The longtime Bitcoin holder sold his entire position this week and revolved into nearly $300 million in ether.

After holding the assets for seven years, Hodler sold 550 Bitcoin (BTC), worth around $62 million.

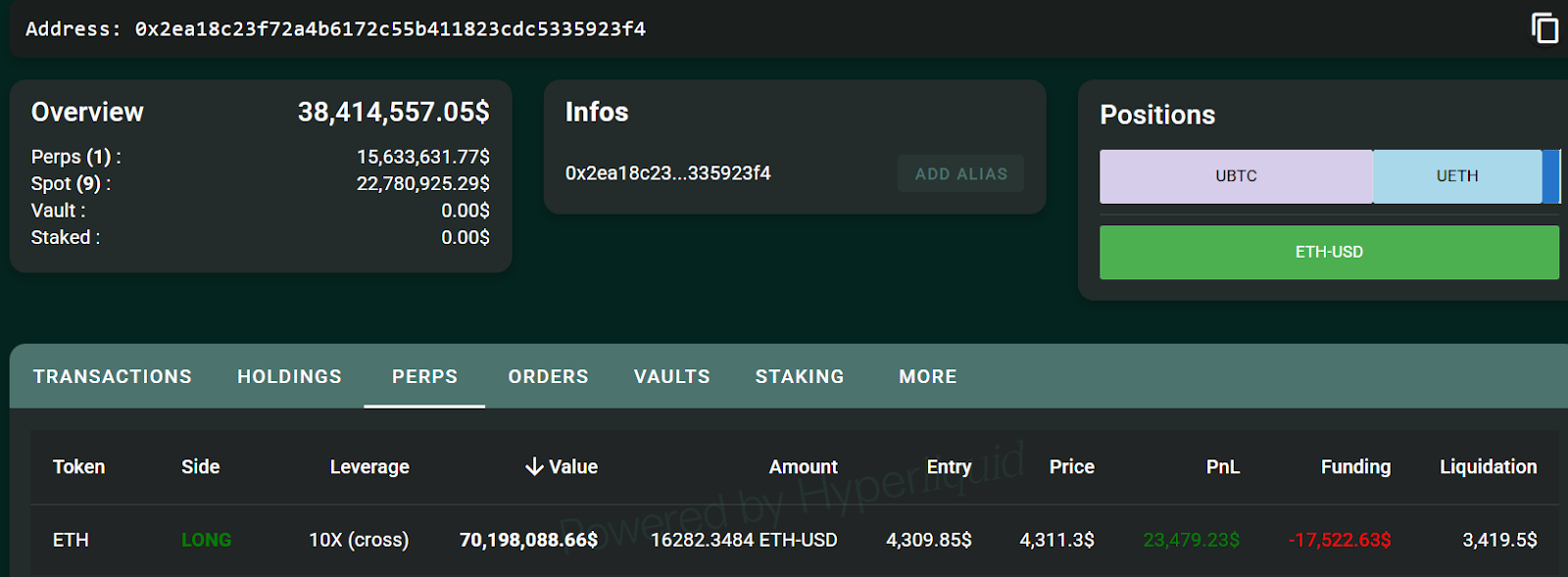

According to Pseudo Onchain Analyst MLM, after selling all Bitcoin via decentralized exchange high lipids, it opened a $282 million long position in ether (ETH) through three separate accounts.

“He's just caught some crazy bullish insider news or gambling. He looked sloppy and was in a hurry,” Onchain Sleuth said on Wednesday's X-Post.

Wallet “0x2ea” Source: Hypurrscan

In many cases, large movements are tracked by traders and measure short-term market trends.

Hodler's rotation comes shortly after Bitcoin immersed near a two-week low of $112,000 on Wednesday, signaling “neurological rise in the market” ahead of US Federal Reserve Chairman Jerome Powell's upcoming remarks and Jackson Hole Symposium Friday.

Related: David Bailey's KindlyMD kicks off Bitcoin Treasury with a massive $679 million purchase

High-quality Bitcoin price is below 200bps after $60 million BTC sales

Bitcoin Hodler's $60 million sale was modest compared to other large transactions, but it was enough to cause a high lipid price dislocation.

With the $60 million sale, Bitcoin's price has dropped to 200 basis points (BPS) in high lipid exchanges, with Bitcoin adding MLM to XPost on Wednesday, saying “currently trading at a 30 bps discount compared to other exchanges.”

A 200 bps price drop is equivalent to a 2% price difference or about $2,267 per Bitcoin. This shows a significant difference compared to other exchanges, assuming the spot price today is $113,370.

The move could suggest that Hyperliquid's orders do not have depth to absorb oversized deals without having a major impact on the big price.

Cointelegraph approaches high lipids to comment on the fluidity conditions of exchange.

Related: Ether Traders have almost wiped out their epic run from $125,000 to $43 million

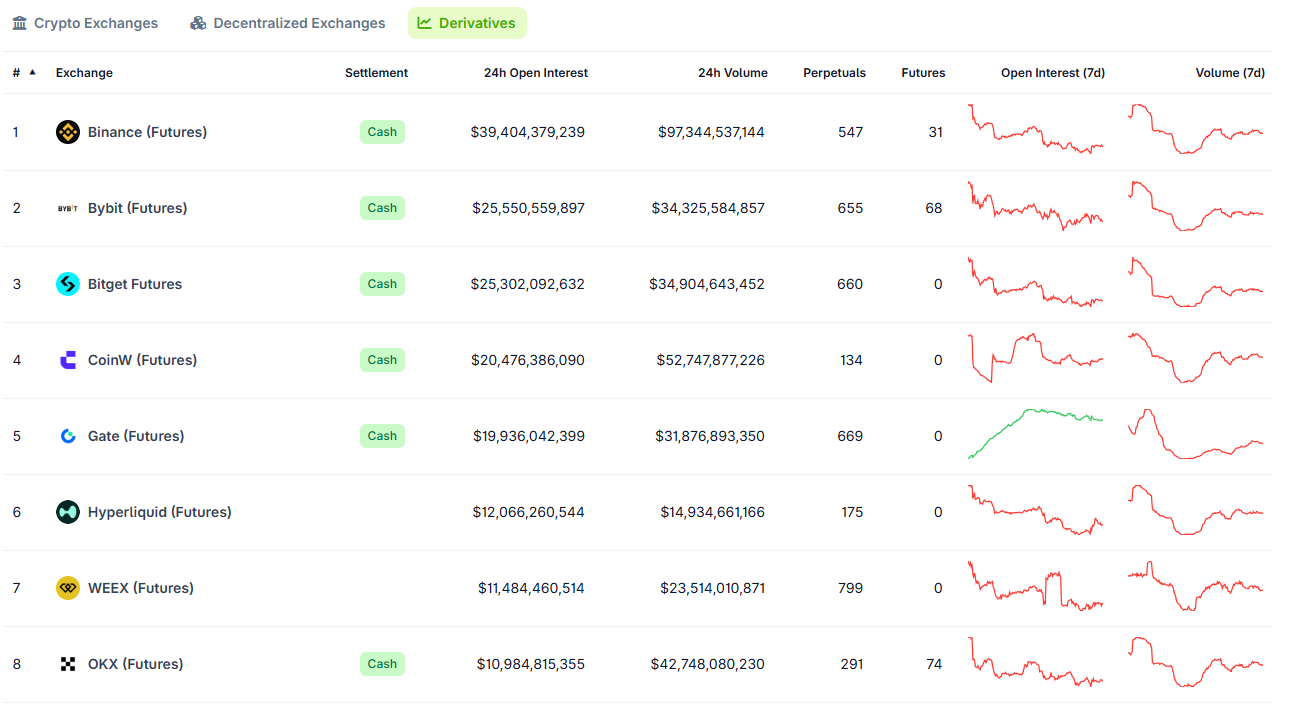

CointeLegraph reported on August 7 that high lipids reached a new $319 billion monthly trading volume in July, pushing forward a new cumulative highest-level high finance platform of $48.7 billion.

In a monthly Crypto Recap report, researchers at Vaneck captured 35% of all blockchain revenues in July, earning great value at the expense of Solana, Ethereum and BNB chains.

Top derivative exchanges with open interest. Source: Coingecko

Hyperliquid has grown into the world's sixth largest derivative exchange, with over $1.2 billion open interest and over $1.2 billion open interest.

High lipids became popular in April 2024 after launching spot trading with an aggressive listing strategy and a simple user interface.

https://www.youtube.com/watch?v=4n4pznl8syw

magazine: Altcoin season 2025 is pretty much here…but the rules have changed