ChainLink (Link), a decentralized Oracle network by market capitalization, has surged price and market interest, sparking speculations of wider gatherings across the Oracle sector. This could potentially make Pyth Network (Pyth) a potential candidate for the next breakout.

However, the key question is whether link momentum reflects growth drivers across the sector, or whether the gatherings are driven by factors inherent in chain links. This distinction can determine the outlook for the entire Oracle ecosystem.

ChainLink appears as the top Gaines of Crypto Market

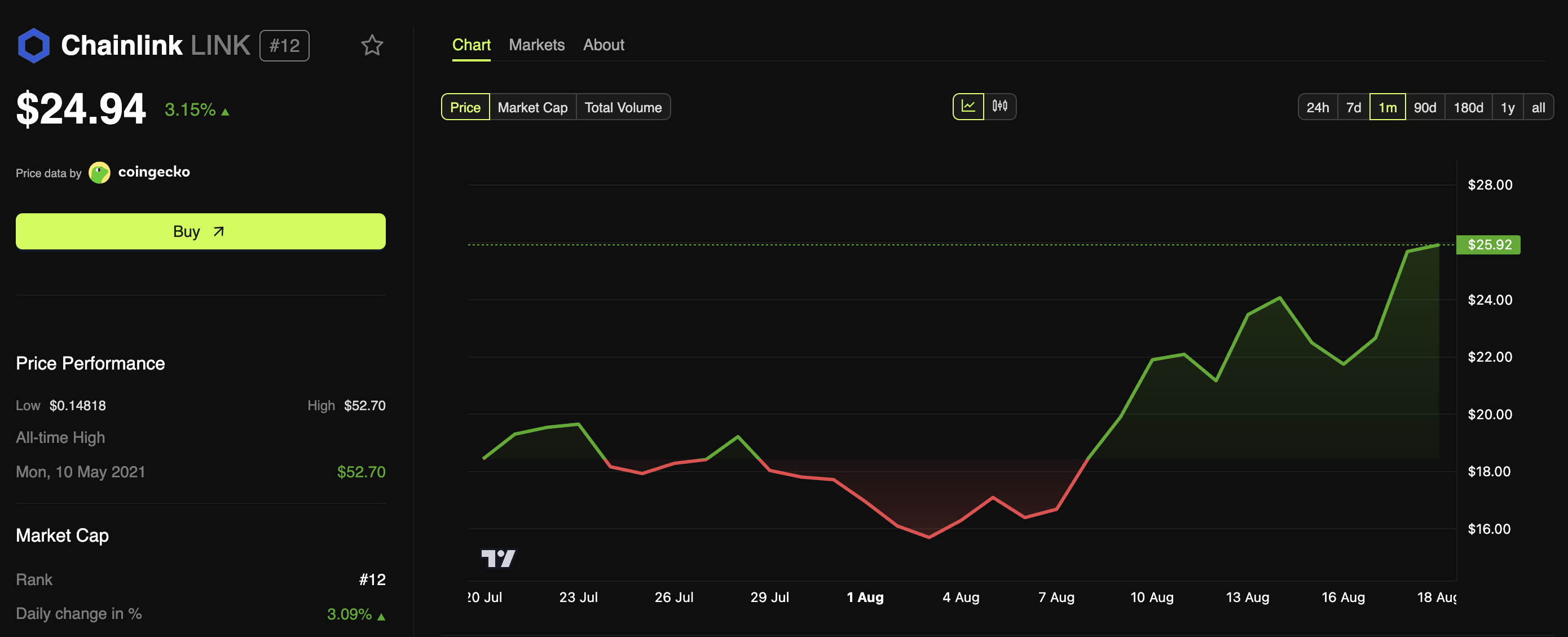

ChainLink's native token Link rose to $26.5 in early trading hours today, according to Beincrypto Markets data. This level was last seen in January 2025.

Despite a modest fix, the price has maintained a 3.15% rise in the last 24 hours, bringing a link to the $24.94 deal at press. What's noteworthy is that Altcoin continues to rise as the wider market moved in the opposite direction.

ChainLink price performance. Source: Beincrypto Markets

This rise has made Link one of the best daily winners and one of Coingecko's trending coins. It's not just about the price.

As Lunarcrush tracked, social media sentiment shows a surge in link mentions and engagement, reflecting a growing interest in investors.

$links are highly undervalued at these price levels.

Top 10 AltCoin @ChainLink is an infrastructural play that continues to be overlooked. I'm not letting this go down.

Look at all these partnerships!

Shoutout @naorisprotocol is also mentioned here! pic.twitter.com/plfotp6mve

– Zach Humphries (@z_humphries) August 17, 2025

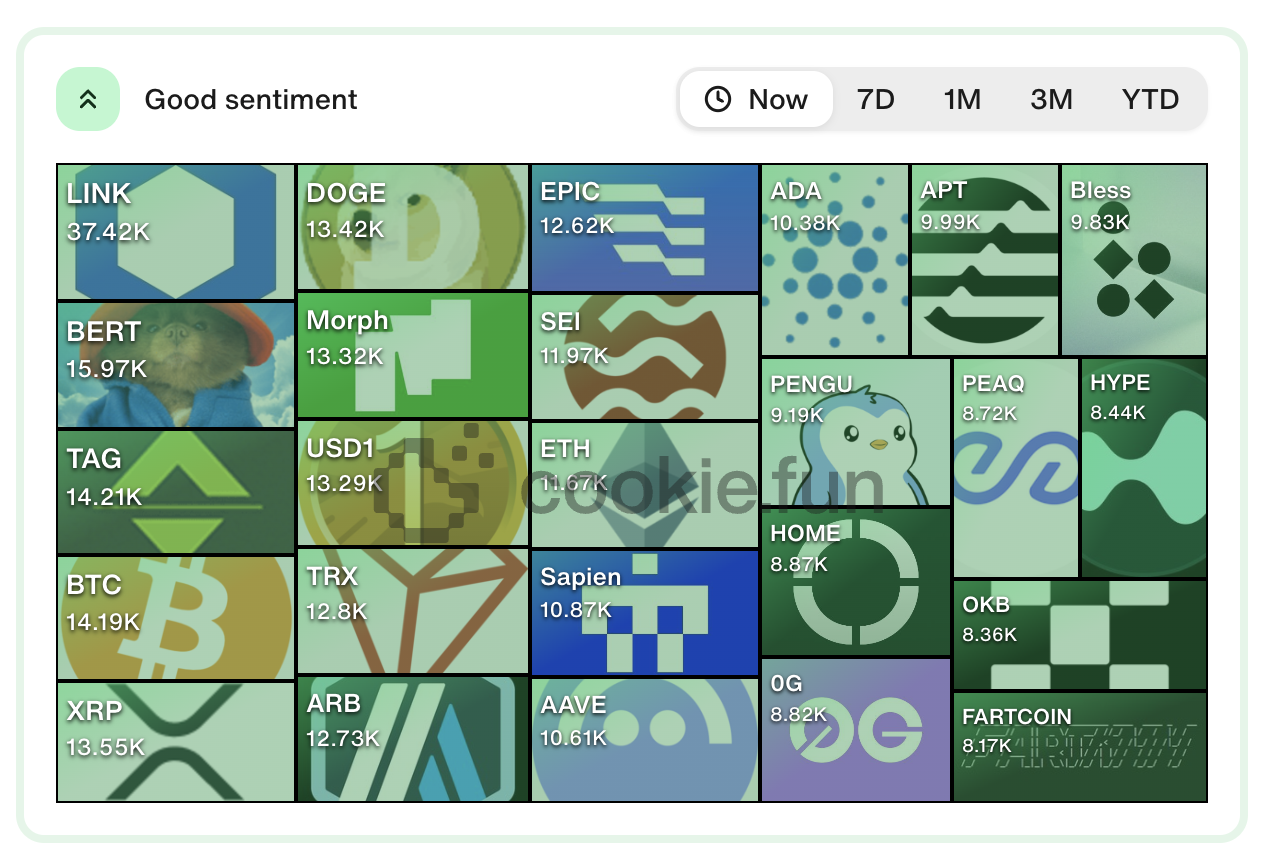

Beincrypto also said Link's retail curiosity is climbing. Google Trends data revealed that search interest for “ChainLink” has reached record highs. Additionally, Cookie.Fun highlighted that ChainLink has the highest mind share in today's crypto market.

ChainLink Crypto MindShare. Source: Cookie.Fun

Does Pyth follow the Link path?

Meanwhile, according to Artemis Analytics data, Oracle Sector has outperformed the other Crypto categories over the past month, rating 35.18%. This paints a bullish picture of the entire sector, but it is worth noting that Chainlink leads most of this growth.

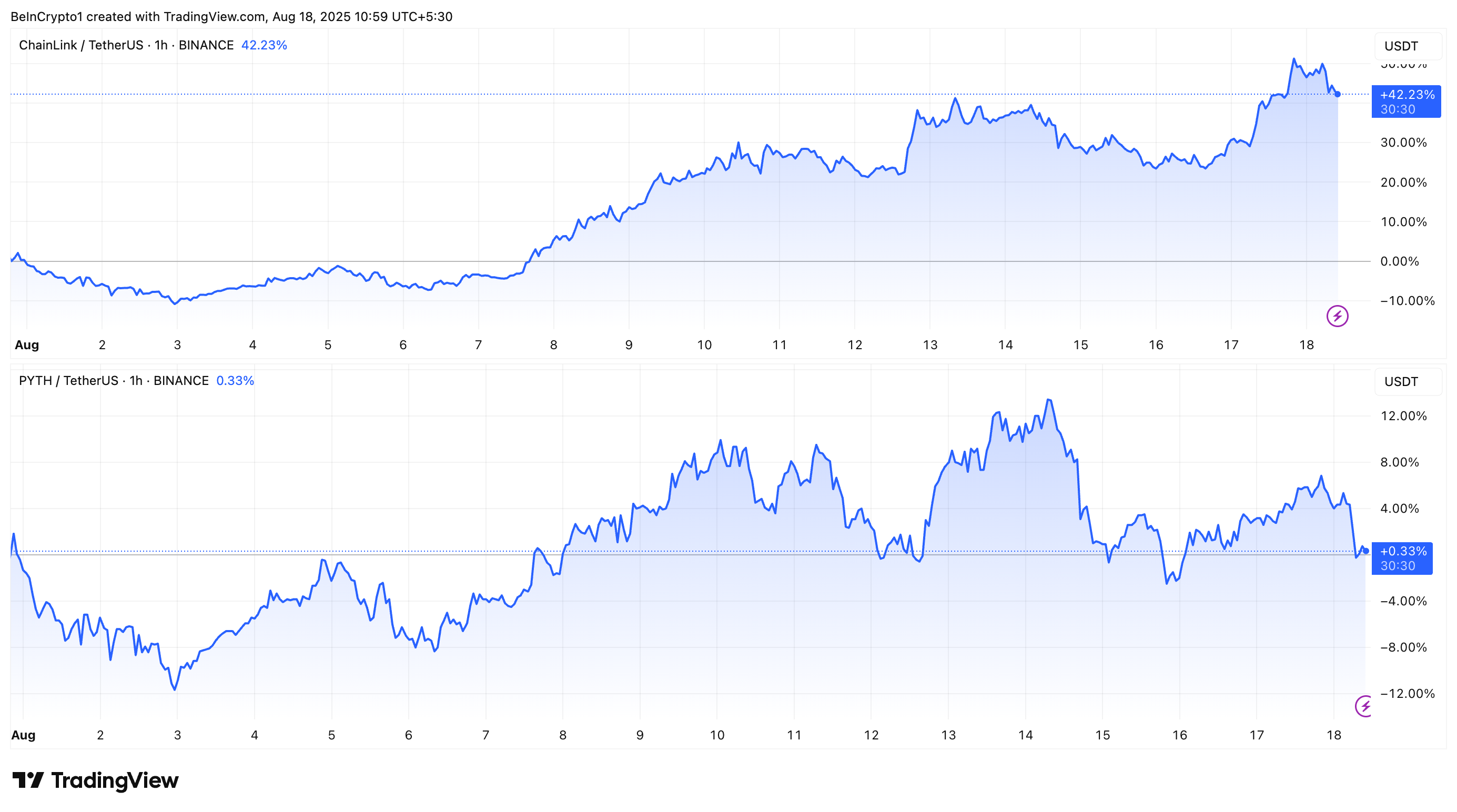

The profit disparity between top projects further demonstrates this imbalance. In August, Link spiked over 42%, while Pyth managed a modest increase of just 0.33%.

Link vs. Pis price performance. Source: TradingView

Nevertheless, on-chain data tells a different story. Pyth and Link's daily transaction counts have been dropping significantly since June. This suggests that the corresponding on-chain activity or sudden rise in demand will not drive price action.

So, what is the growth of driving links? That momentum appears to be driven by supply-side factors and large holder actions. The launch of Chain Link Reserve, an initiative designed to accumulate link tokens, was a key driver. This move reduces sales pressure and supports price growth.

“ChainLink Reserve is designed to support the long-term growth and sustainability of chainlink networks by accumulating link tokens from on-chine services using off-chain revenue from large companies that adopt chainlink standards,” ChainLink said.

Furthermore, whale accumulation and institutional partnerships have played a pivotal role. So, these are all unique catalysts that do not exist in the Pyth's or other Oracle Solutions ecosystem.

Piss may benefit from the still-in-progress bull run. However, it is not certain whether the benefits can reflect the benefits of the link. For now, ChainLink is still the dominant force of the sector, and the Pyth moment hasn't yet been realized.

Will posts (links) after ChainLink be Pyth Network (Pyth) turn? On-Chain Data provides clues that first appeared in Beincrypto.