Ether Lee Rium went to volatile stages in 2021 last week, and was excited throughout the market. After rapidly, ETH retired to defend support by the buyer returning and testing important demand levels. Bulls is elastic, and analysts pointed out the possibility of Ether Lee in the short term over $ 5,000.

Nevertheless, the deeper risk of orthodontics weighs great weight, causing uncertainty between traders and investors. Fear began to appreciate because I was wondering if Ether Lee's rally was sustainable or another fullback was on the horizon.

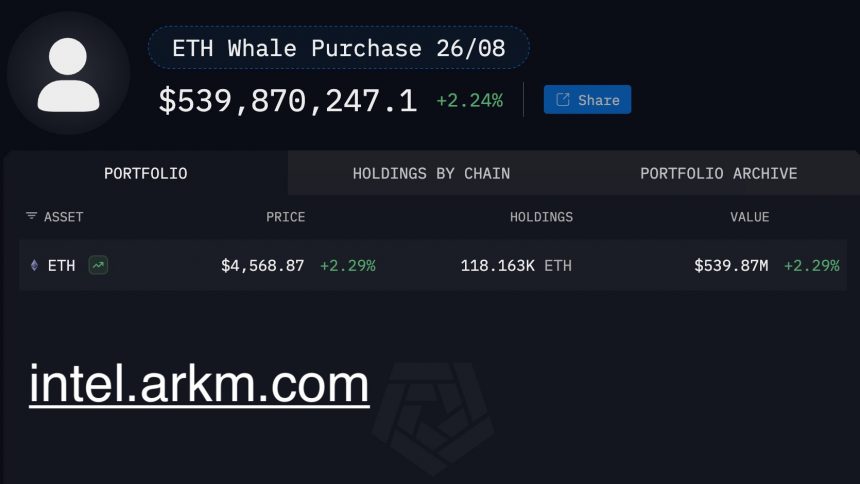

But in this environment, one irreversible trend is noticeable. Whales are accumulated. Arkham Intelligence has found that nine whale addresses are about $ 450 million in Etherrium yesterday to announce the trust of the largest market participants. The wave of this accumulation emphasizes how the bone investors use the recovery and potentially prepare the next leg upwards.

Ether Leeum Whale is a signal confidence

According to Arkham Intelligence, Ether Leeum Whale is creating a decisive movement to form the next step of the market. According to the data, nine large addresses have jointly purchased $ 488 million a day. Five of these were directly introduced from Bitgo, a major institution manager, and the other four acquired their position through the OTC (Over-The Cround) desk of Galaxy Digital. This transaction reflects the increase in the role of the institutional rating platform in promoting not only individual whale confidence but also large -scale Etherrium accumulation.

The surge in whale activities emphasizes important market epidemiology. Deep pocket investors are on their own about the following legs at the price cycle of Ether Leeum. Historically, during the volatility period, the accumulation of whales has given a strong foundation for a strong story, over a significant upward momentum. ETH has already tested the demand area after 2021, which can help to stabilize price behaviors and build momentum for unknown territory.

Beyond whales, public companies are also in painting. Companies such as Bitmine and Sharplink Gaming recently released Ethereum positions to further verify the role of ETH as an institutional grade asset. Their participation reflects what Bitcoin has experienced in the early stages of adoption.

Taken together, the combination of whale accumulation, institutional OTC purchases, and adoption of public companies draw a clear picture. Ether Leeum's confidence in the long -term trajectory is being strengthened. Short -term risks remain, but this trend strengthens the strong case where ETH can move to price and potentially surpass $ 5,000. The market is closely watching, but whales and institutions seem to lead the claim.

Ether Lee has the ground with Bulls Eye $ 5,000

Ether Lee is trading about $ 4,592 after rebounding from a rapid retreat at $ 4,850. The 4 -hour chart shows ETH recovery strength above 50 and 100 days moving average. This movement restores trust in short -term uptrend, even if volatility does not have a trader in the superiority.

A wider picture is still supportive. Ethereum has a 200 -day move to $ 4,119, and Ethereum has a comfortable cushion that emphasizes elasticity despite the recent swing. Maintaining a faster average not only stabilizes the amount of exercise, but also sets the steps for another attempt to resist. The future important barriers are $ 4,800, where the seller has previously blocked the rally. The decisive rest can help analysts to be a milestone, $ 5,000, which believes that the analysts will cause fresh passion and potentially start a new price discovery bridge.

Nevertheless, there is a risk of another fullback. The fall of less than $ 4,400 can return ETH to $ 4,200, where pre -purchase pressure occurred. But now feelings are carefully optimistic. Whales continue to accumulate, technology remains constructively, and Ether Lee is ready to test higher levels when momentum is delivered.

DALL-E's main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standards, and each page is diligent by the chief technical expert and the seasoned editor's team. This process ensures the integrity, relevance and value of the reader's content.