Ethereum has recently reflected a surge in Bitcoin volatility, facing a rapid rejection that is close to the highest level of history.

This reversal injects uncertainty into the short-term outlook, and ETH is now retesting key support to determine whether the broader bullish trend remains.

Ethereum Price Analysis: Technology

By Shayan

Daily Charts

On the daily charts, Ethereum was rejected near the highest ever $4.8K due to high sales pressure, likely added to the supply. The decline recedes towards the confluence of support, such as the midline of the ascending channel and the $4.2K demand zone.

As long as ETH is held above this area, a wider bull market structure is effective. However, breakdowns below this zone could expose $3.8k, which is consistent with the previous integrated base and marks a deeper retracement. Meanwhile, the RSI indicators are rolling from the conditions purchased, forming a bearish divergence that enhances the corrected tone.

4-hour chart

In the lower time frame, Ethereum showed a classic liquidity hunt as it approached the liquidity pool around the $4.8K mark, triggering a stop order and a slow breakout entry before a sudden reversal. This rejection also falls below the recent higher and lower levels, suggesting an early stage of a change in market structure.

Currently, ETH is integrated within the correction phase and is testing multiple support confluences. These include the midline of the multi-month channel near $3.8K for the $4.2K region, the uptrend line (blue), and for the deeper pullback. Until a critical breakout occurs, ETH will remain volatile and may vibrate around these critical support as the market establishes the next direction.

Emotional analysis

By Shayan

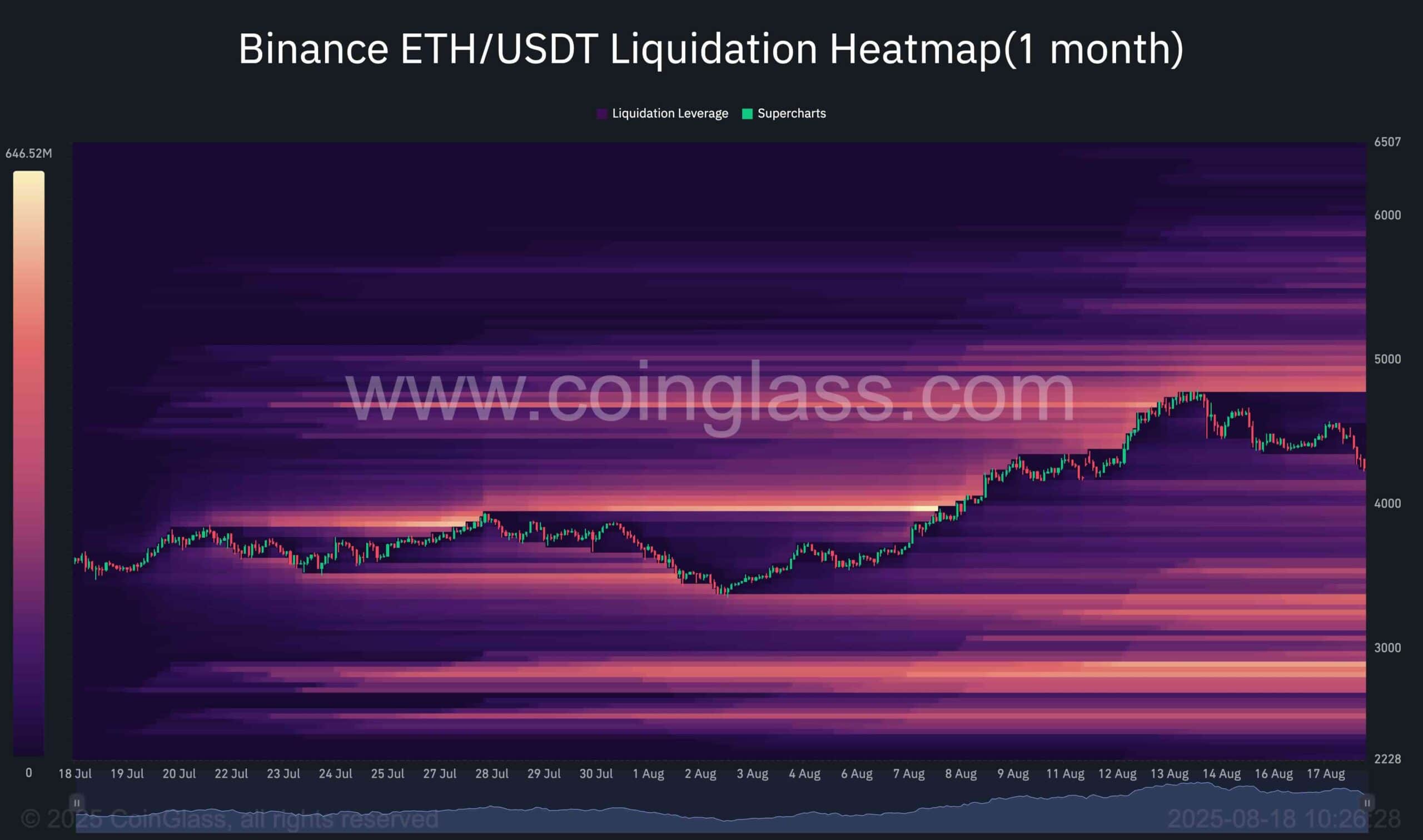

Ethereum has recently shown an increase in volatility, with price action being heavily influenced by liquidity-driven movements. The liquidation heat map highlights the concentration of leveraged locations and offers important levels of potentially attracting prices in the short term.

Over the past week, ETH has surged towards the $4.8K region, sweeping out the liquidity pool there, before encountering strong sales pressures that have caused sharp rejection. This retracement brought the price back to the $4K zone. This serves as an important and psychological support.

In particular, large clusters of liquidation levels are now below the 3.8K threshold. This suggests that if a deeper correction occurs, ETH can target this area, causing a long liquidation and gain liquidity before it surpasses another bullish leg. These levels often act as a price magnet, increasing the chances of securing liquidity in the area.

That said, traders should be aware of false breakouts, as liquidity hunting on both sides of the market is likely to last until a critical trend structure takes hold.