Economist Henrik Zeberg believes Bitcoin (BTC) is ready for a massive gathering before the cycle ends.

In a new strategy session on the YouTube channel of Analytics platform SwissBlock, Bitcoin says it will reach “a new extreme all-time high” as other risk assets, including stocks, rise to “potential blow-off tops.”

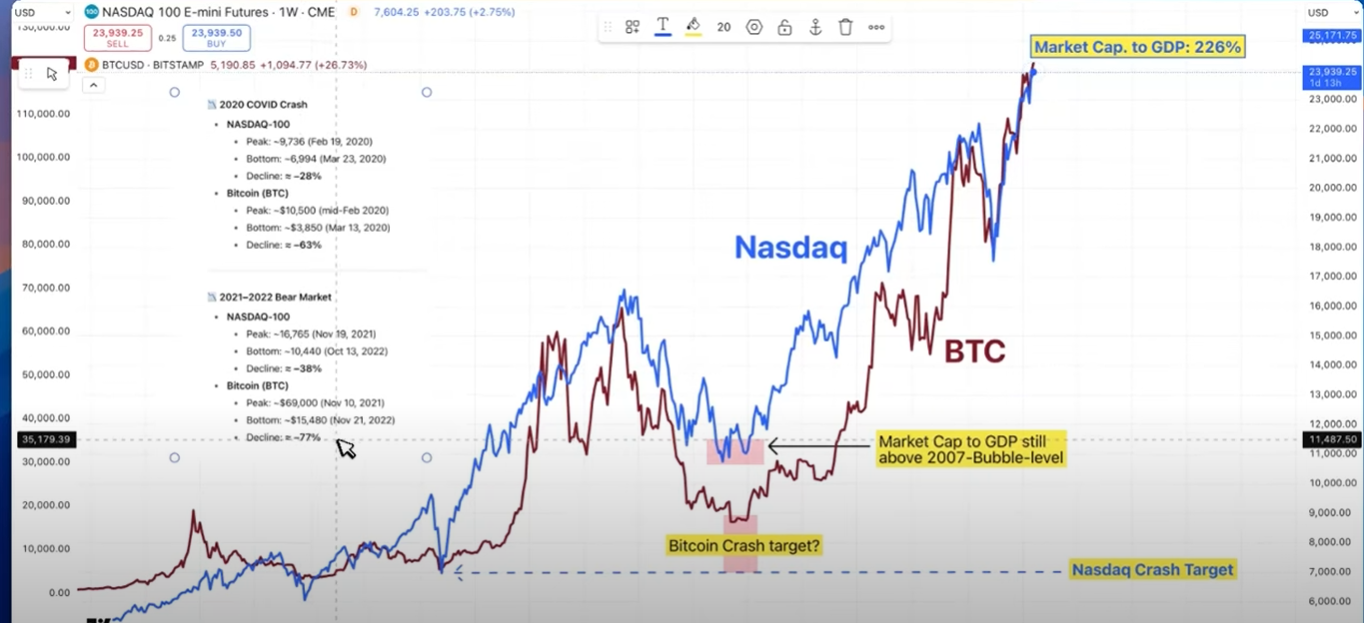

According to Zeberg, Bitcoin decreases dramatically after a blow-off top. The economist shares the Bitcoin reverse chart and projects his flaws targets of the Crypto King.

“We're in the biggest bubble ever, and there's no doubt about that… What do you think Bitcoin will do when we see a 75% to 80% drop on the Nasdaq? Well, first of all, you don't think Bitcoin will work or work out in that crash.

A 75-85% reduction in Nasdaq could easily collide with a 90% or 95% reduction in (Bitcoin). This is something I think could happen with Bitcoin. A potential decline of about 95%, maybe bad after a bubble top or bubble top. ”

Source: Henrik Zeberg/YouTube

Economists say such a dramatic drop in Bitcoin prices is in line with the historical precedent and the crypto king's stock market.

“And when we look at Nasdaq and Bitcoin for close correlations, we see that Bitcoin is not only superior to Nasdaq, but also has a drawback.

In 2020, we saw Nasdaq drop by 28% and Bitcoin drop by 63% with Covid Crash.

NASDAQ fell 38% between 2021 and 2022, while Bitcoin fell 77%. ”

Source: Henrik Zeberg/YouTube

At the time of writing, Bitcoin is worth $112,799.