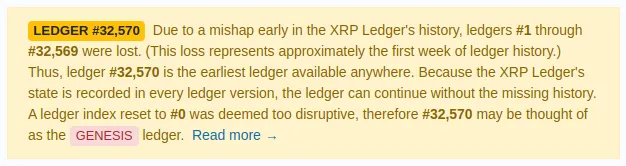

It seems that Bitcoin Art and Bitcoin companies are not mixed together. But for decades, and for centuries, businesses have actually gathered art to express their role in society. As early as the 15th century, Bancamontede Paschidisienna (1472) founded one of the first corporate art collections. What began as decorative decorations quickly evolved into status symbols and signs of wealth, success and cultural responsibility. Can Bitcoin native companies gain strategic benefits through digital art? And what role does Bitcoin Art play as a new asset class and cultural anchor?

Why do businesses collect art?

Paintings, sculptures and facilities are clinging to headquarters around the world to beautifully beautiful the walls, as well as signal the arts as a statement, highlighting the identity and values of the company. The rise of the digital economy, particularly Bitcoin, raises the question of how this tradition can continue into the 21st century.

The Corporate Art Collection is currently a fixed part of the corporate culture. By mid-2010, there were already over 2,000 major corporate collections from North America onwards, worth billions. The motivations are diverse. Surprisingly, immediate financial gains are not the main factor. Tax credits are not motivating companies. Rather, art engagement helps companies advance their strategic goals, reach new client groups, strengthen employee loyalty, and enrich the company's quality of life. In other words, the art of business creates Cultural capital – Value defined by French sociologist Pierre Bourdieu as the sum of cultural knowledge and fame.

Therefore, art collecting companies simultaneously pursue image construction and cultural promotion. Historically, clear patterns emerge. In the thriving 1950s, many American companies began to bring together art to support their communities by making cultural statements on newly built campuses. It was cooled when movement peaked in the 1980s and other forms of corporate philanthropy (education, social causes) came to the forefront. However, businesses that continued to buy art did so under stricter standards and with clear objectives.

Palais Popraia Terrace at night, credits: Photo-files.de

Strategic leverage in the arts: cultural capital and brand identity

The corporate art collection plays several roles at once. Internally, it creates an inspiring environment that promotes creativity and identification. Externally, they act as a reputable tool. Art Signal Education, stability, community spirit, and art collections have long been part of brand identity.

The best examples show that goals are social values rather than exaggeration. Deutsche Bank, for example, explicitly established its collection in 1980 to support new German artists. Today it holds tens of thousands of international artworks and runs its own museum in Berlin (Palace Popraire) to host public exhibitions. Here, art builds a bridge between company and society. JPMorgan Chase has been pursuing similar concepts for decades. Started in 1959 by David Rockefeller, it focuses on emerging and overlooked artists around the world. Such collections are actively constructed and are not merely used as decorations, but at the heart of the corporate DNA.

Strategically managed collections become levers Cultural capital. By choosing art (including Bitcoin art) that matches the company's philosophy, companies can subtly convey their value: innovation, internationality, or respect for tradition. UBS began building corporate collections in the early 1970s as part of its commitment to cultural engagement focusing on both established and emerging artists around the world. For example, the UBS Collection reflects the global reach of banks by acquiring art from all regions in which they operate, including new markets such as Thailand and Korea. Leaded by an independent curator and an international advisory committee, UBS created a collection representing the diversity of the community, shining the spotlight on young, emerging artists.

Economists believe that such investments are similar to other intangible assets. They increase brand value through cultural legitimacy and perception. The company is a new patron. For example, the bank's collections go beyond the original marketing capabilities, and are now on par with the Renaissance families who once supported the arts, serving as “new Medici” patrons. This private sponsorship is more important than ever, especially as public cultural budgets shrink. A well-managed corporate collection therefore serves not only businesses but society as a whole, filling the gaps left by underfunded public museums. They are, although used correctly, cultural assets for the public.

Changes over the past decade: From contemporary art to bitcoin art

Recently, corporate collections have evolved primarily with content. While contemporary works – painting, sculpture, photography – remain dominant, digital art forms are increasingly gaining status. Digital art existed decades ago in the 1960s (from early computer protator drawings to video art) and from JPMorgan's collections of integrated video and media art. However, in the 2010s, blockchain technology revolutionized. NFTS (inappropriate tokens) allowed us to attach proof of ownership to digital artwork and trade them. In particular, technological advances have begun to emphasize innovative images by including digital works in their collections or building their own NFT portfolios.

However, development was not linear. The 2021 NFT boom was fuelled by epic auctions such as Beeple's Everydays and a spectacular US$69 million auction. Many collectors, including companies, purchased digital art in Peak hype. Since its peak in 2021, NFT Art Market has collapsed more than 90% from its annual revenue of USD 2.9 billion in 2021 to approximately USD 24 million in the first quarter of 2025. This dramatic revision is reflected in the attention of established collectors. A study by Ant Art Basel/UBS shows that the share of digital art in the Net-Worth collection fell in parallel. In short, companies that plunged into the NFT bandwagon were putting the brakes on as speculative bubbles burst.

This should be considered mature, not the end. What remains is the heart of serious actors and institutions who believe in the long-term potential of digital art and are now more selectively collecting. For corporate collections, this means that digital art can be integrated with greater caution. This is not a short-term PR stunt, but a substantial addition. Rather than chasing all trendy NFTs, businesses should focus on digital art with clear artistic quality and historical backgrounds. New presentation formats such as company galleries and online platforms are being tested. Therefore, over the past decade, art and technology have converged, and corporate collections have gradually learned to view digital art as part of the concept.

Digital art from a Bitcoin perspective: the current situation and the future of collections

Within Bitcoin, digital art opens a special chapter. For years, the NFT market was primarily carried out on Ethereum and other smart contract platforms, but Bitcoin, which was primarily conceived as a financial system, was culturally expressed by physical objects (Casashius Coins, Bitcoin-themed sculptures, or paintings) and meme cultures (e.g. Pepe). But Bitcoin-centric art projects actually predate NFT hype. In 2012, experimental works began to appear in Bitcoin-Fork Namecoin. The 2013 Colored Coins initiative provided an alternative way to encode and transfer digital assets in the chain. The launch of Counterparty Protocol (2014) accelerated the emergence of artwork created by the first counterparty. Most famous is the rare Pepe Trading Card (2016), which is now considered a pioneer in crypto art. In-person native experiments at Bitcoin Layer 1 also emerged around 2015, but after the 2023 ordinance boom, Bitcoin attracted widespread public attention as a medium of digital art. For corporate collections, this indicates that Bitcoin-based digital art has deep historical roots, and is clearly on the rise, and few can be ignored by anyone who wants to stay up to date.

Nardo, Bitcoin Magazine

From a Bitcoin alone, digital art is viewed as a cultural representation of the ecosystem, not just an asset. Bitcoin, often referred to as socioeconomic movements, carries its own aesthetics and ideology (such as decentralization, censorship resistance, HODL mentality). These values are reflected in the artwork, from visualising blockchain data to portraits of Nakamoto at to works that permeated memes. Such Bitcoin native works could become iconic cultural commodities comparable to 19th-century industrial paintings and early propaganda art with drastic economic changes. For the current collection, this means adopting Bitcoin Art. It now has a history of not only digital art, but also finance and technology. The 2020s writes the artistic stories of cryptocurrency companies. By collecting emerging historic Bitcoin art, they can become part of that story and help shape it.

Why Bitcoin Native Companies Need to Collect Art and Bitcoin Art

Given these developments, why do Bitcoin companies need to collect art now? The answer confuses reputation, identity, and responsibility. The collection certainly can hone the image of Bitcoin companies, show openness to culture, and reduce the perception that they are merely technical or financial nerds. More importantly, its positive contribution to cultural formation within the Bitcoin ecosystem. Bitcoin is more than a protocol. It is a social movement with its own conferences, memes and global community. Culture is the adhesive that holds such movement together. If a company like Nakamoto, Strategy, or Metaplanet builds a collection, it creates an identity anchor for the Bitcoin community. The curated Bitcoin Art collection allows you to visualize the value and story of movement – act like a visual manifesto.

At the same time, companies become the main characters of this culture. Just as big banks became “new medici” through collections, Bitcoin companies were able to establish themselves as digital patrons that nurture and shape the emerging art scene. This goes beyond sponsorship. That means taking on long-term responsibility for cultural heritage. With top talent and customer competition, it can be decisive. So, who doesn't want to work or invest in a company that helps shape culture and history rather than simply chasing profits? A well-reached art initiative can cause loyalty and excitement that prevents budgets from being purchased within a company.

It also has economic network effects. The vibrant cultural environment around Bitcoin increases the overall appeal of the ecosystem. The more art, music, literature and discourse exist about Bitcoin, the more it becomes fixed in society. It can indirectly increase demand (people encounter Bitcoin through art). Companies that collect and support art are now investing in the future viability of Bitcoin, bringing long-term commercial benefits. As the strategy is the largest Bitcoin finance company, it has an inherent interest in strengthening Bitcoin, both culturally and financially, to protect the lifespan of its holdings. Art can become a soft-powered instrument, creating the legitimacy of the wider public's Bitcoin story.

Measures: Construction of museums, scholarships, prizes and archives

What specific art initiatives can Bitcoin companies pursue? There are many historical precedents.

Some banks and businesses have established their own museums and art halls (Samsung's Lium Museum in Seoul, and Paleis Poprare, Deutsche Bank). Bitcoin companies can similarly establish the Bitcoin Museum to display outstanding works such as digital projection, interactive pieces, classic paintings, and Bitcoin-themed sculptures. The first initiative is already pointing in this direction. The Bitcoin Museum in Nashville, for example, is a remarkable early attempt to tell the story of Bitcoin through a combination of artifacts, memorabilia and artwork. Such museums serve as a cultural encounter point for the community and the public.

This is what my ideas for businesses are based on. It is about assembling collections beyond modern Bitcoin artists and tracking the intellectual history of Bitcoin in art since the 1910s. Professionally managed collections are rooted in historical contexts, adapted to thematic exhibitions, available for loans, and enhance both academic awareness and the cultural presence of Bitcoin-related art.

Scholarships and prizes are powerful levers. Companies may offer the annual “Bitcoin Art Scholarship” to support talented young artists engaged in Bitcoin, or Bitcoin-based digital art (the most innovative ordinal project of the year award). Such awards instantly resonate with art and cryptography scenes, giving recipients greater visibility. Think of the Arab Bank's Swiss Digital Art Award.

Like major collections of past, which intentionally purchased works from unknown artists of the time, Bitcoin companies should look for tomorrow's hidden champions, rather than chasing volumes without cultural values. Supporting today's Bitcoin Art avant-garde could prove to be culturally and financially rewarding later. Analysts said blockchain-based digital art could become the next trillion dollar asset class, appealing to global collectors and new investor groups.

A frequently overlooked but important component is building archives and document structures. Art is just as valuable as its history is traceable – especially in the digital realm. Therefore, companies can invest in archival infrastructure, such as a database of all known Bitcoin-related artworks, including details such as artists, descriptions, and on-chain transaction history.

Professional Support: Art Historian, Curator, Museum Practice

As these plans exist, ambitious and valuable companies need expertise. Collecting art, especially digital art, is not casually processed by a small number of economists and IT specialists. Bitcoin companies that want to invest in culture should involve artworld experts from the start. This has tradition. For example, the UBS Collection has been managed by curatorial experts for decades and has been advised by the International Board of Directors. These experts know how to build collections with consistent narratives, assess quality, and ensure proper preservation and presentation.

Digital art poses additional challenges, from digital inventory questions to display modes. Here, the museum experience will be rewarded. The company may work with a media art specialist who has already curated digital exhibitions. Art historians can bridge the history of art with “new Bitcoin art” and put collections in context. Since the 1960s, such perspectives, such as avant-garde art, protest art, and digital art, have helped us to deepen our understanding and identify artists who may remain relevant. Continuous documentation and research further enhance cultural value.

Ethical and legal advice is another aspect. Transparency and responsible conduct are essential in this area where wealth is being scrutinized. Art historians and curators ensure that collections are not simply staged as PR, but have a reliable respect for the art community. Classic corporate collections usually promise to buy art directly from artists and galleries at the primary market, thereby supporting artists who live instead of chasing auction trophies. This attitude is recommended for Bitcoin companies, away from a quick reversal to sustainable sponsorship. Hiring and consulting curators to design and care for collections reflects best practices from companies that systematically maintain collections.

Finally, art and culture as an investment require long-term thinking. Classical art investments historically have a moderate return of around 6% per year, and experts advise you to buy art not only from returns but primarily from passion. The same could be done with Bitcoin Art. Its intangible benefits (social influence and cultural heritage) are of paramount importance, but may continue to be financially evaluated. Professional advice can help you balance artistic and financial value. Once both are adjusted, the art collection becomes a strategic asset that does not appear as a number of balance sheets, but has a significant impact both inside and outside the company.

Conclusion: The bright future of art

In an age where the distinction between the digital and physics worlds is becoming increasingly blurred, corporate art collections are on the verge of entering a new era. Bitcoin represents not only economics but also changes in cultural paradigms. The corporate art collection in the Bitcoin era is more than a continuation of the old tradition with new tools. They are opportunities to shape the emerging cultural universe. Historically, companies have collected art, introduced their faces to society, inspired employees, and made their values concrete.

Today, Bitcoin companies can adopt these motivations and instill new lives. By collecting digital artwork on-chain, you create cultural capital in a language that suits your business DNA. They can strategically utilize this capital to generate network effects. Supported artists and each donated artwork strengthen the Bitcoin story as a cultural movement, not just technology and investment.

The next step for me is clear. Art Scholarships for Emerging Bitcoin Artists. Dedicated online and offline display space. Partnerships with museums and art academies. Perhaps even a corporate museum. Companies need to approach tasks with humility and seek specialized expertise. Curators should be consulted for art strategies, so that CFOs are consulted for investment strategies. A company that focuses on Bitcoin like this could become a real cultural actor and could gain future recognition similar to today's collections of UBS, Deutsche Bank, or JPMorgan.

The young Bitcoin art scene now presents historical opportunities. The culture is still adaptable, with the “canvas” being hardly painted. The companies currently acting can write cultural history. They contribute not only to digital masterpieces, but also to decentralized future identities. Bitcoin is poised to open a new chapter. Art provides the language to convey it. The corporate collection helps to shape Canon. This is strategic leverage in the most noblest sense. It combines capital with culture to create lasting value for the company, community and future.

Nakamoto's art collection will now look like a Rothschild kindergarten classroom.

– David Bailey

$1.0mm/BTC is the floor (@davidfbailey) for July 11th, 2025

The way companies add Bitcoin Art to their corporate collections first appeared in Bitcoin Magazine and is written by Steven Reiss.