto previously reported that Stablecoin is one of the fastest growing assets in the market.

“A very impressive growth in XRP ledgers. The fastest increase in real-world assets compared to other blockchains,” Kwok posted.

It is noteworthy that XRPL has made significant advances in tokenization recently. Previously, Ripple worked with Ctrl Alt to support the real estate tokenization project in XRPL's Dubai Lands division. Additionally, in June, Circle's USDC Stablecoin was released on the network.

In particular, Ripple itself is very optimistic about the growth of the entire sector. The report predicted that by 2033 the real-world asset sector could reach $18.9 trillion.

But not everyone shares this positive view. Recently, Financial Giant JP Morgan said the overall market for tokenized assets remains “pretty insignificant.”

“This picture of disappointment about tokenization reflects that traditional investors have not seen the need so far. So far, there is little evidence of banks or customers moving from traditional bank deposits to tokenized bank deposits on the blockchain.”

Furthermore, the sector is primarily controlled by companies from cryptocurrency, with a total market capitalization of around $25.7 billion. In fact, its growth was relatively slow.

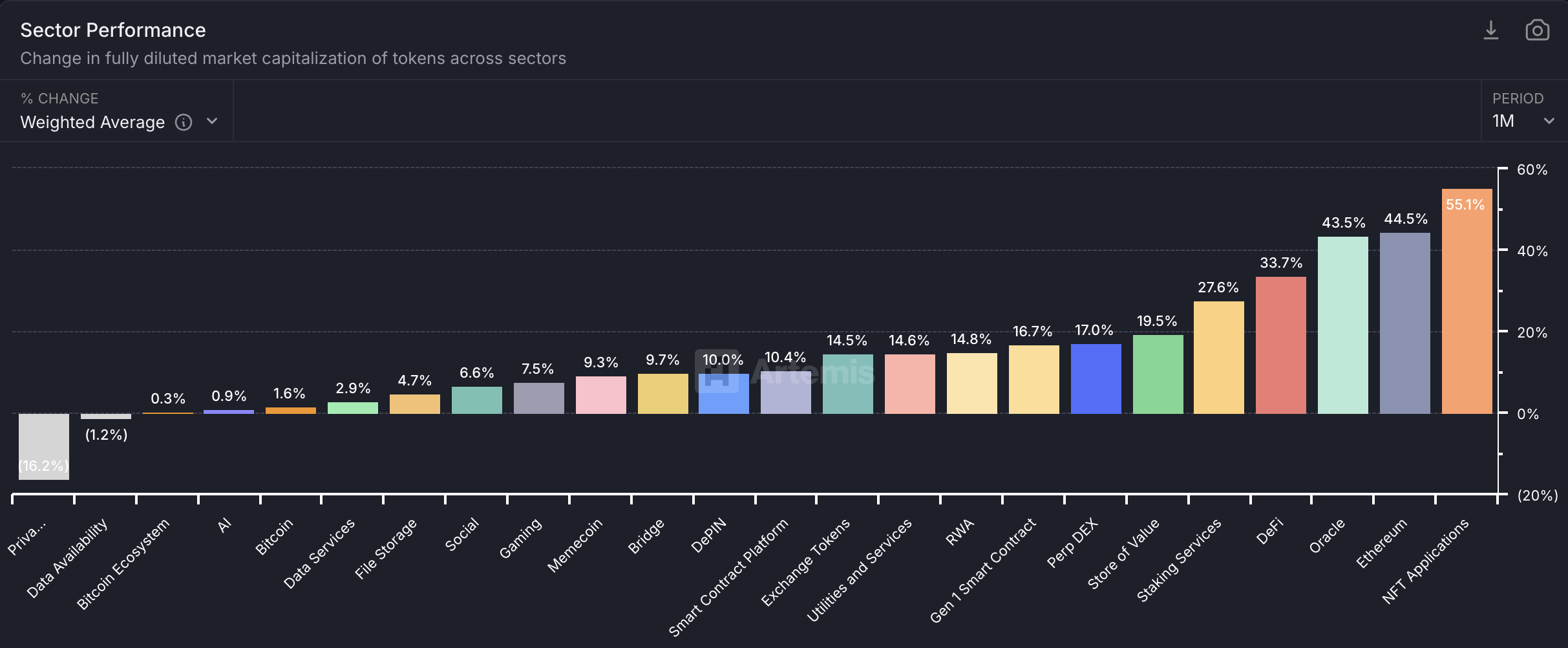

Crypto sector performance. Source: Artemis

Artemis data revealed that RWA has risen by just 14.8% over the past month. This figure is extremely overwhelming, especially when compared to the massive growth seen in Impossible Tokens (NFT), Ethereum, Decentralized Finance (DEFI), and other sectors.