Bitcoin could surpass all major assets over the next decade, according to a new Bitwise report, which projects an annual growth rate of 28%. The company cites growing demand, rare supply and growing concerns for the Fiat currency collapse as a major driver for the rally.

summary

- Bitwise Project Bitcoin could increase by 28.3% per year over the next decade, potentially reaching $1.3 million per BTC by 2035.

- Growth drivers include $1-5 trillion in potential institutional demand, 94.8% of the 21 million BTC already in circulation, and US debt, which has increased by $13 trillion over five years.

- Combined with a low correlation of 0.21 with stocks, these factors make Bitcoin a strong long-term storage storage.

According to a new report from Bitwise Asset Management, Bitcoin (BTC) could be on another major leap. This states that over the next decade, BTC outperforms all major assets worldwide, with an estimated compound annual growth rate of 28.3%.

In a 24-page report, Bitwise states that the paper is driven by “three key factors,” outlining what Bitwise considers as a key component of long-term Bitcoin rallies. It is growing concern about institutional demand, limited supply and the decline of Fiat Money.

The first factor, institutional demand, comes from the unique nature of Bitcoin adoption. Unlike other emerging assets such as private equity and credit, which first attracted institutional investors, the rise of Bitcoin was led by retail investors, the report reads. Almost 95% of all Bitcoin that exists are already owned “mainly by retail investors” and are owned with little exposure to institutions, the company says.

As institutions begin to be allocated to the largest cryptocurrency by market capitalization, the market could see the tide of demand.

“The World Bank believes that institutional investors are managing around $100 trillion in total assets. Over the next decade, these investors believe that they will allocate 1% to 5% of their portfolio to Bitcoin. This means they will need to buy $1 trillion to $5 trillion in Bitcoin.”

Bitwise

By comparison, Bitcoin ETP currently holds $170 billion. This is part of the $1 trillion to $5 trillion that institutions expect to be able to purchase over the next decade.

Supply is short

Adding fuel to the fire is a strict rarity of Bitcoin. It is well known in the crypto world that its total supply concludes with 21 million btc, with 94.8% of that supply already in circulation. The new BTC will be produced at slower speeds, with annual issuance expected to fall from 0.8% today to just 0.2% by 2032. Unlike gold and oil, Bitcoin supply increases to meet the increasing demand, making it more resilient.

As Bitwise points out, the large conflict of institutional demand with a limited inelastic supply provides a “simple economically driven basis for our paper.”

You might like it too: Bitcoin Bottleneck: Demands Outmints Supply, who is responsible?

Finally, Bitwise points to growing concerns about the Fiat currency collapse. The US federal debt has swelled to $36.2 trillion at $13 trillion over the past five years, but annual interest payments have risen to $952 billion, making it the fourth-largest item in the federal budget. As interest rates exceed expected GDP growth, pressure on traditional currencies is increasing.

“The combination of institutional demand, limited supply and growing concerns about tort will bring benefits to Bitcoin investors as Bitcoin gains an increased share of a valuable market and the size of that market increases.”

Bitwise

Evaluation model

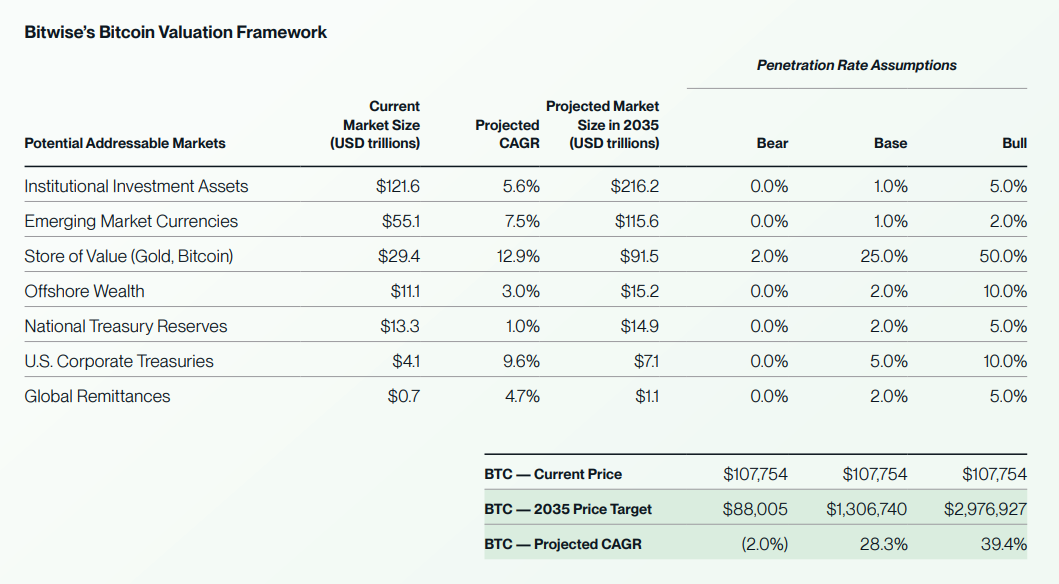

To estimate the future price of Bitcoin, Bitwise uses an entire addressable market approach that examines the potential size of the market that Bitcoin can serve and its penetration potential. This includes non-Yorineck stores with no value, such as gold, the Ministry of Finance of the Business and the Country, offshore wealth, and global remittances.

Bitwise Bitcoin Evaluation Framework | Source: Bitwise

Based on conservative assumptions, Bitwise forecasts a 2035 Bitcoin price of $1,306,740, reflecting a CAGR of 28.3% from current levels. Bear and Bull cases range from $88,005 to nearly $3 million per BTC. The company notes that these forecasts are not guarantees, but rather frameworks for understanding market opportunities.

Bitwise also claims the value of Bitcoin in simple terms. It provides services that store wealth digitally without relying on banks or governments. As the company explains, the more people want this service, the more “the more valuable Bitcoin.” At the same time, the fewer people want this service, the less valuable Bitcoin. If no one wants this service, Bitcoin is worth zero, the report says.

The four-year cycle is dead now

A low correlation with other assets in Bitcoin adds another layer of attraction to investors. Over the past decade, the average correlation with US stocks has been only 0.21, and despite the general media portrayal, it has rarely exceeded 0.50 in short-term measures. Even when stocks drop sharply, Bitcoin has historically recovered faster, highlighting its potential as a diverse asset.

The fusion of rarity, institutional interest, hedging potential, and low correlation makes Bitcoin an attractive long-term portfolio asset. However, Bitwise analysts warn that the traditional four-year cycle may no longer apply as the impact of past market drivers has faded.

read more: Is Ethereum destined to be more reversed? Here's what analysts are thinking: